China's mobile payment apps as soft power

Mobile wallets as global soft power (part 1)

If hard power is economic sanctions and war, soft power is winning hearts and minds through other means such as culture, business, and trade. Tourism can be the ultimate form of soft power. Often, our fondness for a country can only grow as we spend time there. But during the COVID-19 pandemic, various aspects of soft power were put on hold as borders closed, ports were shut down, and supply chains severely disrupted.

China was the first country affected by COVID-19 and one of the last to fully re-open to international travellers. Even the border between Hong Kong and mainland China was closed during this time. Since the re-opening, international flights have struggled to recover to the pre-COVID levels. From The New York Times:

At the start of last year, there were only about 500 international flights every week in China, according to the Civil Aviation Administration of China, the aviation regulator. Now there are about 4,600, and that number is expected to increase to 6,000 by the end of the year — about 80 percent of prepandemic levels.

Flights between the US and China are still way below what they once were.

Before the pandemic, there were more than 300 flights every week between the two countries. That number was 36 a week in September and has gradually increased. In November, the countries agreed to increase flights to 70 a week.

Due to the ongoing war in Ukraine, American carriers avoid flying over Russia, adding to the flight time between the US and China. On the other hand, Chinese airlines can still fly over Russia. Some politicians in the US have voiced concern that Chinese airlines may have an unfair advantage, but gradually, flight connections grow again.

Travellers who have visited China in the past year, after not being able to do so for some time, will see how much things have changed, especially when it comes to payments. Before COVID-19, mobile wallets such as Alipay and WeChat Pay were popular. But during the pandemic, the growth in demand for touchless payments meant that their popularity accelerated massively. These days, often, the only option is to use Alipay or WeChat Pay. Cash and Cards are rarely accepted.

The video below illustrates the ubiquity of mobile wallets in China. A Japanese filmmaker explores rural China. After a near-vertical climb up to a cliff-top village, he uses Alipay to pay for a bottle of water. It starts around 8 minutes into the video and is quite remarkable.

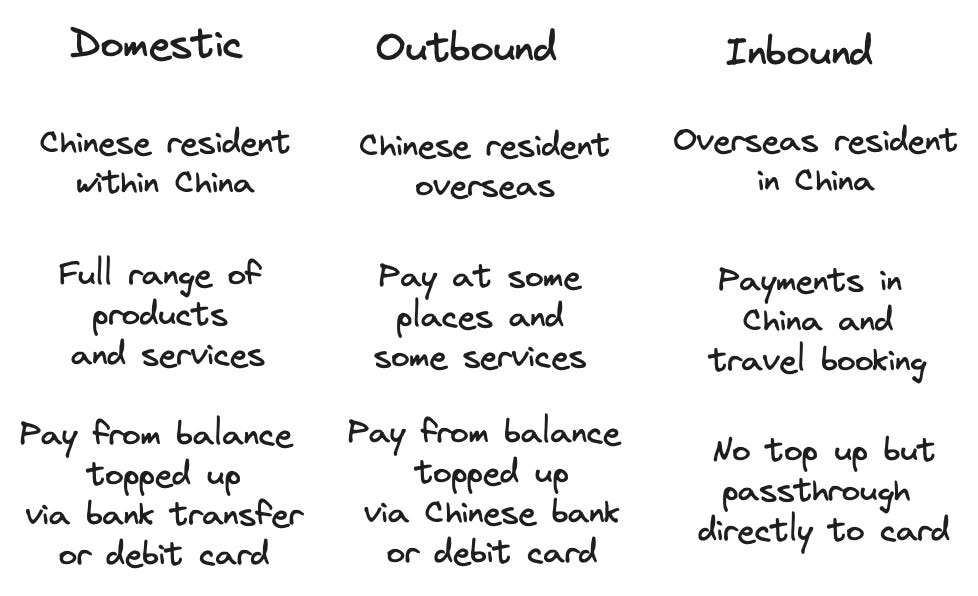

Chinese mobile wallets were designed just for local users. Chinese bank accounts can top up mobile wallets such as Alipay via bank transfer, and a Chinese resident can use a domestically issued debit card to top up their balance. Alipay has built an eco-system of various financial products and services, which are often better than what a traditional bank offers its customers. It's common to top up an Alipay balance after getting paid each month and use Alipay for payments, savings, and investment products. Additionally, some employers in China insist that their staff have a bank account at the same bank as the employer uses. There isn't the same level of competition between banks to offer better products or services compared to the UK or other markets. Mobile wallets have filled this gap, offering better interest rates on savings and other innovative financial products.

For tourists, this predominance of mobile wallets presents a problem. How do tourists pay if most businesses don't accept cash or cards? After the border re-opening to international tourists in China, there was, in theory, a way for tourists to use Alipay via a service called Alipay Tour Pass. This service was a virtual prepaid debit card that could be topped up with up to 5000 RMB (approx. 700 USD). But it came with a 5% fee, payments often didn't work, and once the 5000 RMB had been spent, it couldn't be topped up again.

Note: In theory, paying with cash in China is still possible. It is illegal to refuse cash as a business in China. However, most companies will only accept it very reluctantly, and even as a tourist, they will prefer you try Alipay or WeChat Pay first.

Recognising the issue at hand. To help international visitors pay more easily, last year, Mastercard announced a partnership with Alipay. It was announced with the headline:

With this partnership, it is now much easier for international visitors to China to use their usual debit and credit cards. Cards can be linked to Alipay directly within the app (both Visa and Mastercard). This partnership doesn't entirely give tourists the experience like a local. Alipay for domestic users is a digital wallet topped up and then spent or used for other services. For international users, Alipay is used by scanning a QR code - same as Chinese users - but then the card linked to the account is debited for the transaction. It's a passthrough transaction rather than a mobile wallet drawing on a set balance.

This change has had some success, but it doesn't always work. Some smaller businesses don't accept Alipay linked to a foreign card. Settings at the merchant level may need to be enabled to accept international cards. YouTube channel JetLag Warriors found a 50-50 success rate of using a foreign card linked to Alipay on their extensive travels around China. You can see their feedback on this video starting at 3.22, where they outline the challenges they found.

Our strategy was to start with Alipay. And you never knew if it was going to work or not. And then we’d just go back to cash afterwards. It’s just something you just have to learn.

It should be noted that JetLag Warriors provided a lot of positive feedback on their overall experience as tourists in China, so their criticisms of the payment infrastructure are not part of any general negativity of their China experience.

Other commentators have also reported a mixed set of experiences. Adding a foreign card to the Alipay app only sometimes works. Some users say they can pay anywhere with no issues. Others say they struggle in many places - even some metro systems don't accept Alipay with a foreign linked card. The backup approach many travellers suggest is paying a local friend to top up an Alipay wallet from a Chinese bank account. This wallet will act as a prepaid balance when a foreign card isn't accepted. But not everyone will be able to do this.

I've mainly discussed Alipay in this post, but WeChat Pay is also worth mentioning. Combined, these two payment apps make up more than 90% of the payment volume in China. While most businesses accept both mobile wallets, in some cases, a company may choose to accept payments in one or the other. (This doesn't present a problem for Chinese consumers, as everyone has both payment apps on their phone, but it does add some complexity for international travellers.) Even some huge merchants, such as JD.com, accept only one of the large mobile wallets and not the other - in this case, WeChat Pay and not Alipay.

WeChat Pay is known in China as Weixin Pay (微信支付). Its owner Tencent announced last year that they, like Alipay, would start allowing overseas debit and credit cards to be connected to their app so inbound travelers can easily pay in China:

Speaking at a World Economic Forum event on June 28 (2023) in Tianjin, Royal Chen, vice president of Tencent Financial Technology, said: “Once overseas credit or debit cards are connected to WeChat, visitors will have access to a new universe of merchants and services, including shopping, dining, hotel accommodation, transportation, and more, spanning both online and offline experiences and covering all aspects of life in China.”

Despite this message, in reality, most travellers have stuck to Alipay. More information is available for tourists using Alipay than WeChat Pay. Wise has published a user guide for WeChat Pay highlighting some nuances, such as the fact that only credit cards - and not debit cards - can be linked to an account. Over time, as more flights and travellers return to China, more tourists will share their experiences with WeChat Pay.

The fast development of China's payment infrastructure has led to a sharp acceleration of cashless payments, and the success of Alipay and WeChat are role models for so-called super apps all over the world. Few, if any, apps anywhere in the world have come close to the ubiquity of China's super apps. Realistically, international visitors have no choice but to get to know China's mobile wallets when travelling there. The impression visitors have of China will be shaped by their experience using AliPay and possibly WeChat Pay. Travellers in China can use the AliPay app not just for day-to-day payments but also to view train schedules, book train tickets, and even book accommodation.

In the West, businesses can offer China's mobile wallets as payment methods to their customers. Companies like Adyen or Stripe can facilitate e-commerce transactions using these payment methods. London stores that get a lot of tourist footfall, such as Selfridges, offer China's mobile wallets as an in-store payment method. Western brands often have accounts on WeChat and Weibo, especially for brand-building and seeking out Chinese customers. Harrods, another luxury department store in London, has even implemented Alipay's version of tax-free shopping, so consumers can get VAT refunds to their Alipay accounts while still in the store. Companies are keen to signal to Chinese customers that we understand your culture, with the goal of increasing sales and establishing a greater connection with shoppers.

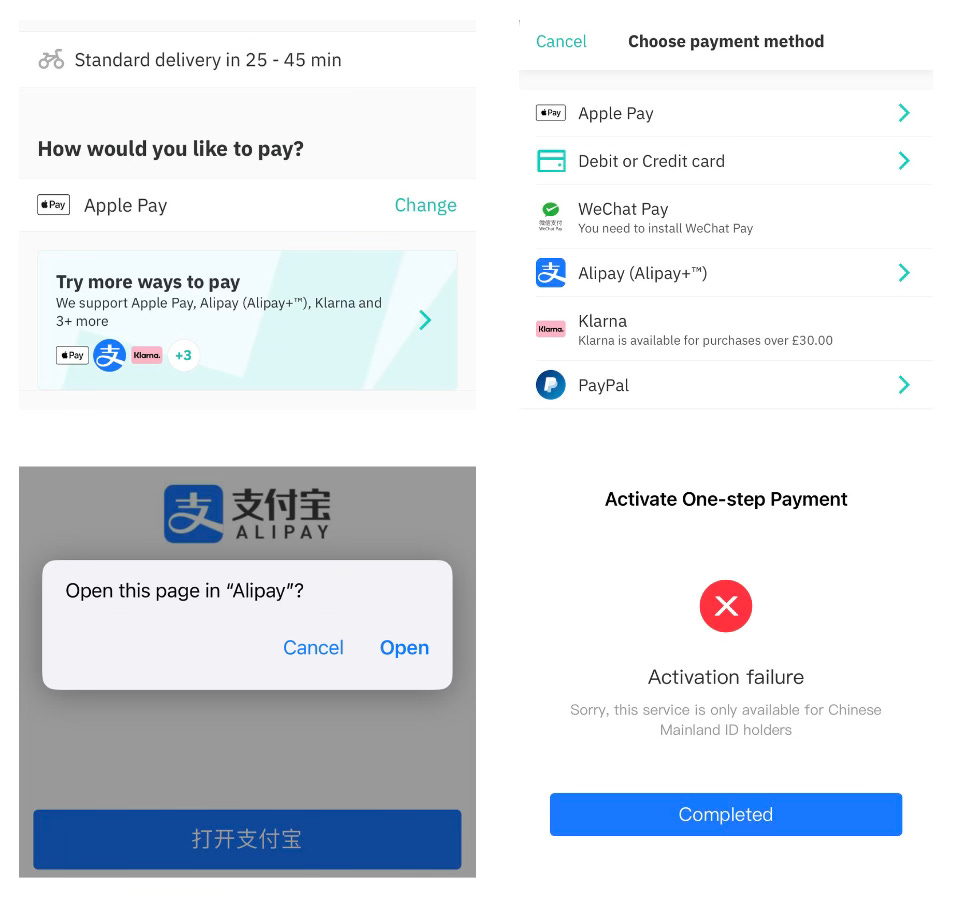

Will Alipay try to build its brand for overseas users? If a tourist has visited China and downloaded the Alipay app to pay in China, can they then use the same app to pay with Alipay in the UK or other countries? I tested out the Alipay app with UK food delivery company Deliveroo. Alipay is one of the payment options on the payment screen. Upon selecting Alipay as my payment method, I was presented with a message saying that this service is "only available for Chinese Mainland ID holders". Alipay is not set up to be a global payment method at this time. It may remain a China-centric product, or there's an option to go wider and cater to a broader audience. For now, there is one Alipay for domestic users, one for Chinese abroad users, and another for everyone else.

Mobile wallets, whether by accident or design, are becoming a source of soft power.

Soft power defined as a country's ability to influence others without coercive pressure. This means projecting values, ideals, and culture across borders to foster goodwill and strengthen partnerships. As a comparison, for many in the West, seeing a Visa or Mastercard logo when travelling reassures us that we can use our usual card-based payment methods. Despite being US-listed companies, they operate at scale throughout the world. So Visa and Mastercard have less of a soft power cache linked to any particular country. However, in taking part in US sanctions against Russia and Iran, Visa and Mastercard are, in fact, operating as mechanisms of hard power. However, all US companies must comply with economic sanctions and related policies.

If you enjoyed this post, please consider liking this post or leaving a comment. It's much appreciated. Please consider subscribing to receive new posts via email or in the Substack app. If you’re an existing subscriber, you can upgrade your subscription to support this newsletter.