How fintechs are changing student finance

In a world of lifelong learning, eduction will evolve to offer new possibilities

The Cost Of Studying Today

University can be expensive, and it's getting more so.

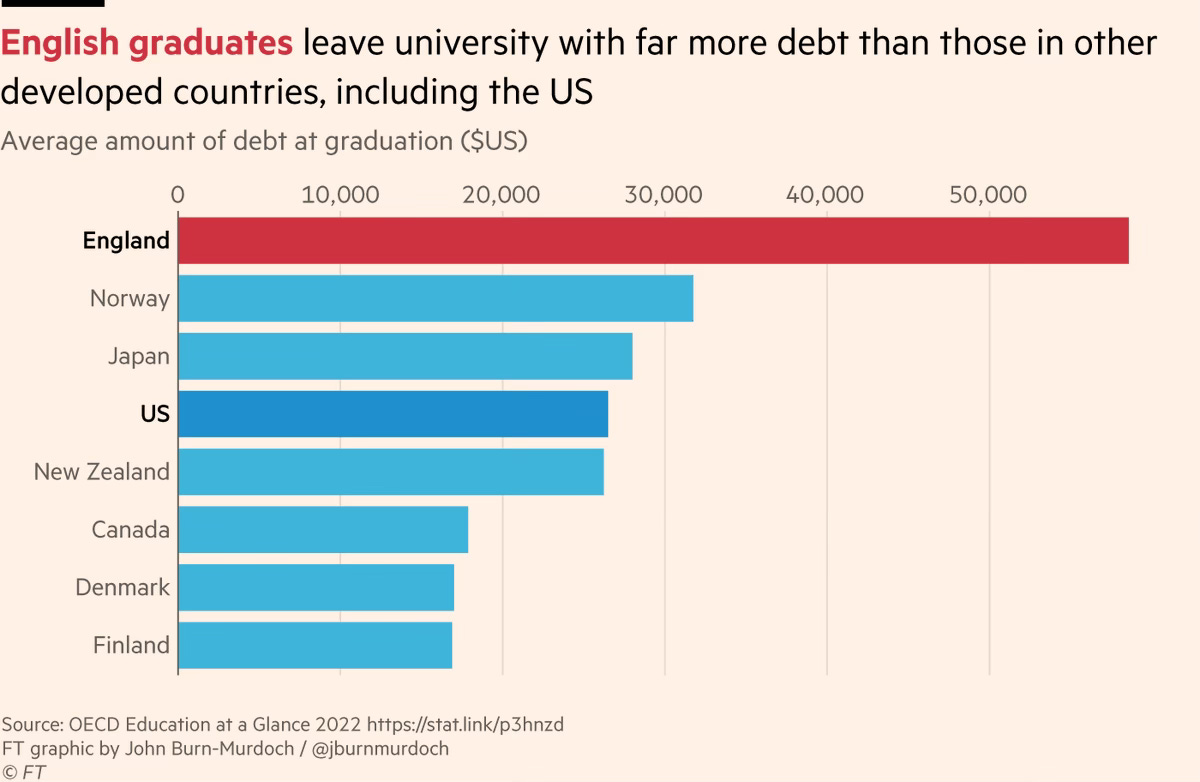

When I went to University in the early 2000s, the tuition fee for my undergraduate degree was £1,000 ($1,250) a year. Nowadays, for domestic students in England, the cost is £9,250 ($11,600) per annum. International students pay even more - the cost can be anywhere from £10,000 ($12,500) to £26,000 ($32,600). Usually, an undergraduate degree takes 3 or 4 years to complete in the UK.

For undergraduate courses, domestic students in England don't need to pay upfront. Instead, debt for tuition fee payments accumulates during a course and then is gradually paid back from earnings. Those starting University in 2023 will pay 9% of their salary on their income above £25,000 towards their debt. As the money is not needed upfront, in one sense, there's no financial barrier to studying. But still, most students leave University with high levels of debt, which can be off-putting.

For post-graduate courses, the fees can still be higher. For instance, a Masters in Management from London Business School costs £47,500 ($59,500). An MBA from Cambridge University costs £69,000 ($86,500), with an additional £18,625 ($23,350) needed to cover living costs. For a Masters degree, compared to Undergraduate courses, there's usually much more limited financial support available, even to domestic students.

In the US, student finance has long been a hot topic. President Biden has eliminated $100bn of student debt through various programmes. However, the Supreme Court struck down his main student debt forgiveness plan, which aimed to wipe out $400bn of an outstanding $1.6tn+ loan book. Many voters, especially younger voters, feel President Biden hasn't gone far enough in student debt forgiveness. Yet he is constrained by the courts and Congress in going further.

One challenge with traditional student loans in the US, is that repayments begin quite soon post graduation - even if the student hasn’t yet found a job. And the repayment amounts are not linked to the borrower's income. So if a student finds a low paid job after accumulating a high level of debt, their student loan repayments can eat up a high proportion of their salary.

Are Income Share Agreements A New Way Forward?

Edly is among several organisations that offer Income Share Agreements (ISA) as an alternative to student loans. In the ISA model, repayments are linked to income, with a minimum salary threshold. There are similarities with the system utilised in undergraduate education in the UK mentioned earlier in this post. Edly's offerings come with an academic year and a lifetime borrowing limit. These limits are often lower than traditional student loans - so they will only be suitable in some cases.

Another critical difference between an ISA and a traditional student loan is the lack of compound interest. With a loan, if a student fails to make a payment, interest will continue to be added, making it harder to pay off the loan. But with an ISA, students know in advance, before accepting the agreement, the maximum amount they will pay over its lifetime. There is a cap on the total number of repayments and the total value to be repaid. Only one needs to be achieved.

In the above video, Edly co-founder Charles Trafton talks about ISAs as an asset class. Stating that an ISA is "not a loan and it's not debt". He mentions that from an investor's perspective, the ISA provides a percentage of the student's income for a number of years. Rather than investing in a single student, investors buy into a pool of investments to minimise risk and get a regular return in line with the repayments made by the associated students.

ISAs may be a welcome option for students. But do we need to consider whether, in a fast-changing world, traditional degree programmes provide the skills we need for the long term? Or are there other models of education that will now take greater prominence alongside the traditional study paths?

Are Shorter Courses Now The Key?

It wasn't long ago that getting an MBA was seen as a sensible career step for ambitious professionals 5-10 years into their careers. But in today's world, learning about AI, Coding, or Data Science may make more sense and provide a better return on investment. Lifelong learning may now become the norm and be delivered in various ways. As technology advances ever more rapidly, the skills needed to succeed at work will change. The time of taking a single university course - or two - and that being enough may be over.

Companies such as General Assembly offer online boot camps - another name for an intensive course - in subjects such as Data Analytics and UX Design. Product School focuses on Product Management. Codeworks offers courses in Web Development and Software Engineering. These are just some examples of the myriad of options now available. Such boot camps are often taken by those looking to enhance their skills or take a slightly different career path. They come with an element of risk as fees tend to be in the region of £5,000 ($6,350) to £10,000 ($12,650), and there is no guarantee of a job after course completion.

An ISA financing model can be a good fit for these shorter courses, as payment is based on the income that follows the course. So, the risk for a student is significantly less than that of a standard loan. Student Finance is one organisation offering ISA agreements for a variety of courses in Spain and the UK. In 2023, they completed a $41m Series A funding round.

(With these courses, a student could be someone new in their career journey, looking for a new position. Someone looking to increase their knowledge later in their career by taking a part-time boot camp, and not necessarily looking to change employer. Or anything in between.)

Tokey is an early-stage startup that also offers ISA agreements. Co-founder Harold Boden told me, "rather than utilising loans or restrictive venture debt, Tokey is building a marketplace platform that lets every investor fund students' tuition". Tokey's open marketplace will allow investors to participate in "social impact investing", which means that students can realise their ambitions whilst allowing investors to diversify their portfolios.

Schools and education providers are of crucial importance to the ISA model. Companies such as Tokey need to get buy-in from education providers to offer ISAs to their students. Schools act as a distribution channel for the ISA providers, providing a flow of students who require their services. In turn, the ISA providers can highlight which schools they work with to provide a flow of students in the other direction. Some schools may consider success-based financing as a key part of their offering that can make a difference between a student participating in a course or not.

There have been some criticisms that the ISA model doesn't allow a like-for-like comparison with a standard APR (Annual Percentage Rate). Variability of repayments as a percentage of income means that there is no fixed APR. So, there will be an element of personal preference here. Some education providers may prefer to offer instalment payments or a more straightforward form of Buy Now Pay Later (BNPL) rather than an ISA option. However, having the option to align risk and success will appeal to many potential students in a world of lifelong learning.

More Startups Tackling Student Finance

Given the size of the education market and the social impact potential, it's no surprise that many fintechs are interested in offering solutions in this area. Specific student finance solutions will evolve to meet the needs - and payment rails - of each local market. In a previous post, I looked at UPI in India and its success in building new real-time payment infrastructure. Utilising the UPI payment rails, Pay Crunch is a fintech providing a credit line specifically for college students. With merchant-based QR codes, credit can be provided, even for those without a formal credit score.

Further insights on startups working in this area can be seen on data provider Dealroom. More than 100 companies are working to solve various aspects of student finance - other than ISA providers. For instance, Prodigy Finance offer loans specifically for international Masters students - so far, the company has funded 30,000 students. Splash Financial has built a marketplace for student loan refinancing, handling over $6bn in refinancing requests so far. Peanut Butter is a platform providing student loan repayments as an employee benefit offering.

Thanks for reading Payments Culture!

Note that views expressed on this Substack are my own and do not represent any other organisation. Also nothing I say should be taken as investment advice.