Mobile payments explosion

Global mobile payments are making an impact

Earlier this year, I was walking around the exhibition halls of Money 20/20 Europe in Amsterdam. I noticed one clear growth area in payments - what can be called global connectors. These are companies such as dLocal and PayU.

The technology that global connectors offer is a straightforward way to connect to hundreds of payment methods.

Why does this matter? Offering Visa, Mastercard, and American Express as payment options can be enough in parts of Europe and the US. However, outside of these areas, more comprehensive payment options are needed to service customers and grow.

Most payment systems outside of the mainstream card networks are mobile-based. In most cases, to pay, they require a QR code to be scanned. They can sit in an e-wallet app or integrate directly into a banking app. (If you’re unfamiliar with QR codes, this guide is worth a read.)

The emergence of affordable smartphones from companies like Xiaomi, Oppo, and Vivo has been a game changer for mobile payments. Today, more than 4.3 billion people own a smartphone, yet ten years ago, this number was less than 1.5 billion. This growth in smartphone adoption has allowed mobile payments to flourish.

We’ve seen an explosion in mobile payments worldwide.

In many ways, the term financial inclusion is used too often. Yet mobile payments are an example of financial inclusion in action. Previously, cashless payments meant having a formal bank account and a credit or debit card; today, just a smartphone is needed.

Some mobile payment mechanisms are well known due to their scale. For instance:

WeChat and Alipay led China to almost entirely skip cards at POS and go straight to mobile QR code payments.

India’s UPI (Unified Payments Interface) processes more than 14.5 billion transactions a month.

Pix in Brazil has grown since its inception three years ago to almost 42 billion payments in 2023!

Nevertheless, many successful mobile payment systems are relatively unknown outside of their home area. Let’s take a look at four mobile payment systems worth knowing. The first one is from Europe, Switzerland, and the rest are in Asia.

TWINT - Switzerland🇨🇭

TWINT (it’s usually capitalised) is hardly spoken about outside of Switzerland, yet in Switzerland, it’s very popular. Somewhat uniquely, there isn’t one Twint app - rather, almost every bank in Switzerland has its own version of the Twint app.

For the few banks that don’t have their own Twint app, users can download a Twint-branded app. This Twint-branded app must then be topped up like a prepaid account.

During the payment process, funds can be drawn from a bank account or taken from a linked credit card. (Most users prefer to pay directly from their bank account.)

Twint can be used for payments at retail stores, e-commerce, and person-to-person payments:

Twint is accepted as a payment method by 77% of bricks and mortar shops and 76% of online shops in Switzerland. And the payment system now has “well over five million” active users.

In addition to payments, the Twint app(s) can store loyalty cards, including for more than 35 of Switzerland's largest retailers. Twint can also be used to pay for car parking, buy insurance in-app, and split payments with friends and family.

Twint’s popularity is especially with young people, who often don’t have a credit card, but with Twint, they can easily pay with their mobile phone. It looks like it’ll go from strength to strength as more functionality gets added. Twint is going to play a vital role as a cashless alternative to card payments in Switzerland.

PayNow - Singapore 🇸🇬

To understand PayNow, we first need to understand FAST. FAST launched in 2014, and stands for Fast and Secure Transfers. FAST enables instant payments between banks, which previously took around three days to complete. FAST can be compared to instant payment rails such as Faster Payments in the UK (FPS).

PayNow is a layer on top of the FAST rails and allows for person-to-person payments, merchant payments via QR codes, or even business-to-business payments.

PayNow doesn’t have its own app. Instead, it’s a user interface that sits within existing banking apps. Users who wish to register for PayNow do so within their banking app via a one-time password such as SMS. In addition to banks, non-bank financial institutions such as Grab and Singtel Dash can utilise PayNow.

One of PayNow’s key strengths is its versatility. In addition to QR code, users can pay by entering a phone number, a Singaporean ID number, or by using a Virtual Payment Address (VPA). The VPA is used for e-wallets and non-bank financial institutions.

For business payments, all that’s required is to know the business's Unique Entity Number (UEN), which links to a Singapore bank account. PayNow’s ability to cater to business-to-business and personal payments has been a key factor in its success.

There are several popular QR code-based payment schemes in Singapore, and PayNow is just one of them. Fortunately, merchants don’t have to place many different QR codes within a store, as Singapore has developed a unified QR code system (SGQR).

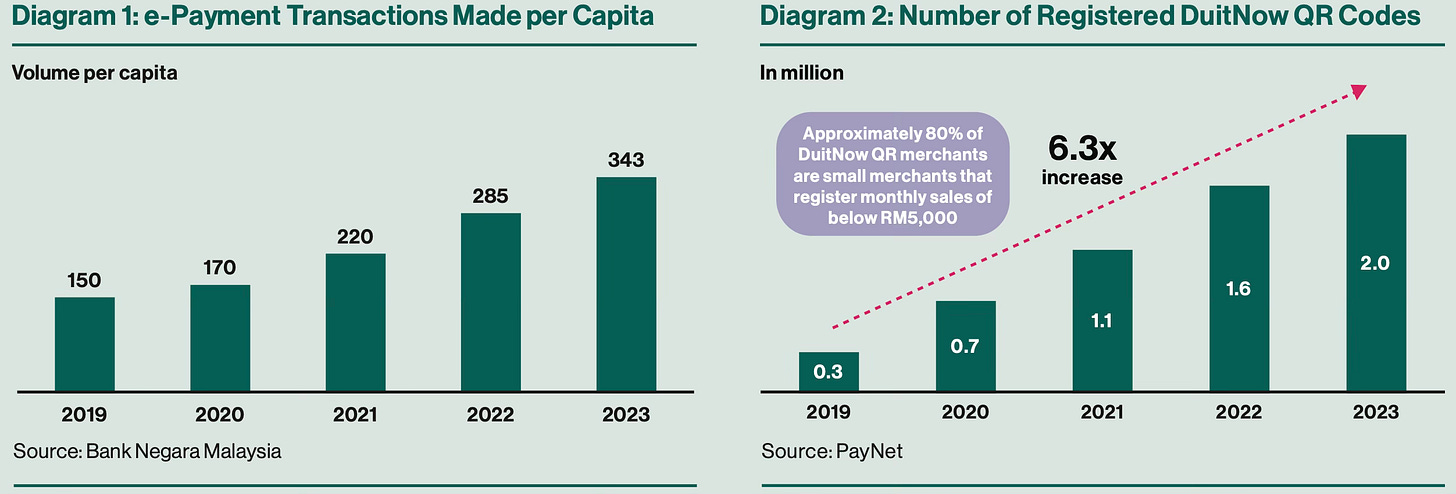

DuitNow - Malaysia 🇲🇾

Duit is a slang word that means money in Malaysian and Indonesian. It is also a homophone in some respects, the same word but spelt differently from the English “Do It Now.”

Good name, but how does this mobile payment system work? Like Singapore’s PayNow, DuitNow doesn’t exist as its own app. Instead, it sits within existing banking apps or e-wallets. The solution’s simplicity and low cost have been key factors in its growth. The fee for processing DuitNow payments via a QR code is equal to processing a local debit card or, in some cases, even cheaper.

DuitNow was launched by PayNet Malaysia in 2019. PayNet runs much of the payments and financial infrastructure in Malaysia. Its largest shareholder is Bank Negara Malaysia (the Malaysian central bank). Additional shareholders come from eleven other financial institutions.

This podcast episode from SoyaCincau is helpful in understanding DuitNow in more detail. As explained in the podcast, with DuitNow, payments can be made from one Malaysian bank to another with minimal information from the recipient. You only need one of the following from the recipient:

Mobile phone number

Passport number

business registration number

NRIC (ID card number)

or army/police ID number.

Malaysia also has developed a single domestic QR code format. One QR code can collect payments from all participating banks and e-wallet providers, making it easy for business owners. No need to display multiple QR codes at the point of sale.

PromptPay - Thailand 🇹🇭

Thailand’s PromptPay is somewhat similar to Singapore’s PayNow and Malaysia’s DuitNow. In line with the previous examples, PromptPay offers low-cost person-to-person payments via QR codes. Payments can even be made from ATMs, and there is business-to-business functionality. PromptPay has “service extensions” extending functionality to tax repayments, social security payments, and charity donations.

National ITMX (National Interbank Transaction Management and Exchange) was responsible for developing PromptPay, working alongside Vocalink, a company that Mastercard acquired in 2016.

With PromptPay, there’s no fee for transactions below approximately $150, which covers a large share of a small business’s sales. Even a transaction of $5,000 only attracts a small fee of $c30, and it can even be free if specific channels are used.

In December 2023, PromptPay saw 75.9 million transactions per day. Its popularity has been driven not just by the low fees but also by other factors. Some observers have noted that PromptPay has delivered several key benefits for the Thai economy:

The unbanked have been connected – farmers in remote areas or friends and family in different regions, PromptPay has made it easier to send money, and cheaper too.

Cash is no longer king – cash is reducing as a dominant force in the country as Thai citizens are choosing to transact through their smartphones.

Fraud, theft and corruption addressed – almost overnight the risk of fraud, theft and local government corruption associated with the distribution of cash payments was gone.

Generating new entrepreneurs – a new generation of entrepreneurs have emerged who are now able to buy and sell online using PromptPay as a secure and reliable payments platform.

Bringing it all together

As we’ve seen, this mobile payments explosion is producing impressive results.

Mobile payments allow for a wide range of functionality, including consumer-to-merchant payments, person-to-person payments, and other functionality dependent on the market and use cases. These examples go beyond open banking. Successful mobile payments offer more than just account-to-account payments. They’re part of a broader ecosystem that benefits both consumers and businesses.

The first example we looked at - Switzerland’s Twint - uniquely has its own app and versions offered by each participating bank.

The examples from Southeast Asia show how powerful QR code payments have become in the region. Domestic interoperable QR code systems are now the norm, and businesses can offer payment options from many providers with a single QR Code.

Innovation is set to continue. Singapore and Malaysia have worked to connect PayNow and DuitNow, meaning that users can send funds from one country to another seamlessly. These integrations will become increasingly common, and a wider network of mobile payment capabilities will evolve as solutions collaborate with each other. International interoperability is becoming a reality.

If you enjoyed reading this post, you can connect with me on LinkedIn, X, and BlueSky.