Block's earnings miss, agentic commerce and much more

A curated look at what's been going on in payments and fintech

The lead story: Block’s earnings miss

Block (NYSE: XYZ), formerly known as Square, held its earnings call last Thursday, May 1st. Amrita Ahuja, Block’s COO and CFO, said on the earnings call:

Cash App gross profit came in below expectations… During the quarter, non-discretionary Cash App Card spend in areas like grocery and gas was more resilient, while we saw a more pronounced impact to discretionary spending in areas like travel and media. We believe this consumer softness was a key driver of our forecast miss.

At the end of her section, perhaps anticipating market reaction, Amrita added:

We have the team, strategy, and organizational strength to navigate potential short-term volatility while continuing to build for our customers

Last Friday, Block’s share price plunged and ended the session down 20%, wiping out more than $8bn in market value. In some areas, Block outperformed expectations. The Square business segment saw a 9% gross payment growth over prior year, but overall, there was disappointment. Cash App’s gross profit increased 10% over the previous year to $1.38 billion, but this was below analysts’ estimates, which expected $1.42 billion. Total net revenue was $5.77 billion, down 3% from the same quarter last year, which was $5.95 billion. Analyst expectations were for revenue of $6.19 billion, a miss of $420 million.

Block operates a two-sided consumer network with products both for consumers and for merchants. As Block describes it, the network brings together buyers and sellers. Cash App is focused on the consumer, or buyer side, and Square the seller side.

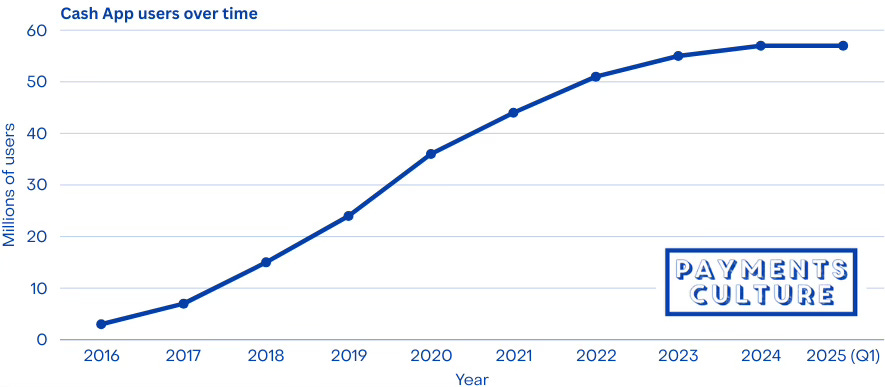

While the overperformance of the Square segment shows some success, Cash App’s user numbers were flat. 57 million users doesn’t sound so bad, but user growth has stalled in the past couple of years. With an adult population of 260 million in the US, there is still, in theory, much more user growth to be had.

The US market is fascinating seen from the UK. In the UK, we have successful neobanks such as Monzo, Revolut, and Starling, which challenge incumbent banks and are growing their user base consistently year on year. (Revolut now has a 29% market penetration across the UK and Ireland, defined as a % of the adult population who are personal account users. This metric is undoubtedly helped by its high usage in Ireland. Still, in the UK alone, Revolut has more than 10m users.)

In comparison, the US has not seen a breakthrough neobank. Solutions like Cash App have become quasi-bank solutions, enabling users to do some of their daily banking. But so far, there hasn’t been a wide enough offering to keep users within the Cash App ecosystem - the goal is to change this. On the recent earnings call, Jack Dorsey emphasised that the company is seeking to expand its suite of solutions. He spoke of increasing engagement with Block’s user base, and consumer loans are one way to do this.

Block already has a banking license. This is an Industrial Loan Company (ILC) license, which primarily allows Square to offer business loans to its merchants. The company has recently received regulatory approval to offer loans directly to consumers via Cash App. Previously, consumer lending was offered via partner banks, and only in some states. Following the FDIC’s approval, which was mentioned on last Thursday’s call, loans can be offered in more states and via the company’s in-house bank. Offering loans directly via Block’s in-house banks will lower fees payable to partner banks and improve unit economics.

In addition to expanding loans, Cash App is enhancing its offering via BNPL. Block’s BNPL offering, Afterpay, was recently integrated directly into Cash App. The integration of BNPL into Cash App is a way to deepen the relationship with its users, who are predominantly millennials and younger. These demographics are more inclined to use BNPL than credit cards.

The development of Cash App’s strategy will be keenly watched in 2025. Another thing that will be closely monitored is whether Block’s disappointing earnings are an early sign of deteriorating macro conditions, especially as the US economy shrank by 0.3% in Q1 2025. Is a recession on the way?

Agentic commerce is on the move

The past month has seen a slew of announcements in the agentic commerce space.

At the moment, the payments industry is mostly talking to itself. Companies are working hard to make announcements and not be left behind. Still, the real impact on the daily lives of the average consumer with agentic payments is some way off.

The best way to think about agentic commerce is this: instead of just asking Chat GPT, Gemini, Claude, or Perplexity to plan a two-week trip to Italy, you’ll soon be able to ask AI to book your journey as well. This means AI utilising payment capability. There are a range of challenges with this, including how to authorise and authenticate the payment transaction. Some of the largest companies in payments are launching solutions they hope will make agent-based payments the norm in the near future.

This area deserves much more attention on this Substack, given the impact it will have on payments and fintech. But for now, let’s review some of the recent updates in this space, starting with Visa and Mastercard’s recent announcements:

Mastercard unveiled Agent Pay. A key part of this announcement was Mastercard Agentic Tokens. Agentic tokens build on Mastercard’s existing tokenisation capability, ensuring card numbers are not required when making payments. Acquirers and PSPs such as Checkout.com and Braintree are set to enhance their existing tokenisation capabilities with the solution.

Mastercard has partnered with Microsoft to integrate Agent Pay into solutions such as Copilot. In its announcement, the company emphasised its “commitment to responsible AI”, which is wise, given that allowing AI to pay on our behalf is quite a big step.

Only a day after Mastercard’s announcement, on April 30th, Visa unveiled its Intelligent Commerce AI product. Visa revealed an impressive range of partners, including OpenAI, Anthropic, Samsung, and Mistral AI. On the PSP side, their own Cybersource gateway is leading the charge.

Visa emphasised the importance of its network, mentioning more than 4.8 billion payment credentials (tokenisation or similar) and 150 million merchant locations. I couldn’t help but think that Visa was subtly saying that it’s the biggest network of the two.

As agentic commerce gains momentum, it’ll be interesting to see how Visa and Mastercard differentiate themselves. Their role as payment networks is largely invisible to consumers. Individuals don’t usually think too much about whether their card is Visa or Mastercard.

The below video shows Visa’s agentic commerce solution in action interacting with a Chat GPT style interface. 32 seconds into the video, an option is shown to personalise search results with Visa Insights. This is presumably based on information from the card issuer to find out which merchants the cardholder has previously visited. Some users may find this useful, but others may find this a step too far in gathering user data.

As well as Visa and Mastercard, PayPal has made progress with agentic payments in the past month. PayPal released their Agent Toolkit, which seeks to “bridge the gap between PayPal’s powerful APIs and modern AI agent frameworks”, allowing for core PayPal functionality as well as integration with 3rd party toolkits. PayPal highlighted features such as allowing AI to handle invoice creation, sending, and follow-up in case of late payments. The API docs for PayPal’s Agent Toolkit are available on GitHub, so developers can evaluate the use cases.

As is often the case with new payment technology, Stripe has been ahead of the curve. Back in November 2024, Stripe’s developer blog discussed agentic payments in detail, including implementation instructions. Since launching the toolkit, various updates and improvements have been made, and Jeff Weinstein, a product leader at Stripe, is a good source for the latest developments.

Stripe’s agentic commerce solution uses its card issuing product for single-use virtual cards. Virtual cards allow an API to set parameters for each card or transaction in line with the purchase requirements. This is a common approach in B2B payments, especially in travel payments. In B2B travel, virtual cards are often used to guarantee flight or hotel bookings by a travel agent or other intermediaries.

The announcements above show that the broader payments industry is catching up with agentic payments. Over time, there will not be as much need to rely on virtual cards, with their own rules, for agent-based payments to function. As payment networks and others in the industry update their systems for agentic commerce, a wider range of options will be possible, with enhanced tokenisation a key driver.

Other News

There were notable developments in Apple’s long-running legal battle with Epic Games (the developer and publisher of Fortnite). Apple charges a 30% fee for in-app purchases, but they have also charged a 27% fee on purchases outside of an app. A US district court ruled that the practice of charging fees on purchases outside an app should stop effective immediately. Apple is appealing. However, the current consensus is that the ruling will remain the place.

The legal case, which has lasted five years, has cost Epic Games more than $100 million so far. It’s worth saying that the ruling only applies to the US. The Digital Markets, Competition and Consumers Act (DMCC) in the UK and the Digital Markets Act (DMA) in the EU oversee this area. Yet, given the size of the US market, changes to payment commissions can significantly impact companies’ net revenue.

This interview with Tim Sweeney, CEO of Epic Games, provides further insight on this topic. Starting from 3:28:45, there is a segment discussing the Apple case and Tim’s thoughts on how app stores could be better for consumers and publishers.

Money20/20 Asia took place in Bangkok from April 21st to 23rd. During the event, Money20/20 facilitated a Regulators’ Closed-Door Roundtable. This brought together regulators from Hong Kong, Southeast Asia, and South Asia. Discussions focused on increasing collaboration to improve financial inclusion.

“At Money20/20 Asia, we aim to provide a neutral and trusted space for regulators to engage in meaningful, forward-looking dialogue. Harmonisation isn’t about uniformity, but about respecting each market’s unique needs while identifying shared priorities and unlocking [the] collective potential to address regional challenges.”

- Ian Fong, VP Content, Asia, Money20/20

At Money20/20 Asia, a joint report by Money20/20 and FXC Intelligence revealed that cross-border payments volume in Asia-Pacific is projected to nearly double by 2032. Volumes will grow from $12.8 trillion in 2024 to $23.8 trillion in 2032. The report, How Will Asia’s Money Move in the Future?, draws on market sizing data and insights from more than 100 industry stakeholders and can be downloaded here.

Whitecap Consulting and the Building Societies Association released the Building Societies Report 2025. Building Societies are the UK equivalent of Credit Unions or Savings Banks. One key point identified in the report is the need for building societies to embrace digital innovation while maintaining their member-focused ethos. Read the full report here.

Fintech Takes reported that Open Banking in the US is in danger. The rule that allows for data sharing between financial institutions, known as Section 1033, is expected to be reopened. Alex Johnson at Fintech Takes noted that the CFPB (Consumer Financial Protection Bureau) could revise or rescind the rule. The latter path would result in a long delay in implementing Open Banking in the US. As we have seen in the UK and EU, a solid regulatory foundation makes implementing data sharing between consumers and banks much easier than a purely market-led solution.

Stripe has expanded its partnership with Tencent to offer WeChat Pay to Stripe terminal customers in new markets. Known in China as WeChat Pay, the solution will be available in over 20 countries via Stripe’s hardware solution, Stripe terminal. Adding payment methods such as WeChat Pay can increase revenue from Chinese consumers, who usually prefer mobile wallets to cards.

Barcelona-based Real-World Asset (RWA) tokenisation platform Brickken has launched a new white-label solution to support demand from asset managers and institutions. This product evolution offers built-in compliance and automated asset issuance. Brickken completed its $2.5 million seed round in January 2025, and the company has over $300 million in tokenised assets on its platform to date.

The Financial Times reported that the UK plans to restrict lending for crypto purposes, including using credit cards to buy crypto. The UK’s regulator, the FCA (Financial Conduct Authority), will bring much of the crypto market under its remit, including lending. Retail investors will face tougher rules than institutional and so-called sophisticated investors.

Fundraising and M&A

Plaid raised ~$575 million at a $5.6 billion valuation. Franklin Templeton was the lead investor. Fidelity Management and Research also participated alongside existing investors NEA and Ribbit Capital. The company has said it doesn’t plan to go public in 2025.

UK payments company Navro raised $41 million for global expansion, giving it a valuation of more than $100 million. Bain Capital Ventures, Motive Partners, and Unusual Ventures invested in the round. Navro offers an employer of record solution and plans to introduce stablecoins in 2025.

Thunes raised a $150 million Series D round, led by private equity firms Apis Partners and Vitruvian Partners. Following the capital raise, Thunes is profitable and plans to expand in the US market. The company plans to strengthen its Direct Global Network, which spans 130+ countries, 80+ currencies, and 550+ direct integrations.

British bank NatWest made an undisclosed investment in credit card rewards start-up Yonder. NatWest is seeking investment opportunities from seed to series B companies that align with its strategic ambitions.

FundThrough, a fintech invoice factoring platform for small and medium-sized businesses (SMBs), acquired Ampla. Additionally, FundThrough has raised a $25 million Series B round, led by Shopify’s largest individual shareholder, Klister Credit Corp.

Of course, the mega deal of April was Worldpay’s sale to Global Payments by private equity firm GTCR. FIS had previously been a minority shareholder of Worldpay, with 45% compared to GTCR’s 55% stake. As part of the deal, FIS will get Global Payments’ Issuer Solutions business for $13.5 billion.

And Finally

Some non-payments and fintech articles worth reading:

The Verge has written about how Microsoft survived fifty years and what it had to change over time to remain one of the world’s most successful companies.

New York Magazine looks at the media company Semafor. In the article, Charlotte Klein describes Semafor as “a media outlet geared toward the powerful.” This may be so, but in any case, some of their newsletters are worth reading.

Media outlet Phenomenal World has an interesting long-read on Chinese electric car company BYD. In terms of quarterly vehicle sales, BYD overtook Tesla in Q4 2024 and is continuing to grow at pace, especially in Asia.

On Rest of the World, Why India Fell Behind China in Tech Innovation looks at why India is lagging behind in the innovation stakes. A key factor is China’s success in keeping more of its talent at home, rather than its tech talent seeking employment overseas.

Last but not least, venture capital firm Andreessen Horowitz, AKA a16z, recently made Erik Torenberg a General Partner after acquiring his media start-up Turpentine. In a recent podcast, Erik was in discussion with a16z’s founders, Marc Andreessen and Ben Horowitz.

The section I found particularly noteworthy in this interview is the section on the decline of corporate brands. Marc Andreessen makes the point that brand marketing and brand messaging were particular to a certain time and place, and that era has now passed.

To paraphrase further, these days, in a world with less and less centralised media, corporate brands are less relevant. Authenticity, transparency, and personality are far more important than corporate brands. People relate to people.

It’s certainly food for thought. The way that many organisations think of marketing, especially brand building, needs to evolve. The old playbook doesn’t work anymore.

Note that views expressed on this Substack are my own and do not represent any other organisation. Also nothing I say should be taken as investment advice.