Payment schemes vs payment rails

What are they and what do they do?

Last month I attended and spoke on a panel at Rivero’s customer event.

The event's theme was The Future of Payment Operations, and the panel discussion was on Payments Rails and Payment Schemes. As a follow-up, I shared some thoughts with Rivero on this topic, which you can find below.

Europe’s payment rails, like its many iconic structures, have stood the test of time. From earliest iterations, these technology frameworks have moved funds between payers and payees, creating a foundation for innovation and growth.

The terms “payment rails” and “payment schemes” are sometimes used interchangeably, which tends to conflate their respective roles and capabilities, according to Matt Jones, consultant and advisor at Payments Culture, a fintech and payments consultancy, who shared insights on this topic with Rivero.

Move Transactions

Payment rails are “literal rails that move funds, often through third-party networks, serving as connecting forces between various parties in the payments ecosystem and as a core foundation of any functioning payment method.”

By contrast, payment schemes are mostly concerned with rules, regulations and consumer protection. Visa and Mastercard are well-known examples. “They maintain an ever-evolving set of requirements and standards, everything from interchange fee regulations, chargeback rules, compliance requirements, and so on.”

Protect Infrastructure

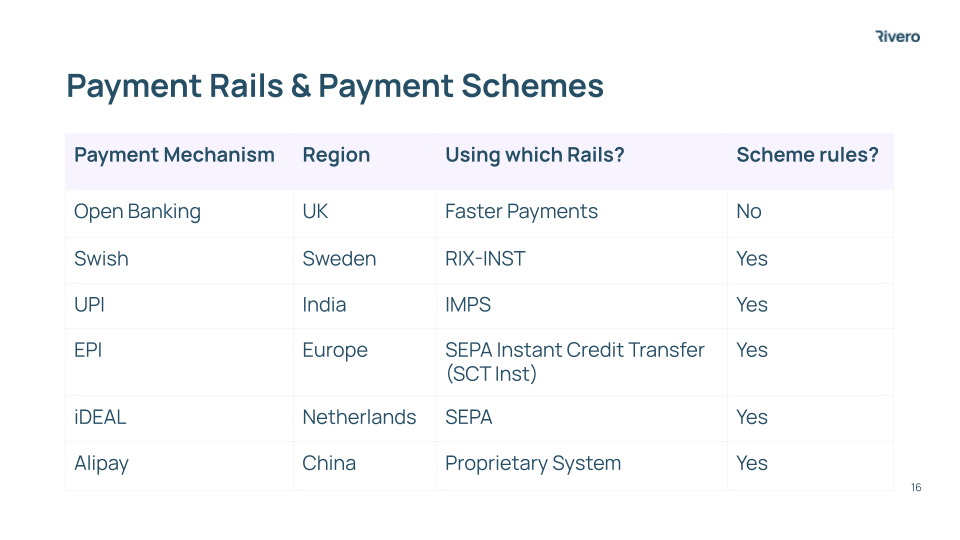

Jones pointed out that Visa and Mastercard function as both rails and schemes, unlike many other payment mechanisms. UK’s Open Banking, for example, runs on Faster Payment Service (FPS) rails. Built to manage bank-to-bank transactions below a certain value, Open Banking operates without extensive pre-defined rules or KYC/KYB requirements, which streamlines customer enrollment but heightens the potential for fraudulent activities.

“There have been reports of [Open Banking] users scanning a QR code that redirects to a scammer’s bank account, with no recourse for victims to initiate a chargeback,” Jones said. “This highlights the need for Confirmation of Payee (CoP), a solution that can check the name on the receiving bank account to confirm it is being sent to the right account. Some payment providers have implemented CoP, but customers do not always check these details.ad actors, aware that there will be no consequences or chargebacks, exploit these situations.”

Beyond simply moving transactions, the UK’s Open Banking enables third-party service providers to access customer profiles and financial histories through application programme interfaces (APIs). This data can power loyalty, rewards, and cash-back programmes but must be safeguarded against misuse as adoption soars. A recent study found 10 million active open banking users in the United Kingdom in November 2023.

Connect Disparate Technologies

With growing demand for speed and convenience, payment mechanisms are architecting payment rails and schemes in uniquely innovative ways that vary by region. Despite markedly different characteristics and approaches, these methodologies are making payments more secure, agile, intelligent, and transparent in their respective markets.

“In Europe and the UK, all payments systems are managed in a very consensual way,” Jones said. “There's a regulator, various industry bodies, and respective participants, all working together to refine and launch payment products.”

Collaborative approaches are non-disruptive to markets and give all participants a voice in decision making but can also move slowly, Jones explained. It takes time for regulators and industry bodies to build consensus while steering clear of abrupt changes that could negatively impact specific stakeholders.

By comparison, India’s UPI is more of a centralised scheme with set rules and regularly published updates. UPI formed part of a broader cashless initiative that removed 86% of the country’s cash from circulation. Fortunately, India was not a strong market for credit and debit, which made migrating from cash to UPI relatively frictionless, as consumers were not replacing existing card payment preferences.

Despite regional differences, payment schemes have similar approaches to consumer protections and best practices. Scheme members manage rules and releases on a regular basis, helping participants adapt to rule changes to mitigate risk and avoid costly non-compliance fines and penalties. Working with standard bodies, regulators, app developers, and each other, schemes may one day achieve an interoperable future, where stakeholders can freely transact across borders.

Innovate and Scale

“Real-time payments are often viewed as competing with cards but that is not always the case,” Jones said, noting that cards are used throughout Sweden, an almost cashless country. “Riksbank's data shows fewer than 10% of the population used cash for their last purchase. Cards and Swish, a popular payment scheme, are both prospering.”

The Swish app simplifies splitting payments and supports both peer-to-peer (P2P) payments and merchant payments. Swish's website states "For information regarding the terms and conditions of Swish, visit your bank’s website," which makes it more an enabling technology and app than centralised scheme with formal rules and regulations.

Jones recalled that Swish was far ahead of other European real-time payment schemes when it was launched in 2012 by six Swedish banks. The simplified real-time payments system continues to scale, attracting more banks, users, and merchants. Alongside Swish, local settlement house Bank Girot launched a real-time payments system (BiR) that facilitated year-round settlements around the clock until it was shut down in 2024, when settlement was moved to The Riksbank's (Swedish Central Bank) RIX-INST system.

New Rails and New Opportunities

Jones acknowledged that modern payment rails and schemes are giving merchants better options but questioned how they benefit consumers.

“Open Banking and various real-time payment schemes seem to have been focused far more on the needs of businesses than consumers,” he said. “For instance, UK’s Open Banking offers lower fees than cards, no chargebacks, and immediate settlement and none of these things matter to consumers.”

Losing chargeback capability is actually a bad thing for consumers and why should a consumer care whether or not a merchant gets funds immediately? What’s far more important, when architecting a new payment method, is to begin with the end-user in mind, by building products that appeal equally to merchants and customers.

Begin building a new scheme by asking, “what’s in it for the consumer?”, and consider creating incentives for customers. “Consumers who move away from cards stand to lose cashback offers, points and miles. What new rewards and incentives can modern payments offer that will make it worth the ride?”

The original version of this post was published on Rivero’s substack.

If you enjoyed this post, please consider liking this post or leaving a comment. It's much appreciated. Please consider subscribing to receive new posts via email or in the Substack app. If you’re an existing subscriber, you can upgrade your subscription to support this newsletter.

Further Reading (Payments Culture)

Other Interesting Reads 👀

Some articles - not necessarily payments and fintech related - that caught my eye:

How Revolut finally won the licence to unlock growth… (Financial Times)

10 Charts That Capture How The World Is Changing (Digital Native)

Olympic Athletes Go High-Tech to Beat Extreme Heat (Bloomberg)