Resilience and Innovation: Ukraine's Fintech Ecosystem

How did payments infrastructure hold up in the midst of war?

This post is an interview with Andrew Riabchuk, Founder of Akurateco Payments Orchestration Platform. Akurateco delivers infrastructure solutions for payment providers, enterprise merchants, and financial institutions worldwide.

Ukraine has been at war since 2014. That was when Russia invaded and annexed Crimea, and conflict soon erupted in the eastern Donbas region. Despite the human cost, much of the world took little notice. It was seen as a low-intensity conflict — something to be managed, and to much of the international community, an annoyance they hoped would go away. The Minsk negotiations were a sign of this approach. Yet in February 2022, with the full-scale Russian invasion, everything changed.

“The first challenge after February 2022 was: does the financial infrastructure still work?“ Andrew explained to me that in war, things we take for granted are under threat.

“Can you pay in a store? Can a business accept payments? Does the client have access to funds?” All of these basic questions were in flux.

Not only was Ukraine under bombardment from physical attack, but cyber attacks on national infrastructure — including core financial systems — were part of the assault from day one. The maelstrom of war meant keeping the financial lights on was a big challenge in itself.

A new operational discipline emerged. “Redundancy, duplication, cybersecurity, strict risk monitoring — all became more fundamental than ever before.” But Andrew was clear that it wasn’t all plain sailing. “It’s not to say there weren’t challenges in the early days. There was, of course, uncertainty in the first couple of months following February 2022.” Yet soon enough, Ukrainians realised that payment and banking services — essential to daily life — continued to operate, with only limited interruption.

In fact, Ukraine's financial system has held up better than anyone could have expected given the circumstances.

Plenty has been written about Ukraine's evolution — even revolution — in the military domain. What worked four years ago has changed; the war itself has changed over time. Ukrainian-American journalist David Kirichenko, writing for the Atlantic Council, described Ukraine as a "drone superpower", noting that many Western countries have a lot to learn from Ukraine when it comes to emerging military tactics and technology.

But while the world has watched Ukraine transform its tactics under fire, the story of how Ukraine's financial sector adapted is rarely told. The results are equally impressive. My conversation with Andrew only scratches the surface, but it provides real-life examples of resilience in practice.

Ukraine’s banking infrastructure

To understand how Ukraine’s infrastructure has held up during wartime, it helps to appreciate the historical context. Ten years back, Ukraine’s tech culture was running ahead of Western markets in some respects. Partly this was due to talent. Andrew highlighted that Ukraine has, for a long time, had a “developer first entrepreneurial mindset” and a deep pool of software developers, some of whom gained experience working for international firms. That experience soon flowed back into local products and companies.

One foundational difference between payments and banking in Western Europe and Ukraine was the use of card-based versus account-based infrastructure. Ukraine was a card-first market, though in a different way to what you might expect. In terms of payments, the UK is a card-centric market. We use contactless cards, either directly or via Apple Pay, to make the vast majority of our purchases, but in Ukraine, cards are also used for sending money. Both major international card schemes have long offered products that allow money to be sent from card to card. Visa Money Transfer and Mastercard MoneySend were precursors of the current products we know as Visa Direct and Mastercard Send. In Ukraine, person-to-person payments were card-to-card payments. In Western Europe, this would usually mean account-to-account payments.

Privatbank was central to this growth of cards as a means of money transfer. Founded in 1992, it became Ukraine’s largest bank and a genuine innovator. Early on, the bank built out specific products for different customer segments, such as retail, SMBs, and large corporates. LiqPay, its e-wallet, became a key payment method for small businesses and is still widely used today.

When Privatbank was nationalised in 2016, many expected the tech-first culture to fade away. But this didn’t happen. The bank maintained its pace of innovation even under state ownership.

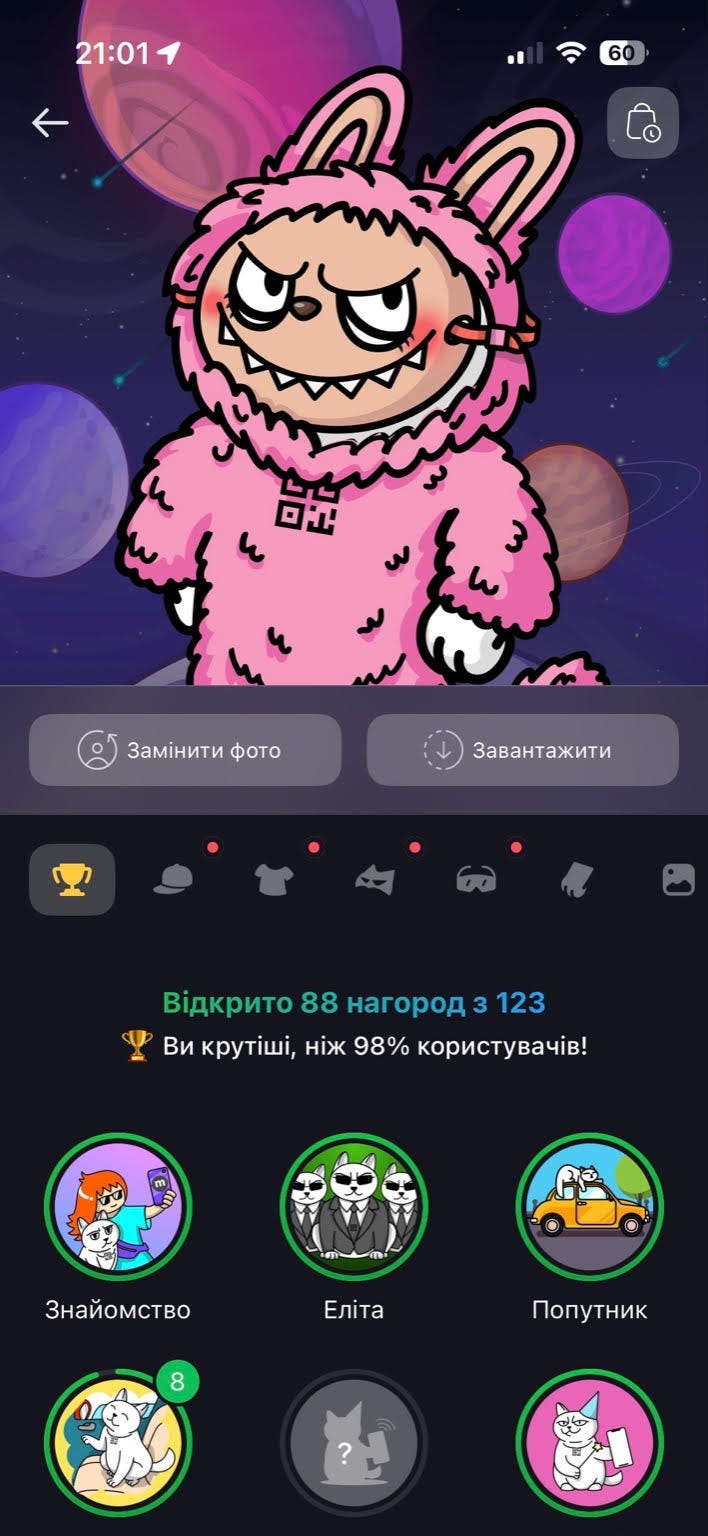

This brings us to Monobank. Founded by former Privatbank execs, Monobank is Ukraine’s leading neobank — a bank with no branches. It took only weeks for the bank to gain one million customers when it launched in 2017, and in 2025 it reached the milestone of ten million customers.

Rather than holding its own banking licence, Monobank operates under the licence of Universal Bank, which is a longstanding commercial bank in Ukraine. Universal Bank is regarded as one of the country’s systemically important banks, but it does not have a substantial consumer banking unit. In essence, Monobank was created as Universal Bank’s retail proposition, and the arrangement suits both parties — the Monobank team gets to focus on helping customers rather than dealing with regulation and licensing.

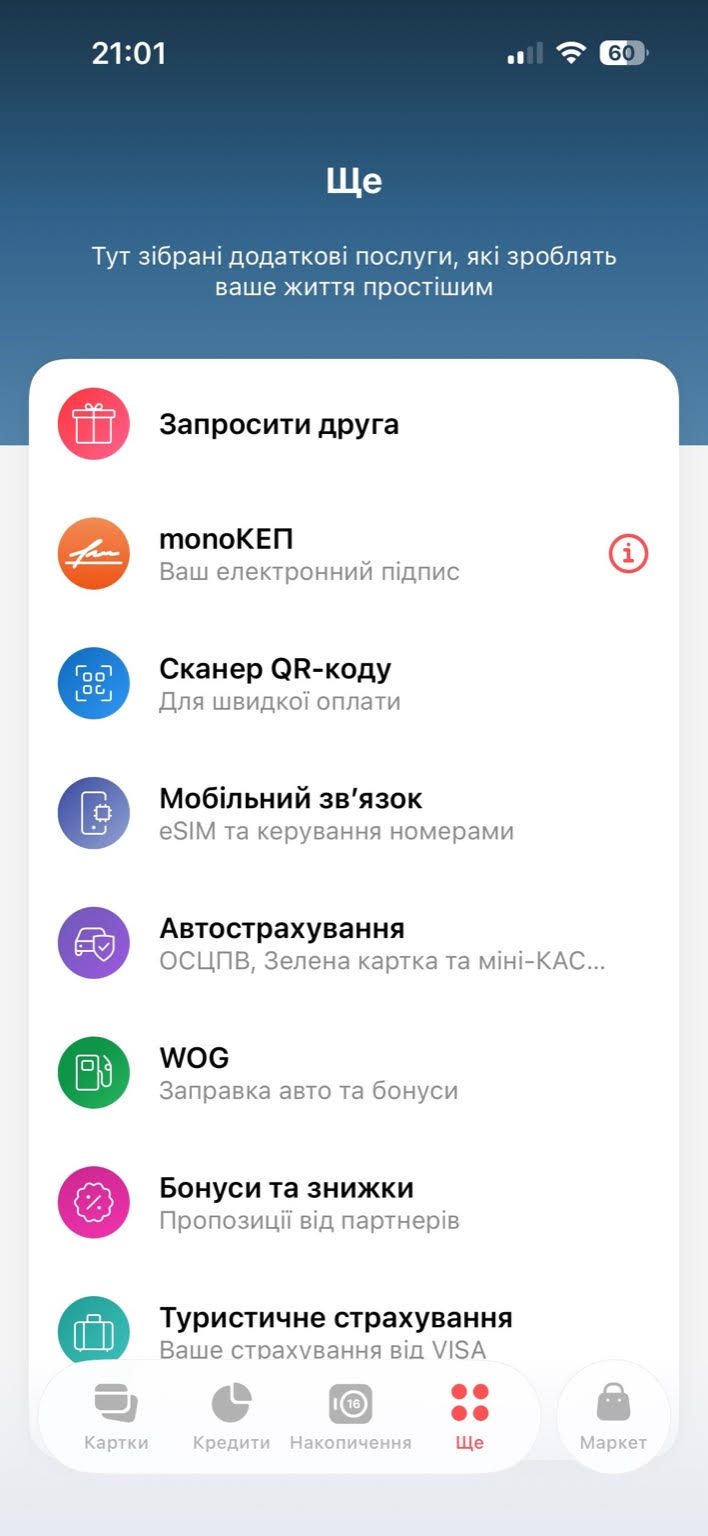

This customer focus soon becomes evident. Looking at Monobank’s homepage, compared with banks in the UK and much of the EU, it’s easy to see a whole host of innovative products and solutions that don’t exist in Western Europe. For example:

The ability to contact the bank’s customer support and concierge services via the Telegram messenger app.

Short-term loans known as “until tomorrow” which usually last from a few days to a month and can be provided quickly to customers who need short-term capital.

Credit and debit cards with both Visa and Mastercard on one card — users get specific perks and discounts tied to each card brand.

A live dashboard that shows customer spending across the bank in real time, by category and at the merchant level.

And then there’s the eRecovery card — a social programme providing funds to those whose homes have been damaged during the war. A product that could only exist in Ukraine right now.

I asked Andrew how Monobank compares to Revolut, which is the closest reference point I have. “Very comparable,” he said, “and in some aspects Monobank is even better.” Looking at what they’ve built, it’s hard to argue. Although, sadly, as the bank only operates in Ukraine, it’s difficult to experience it firsthand.

Kiosks and cards

Today Ukraine is home to one of the world’s leading neobanks and other innovations. But back in the 2000s and 2010s, physical payment kiosks were a common sight in malls and supermarkets.

Payment kiosks are self-service terminals operating under brands such as EasyPay and iBox. They allow people to pay utility bills, top up mobile accounts, and add cash to bank cards instantly. While mobile banking has grown rapidly, kiosks remain relevant as an offline payment channel, especially in smaller cities and in times when people value redundancy and accessibility.

As a sharp contrast to kiosk infrastructure, data from Mastercard highlights Ukraine’s advanced attitudes to digital payments. 41% of Ukrainians surveyed carry only a digital card — such as in their Apple Wallet — and more than 95% of card-present transactions are contactless payments. It is this balance between physical infrastructure and digital technology, not only in the financial system, but in broader society that has held Ukraine in good stead during wartime.

Innovation during war

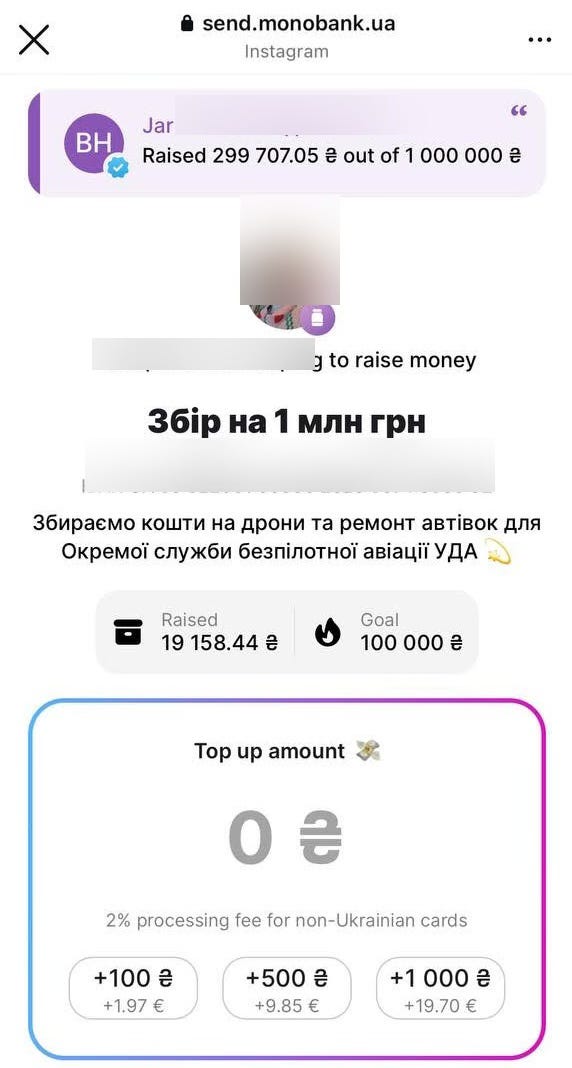

Monobank added jars to its app in 2019 (банка in Ukrainian). Similar in many ways to Monzo’s concept of pots, Monobank’s jars allow users to set up a savings account with specific goals, often with visual cues — if you’re saving for a holiday, why not add an image of a beach? As you may have anticipated, Monobank has taken this one step further than many other neobanks. Users can send a link on messenger apps for friends and family to add to jars, anyone can contribute (not just Monobank customers), and even Apple Pay can be used to pay into a jar.

In 2022 jars took on a new purpose. When the full-scale invasion happened, the military needed equipment faster than government procurement could manage. Ukrainians began using jars to collect donations to support the war effort. Volunteers, including friends, family, and work colleagues of those on the frontline, and society at large stepped in. People gave whatever hryvnias they could afford. Jars were set up to buy body armour, medical supplies, and thermal imaging equipment. To facilitate this cultural phenomenon, Monobank stepped up.

“People just intuitively started to use jars to collect donations,” Andrew explained. “And Monobank created a separate product for donations.” Additionally, foreign cardholders were soon able to add to jars, leading to links being shared on social media as Western citizens sought to help the Ukrainian war effort. Some years earlier such transactions would have likely been blocked by the payment processor in Ukraine or the card issuer in the UK (for example), yet they worked easily and seamlessly in most cases.

From a personal perspective, I often donate to different causes through jars. When people I trust are raising funds, it becomes a very easy and immediate way to support them. It also makes giving feel more personal — you’re not donating to an abstract cause, but supporting someone you know, who is directly involved.

At first glance, this model may seem like it adds an extra layer, but in practice it significantly boosts fundraising by making campaigns more relatable and accessible.

Kateryna Leliukh - Head of PR at Akurateco

The innovation hasn't been limited to jars. Like much of the world, Ukraine has seen significant growth in BNPL in recent years. These solutions are powered by a mix of banks and specialist BNPL providers. The sector is well-regulated and operates within Ukraine's financial and consumer credit framework. It has become a useful means for consumers to spread out payments during times of uncertainty.

Diia and European integration

A couple of years ago, I spent some time in Estonia. I discovered that it’s a country where almost everything can be done online, and done efficiently too. Almost zero paperwork, and integrations that make life much easier than anything we have in the UK. From talking with Andrew, I learned that Ukraine’s e-government system, known as Diia (Дія, meaning "action" in Ukrainian), is perhaps even better. “I would say that Diia is by far better than other e-government apps.” This got me intrigued. He added, “I couldn’t name any similar project in the world which has such sophisticated functionality.”

The array of functions Diia supports is impressive.

Within the Diia app, users can store identity documents and driving licences, track traffic fines, monitor debts, and access a wide array of government services. The Akurateco team told me about one particular feature that I wanted to highlight as it’s something specific to the situation the country finds itself in. Inside Diia, users can buy Military Bonds. These government-issued war bonds are named after Ukrainian cities and places under occupation — for example Alchevsk (Алчевськ), Foros (Форос), and Livadia (Лівадія) — adding a symbolic layer to the investment product.

Ukraine is aiming to join the European Union in the coming years. This means aligning with various financial-sector frameworks. Andrew explained that Ukraine’s central bank has been proactive in this area. “Even now we are ready to meet the criteria and requirements. In some cases, Ukrainian regulations are already stricter than EU standards require.”

Despite the ongoing war, this focus on European integration is important.

Reconstruction and claiming a place in the wider European project is key to Ukraine’s future. Yet it’s not only in military terms that the West has a lot to learn from Ukraine. When it comes to the financial sector and wider technological innovation, Ukraine is leading the way, and much of Europe has plenty of catching up to do.

Thanks for reading Payments Culture!

It was great working with Andrew, Kateryna, and the Akurateco team on this post. It’s a topic I have long wanted to learn more about, and even though we barely scratched the surface, I hope it gives readers a useful window into Ukraine's story.

Akurateco is a payment software vendor offering a white-label payment orchestration solution for acquiring banks, PSPs, and enterprise merchants. Around 50% of the team is currently based in Ukraine, and they continue operating despite wartime conditions — something that has shaped not only their internal resilience, but also how they think about reliability, redundancy, and uptime in payments.

In 2024, Akurateco was selected as part of Ukraine’s official delegation to London Tech Week, alongside seven other Ukrainian startups — highlighting their role within the broader Ukrainian fintech ecosystem that keeps building internationally while remaining closely connected to the realities on the ground.

Note that views expressed on this Substack are my own and do not represent any other organisation. Also nothing I say should be taken as investment advice.

Support this newsletter

An annual membership to Payments Culture works out less than the price of a coffee each month. By supporting, you’ll help me keep writing. Paid members will get access to exclusive posts, as well as new features I’m building out in the months ahead.

Note: You can refer friends or colleagues to earn complimentary month(s) of paid membership.