Stablecoins have had a rocket boost - will merchant payments be next?

Payments will be enhanced with new rails for a new era

Post synopsis:

Stablecoins have, since 2014, offered a low-cost digital asset linked to assets such as the US dollar. They bridge the old and new worlds of banking by enabling money movement on new payment rails.

Companies like Walapay and Sling Money are advancing money movement with stablecoins. Stripe’s $1.1 billion acquisition of Bridge has highlighted the growing interest from established players. Although merchant adoption remains limited, startups like Easy aim to streamline stablecoin payment acceptance.

Regulation is evolving with the introduction of the GENIUS Act and recent OCC guidance. As stablecoins gain traction and regulatory clarity improves, they can transform payments across a wide range of use cases.

Understanding stablecoins

The first stablecoins emerged in 2014, making the concept of stablecoins older than even Ethereum. (Ethereum is the second-largest cryptocurrency by market value and has held this spot for seven years, a long time in the world of cryptocurrencies.) Cryptocurrencies are volatile assets so the concept of stablecoins is simple. They are a subset of cryptocurrencies with a specific goal: preserving value and reducing volatility.

Linked to the value of assets such as the US dollar, Euros, or Gold, stablecoins allow users to store value on a cryptocurrency exchange or in a crypto wallet. Due to financial regulations, many exchanges prohibit users from holding assets in actual US dollars. As a result, stablecoins like USDT and USDC serve as dollar equivalents, allowing users to maintain funds in a proxy for these real world assets.

For many users, once money has moved on-ramp into the cryptocurrency ecosystem, there’s good reasons to keep it there. Removing money from a cryptocurrency exchange incurs fees and may have tax implications. Having the option to keep funds in a stable asset such as US dollars but still on-chain can be beneficial.

In theory, for every stablecoin dollar, there’s an equivalent dollar in real-world safe assets. Safe assets are, for example, short-term treasuries (US Government bonds), cash and money market funds. Each stablecoin has its own methodology for maintaining its dollar peg. It’s true that there have been cases where, during financial stress, the peg between a stablecoin and the dollar has broken. But these periods have been short-lived, and the 1-1 link has returned within days.

Apart from holding value on an exchange, stablecoins have found a range of new use cases. Almost 99% of stablecoins are pegged to the US dollar, and this link to stable assets means they are ideal for lending collateral. Additionally, there’s an ever-evolving world of decentralised finance (DeFi) that utilises stablecoins to facilitate complex financial alchemy. The lines between the old and new financial worlds are blurring. On one hand stablecoins can help with some of the intricate demands of the crypto ecosystem. On the other hand they can also help with familiar use cases such as moving money from person to person.

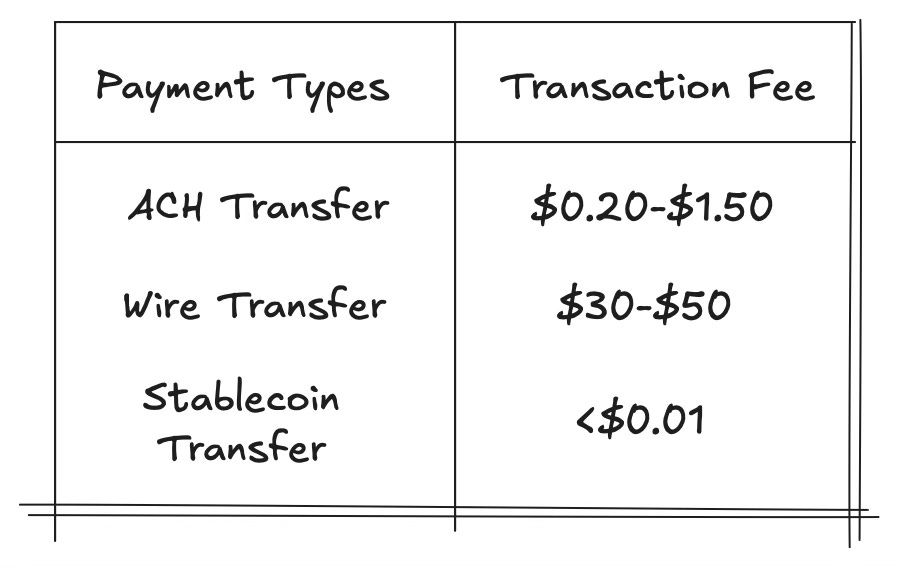

Stablecoins can be used to move money in US dollars at a lower cost than any other option. Indeed, neither the sender nor recipient needs to know that stablecoins are involved in the money movement process. A customer-facing User Interface (UI) only has to show the movement of real dollars from one user to another. If the cost is low and the User Experience (UX) is good, then users won’t be concerned whether stablecoins are involved.

Examples of companies developing stablecoin solutions for money movement include Walapay, which is building a global money movement API with stablecoins at its core. Another example is Sling Money. Founded by ex-Monzo Chief Product Officer Mike Hudack, Sling Money, powered by Avian Labs, will allow users to send money almost anywhere globally. More than 75 countries are live so far, and the company is growing at pace.

The importance of Bridge

Even though companies have been building in the stablecoin space for years, the area has garnered ever-increasing interest in the past months. This interest has been largely driven by last October’s announcement that Stripe had acquired the stablecoin start-up Bridge. At the time, Bridge co-founder Zac Abrams announced on X:

Stablecoins represent an entirely new payments platform. Realizing the potential of this platform will be a decades-long journey.

As we’ve gotten to know the Stripe team, it’s become clear that we both share a vision for what’s possible with stablecoins and an excitement around the opportunity to create and build this future.

Bridge is Stripe’s biggest acquisition to date, paying $1.1bn to acquire Bridge. Bridge was only founded in 2022. The valuation represents a convergence of what Bridge has built so far, working with companies like Space X to optimise their treasury operations, and a reflection of the potential inherent in the stablecoin space itself.

Endorsing the potential of stablecoins, at the time of the announcement of the Bridge acquisition, Stripe co-founder Patrick Collinson posted on X:

Stablecoins are room-temperature superconductors for financial services. Thanks to stablecoins, businesses around the world will benefit from significant speed, coverage, and cost improvements in the coming years.

Considering this acquisition from a strategic perspective, it makes sense.

Like all firms, Fintech companies are stuck in an Innovator’s Dilemma. Clayton Christensen coined this term to describe how established firms struggle against new entrants. The new entrants have disruptive technology that is simpler and cheaper than the incumbents.

Established firms don’t want to drop prices, so over time, new entrants with a better product are willing to accept lower margins. These new entrants take market share from incumbents. By acquiring Bridge, Stripe can ensure that if - or when - stablecoins disrupt mainstream payments, they can stay at the front and centre of the next wave of innovation.

Note: As many reading this will know, Bridge is not Stripe’s first foray into stablecoin payments, but Bridge is clearly a sign of their ambitions in this space.

Stablecoins for merchant payments

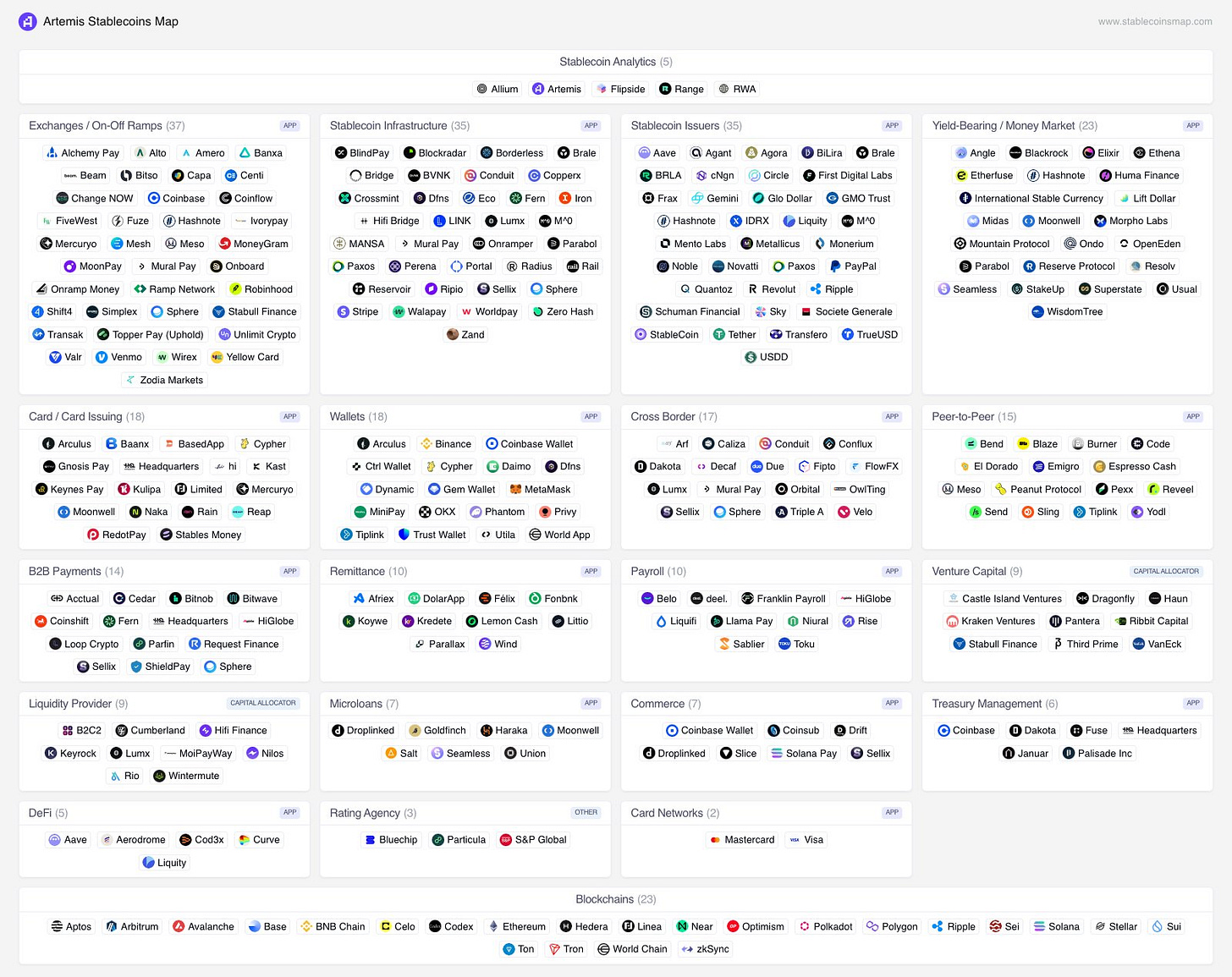

So far areas such as treasury management, B2B payments, and microloans have found their place in the stablecoin ecosystem. However, merchant-level solutions built on stablecoin rails remain notably absent, and are not found on the stablecoin map. This situation is not likely to remain the case for long. Respected voices in payments, such as Chris Colson, a payments expert at the Atlanta Fed, recently mentioned that stablecoins could one-day rival card payments. Chris’s colleague Nanci McKenzie noted that it’s possible to spend with the stablecoin USDC at some stores in the United States via the SPEDN app. Although right now the payment process with SPEDN seems somewhat clunky.

Sling Money, mentioned earlier in this post for their money movement use case, is looking to build merchant level payments at a later stage. Once the stablecoin infrastructure is in place, additional use cases can be built on top. In this case, Peer-to-Peer (P2P) payments will lead, with Consumer-to-Business (C2B) payments following on. In what they describe as their master plan, Sling Money explains their plan:

Ship and grow the world’s first universal P2P payments app. Low-cost, lightning-fast and delightfully simple. Sling Money uses modern blockchain technology to make international transfers possible at a fraction of the prevailing cost and speed. We will do this across about 150 countries with a combined population of 2.9 billion people.

Move more transactions on-chain. Transfers that happen exclusively on the blockchain are instant and cost almost nothing. We believe that as Sling Money grows an ever-increasing proportion of transactions will shift to being entirely on-chain – and thus free and truly instant – and that this will open global markets in ways never before imaginable.

Beyond P2P. As our users naturally accrue balances and more transactions shift on-chain, we plan to build additional features to allow our users to spend their balances for everyday purchases at merchants all around the world with both traditional products like debit cards and emerging technologies such as Solana Pay.

There’s a key challenge with building a stablecoin payment solutions for day-to-day adoption. At both the consumer and merchant levels, any solutions needs to function just as well as card payments - ideally better. And any solution need to deliver tangible benefits for both users and businesses. For mass adoption to take off, stablecoin payments shouldn’t require expertise with cryptocurrency wallets. Any solution has to be straightforward to use for anyone.

This challenge is something that payments start-up Easy is working on. The company utilises stablecoins on the Solana blockchain, but Easy doesn’t mention stablecoins prominently in its messaging. Instead, it positions itself as a next-generation payment processor, competing with both old world and new world payment providers.

Easy’s pricing is much cheaper than that of traditional processors. Yet the vision is about more than cost savings. The goal is to bring new ways of operating to small businesses. Programmable smart contracts and distributed ledger technology can give companies greater control over their money. Business can enhance their payment offering in a way which is intuitive and accessible to all users.

In a recent post on Fintech Brainfood, Simon Taylor described Easy as “a programmable payment processor”. This programmable element is due to smart contract technology, which will be familiar to many in the crypto space. But for those not familiar with this idea, Easy co-founder Niko Le Mieux explained to me that:

Programmable payments can allow companies to enable automated and conditional behaviour into money movement. With smart contracts, features such as Buy Now Pay Later (BNPL) or Save Now Pay Later (SNPL) can be integrated with a high level of customisation. But this is just the start. Programmable payments can allow for actions based on specific timing or events. One interesting use case is using smart contract to automate the treasury functions of Easy’s customers. We want to give all businesses the tools and functionality to run their business in the best way for them.

Easy is currently part of the Solana Labs incubator programme based in New York City. They have described the Solana ecosystem as highly collegiate and supportive when building real-world payment use cases. Solana’s focus on community is a key reason why the blockchain has successfully attracted attention, talent, and capital. From companies like Easy and Sling Money on the start-up side and BlackRock and Franklin Templeton on the institutional side. Solana has a rapidly evolving ecosystem that is developing at pace and eagerly looking to challenge established technologies and organisations.

Regulation and legislation

In the past days, Bank of America’s CEO Brian Moynihan said that the bank will launch its own stablecoin when it’s legal for them to do so. When the 2nd largest US bank by assets says such things, the market takes notice. Brian Moynihan’s comments follow on the heels of significant legislative and regulatory developments.

On February 4th, the GENIUS Act was introduced to the US Senate. GENIUS is an acronym for Guiding and Establishing National Innovation for US Stablecoins. The GENIUS Act will be the most comprehensive stablecoin legislation to date. The Act will lay out the requirements for operating stablecoins. But it’s likely to be mid-2026 or later before the GENIUS Act actually becomes law.

On March 7th, the Office of the Comptroller of the Currency (OCC), a federal bank regulator in the US, published important guidance. The OCC clarified that banks can engage in “certain stablecoin activities” and will not require specific permission from the organisation to do so. Whilst the OCC’s clarification is helpful, many organisations will likely wait to see how the GENIUS Act proceeds.

In the meantime, while we wait for the GENIUS Act to progress through Congress, expect financial institutions of all sorts to be working on their stablecoin strategy.

Thanks for reading Payments Culture!

Please leave a comment or share with a friend or colleague if you enjoyed reading this edition. It’s much appreciated and helps grow the audience of this newsletter.

If you enjoyed reading this post, you can connect with me on LinkedIn or X.