You've heard of BNPL - what about SNBL?

How SNBL delivers instalments without credit and a Q&A with South Africa's LayUp

This post includes a Q&A feature with the South African fintech LayUp.

Buy Now Pay Later (BNPL) has been one of the success stories in payments over the past decade. Many providers offer BNPL solutions, but Klarna has been the breakout success - it's the best-known BNPL brand in the USA and Western Europe. Klarna's brand is such that when consumers see the logo at an online checkout, they know they can pay in instalments, usually three equal payments over a set period - with the option to pay more quickly if desired.

Alongside its success, BNPL isn’t without controversy. Klarna’s UK website makes clear that their products are “unregulated credit”, and there’s an ongoing discussion on the future regulation of BNPL, not just in the UK but around the world. BNPL can enable consumers without a formal credit score to borrow over the short term. Essentially, rather than getting a credit card with a set limit of £1,000+ agreed upfront, BNPL is providing credit on a piecemeal basis, on a per-purchase basis.

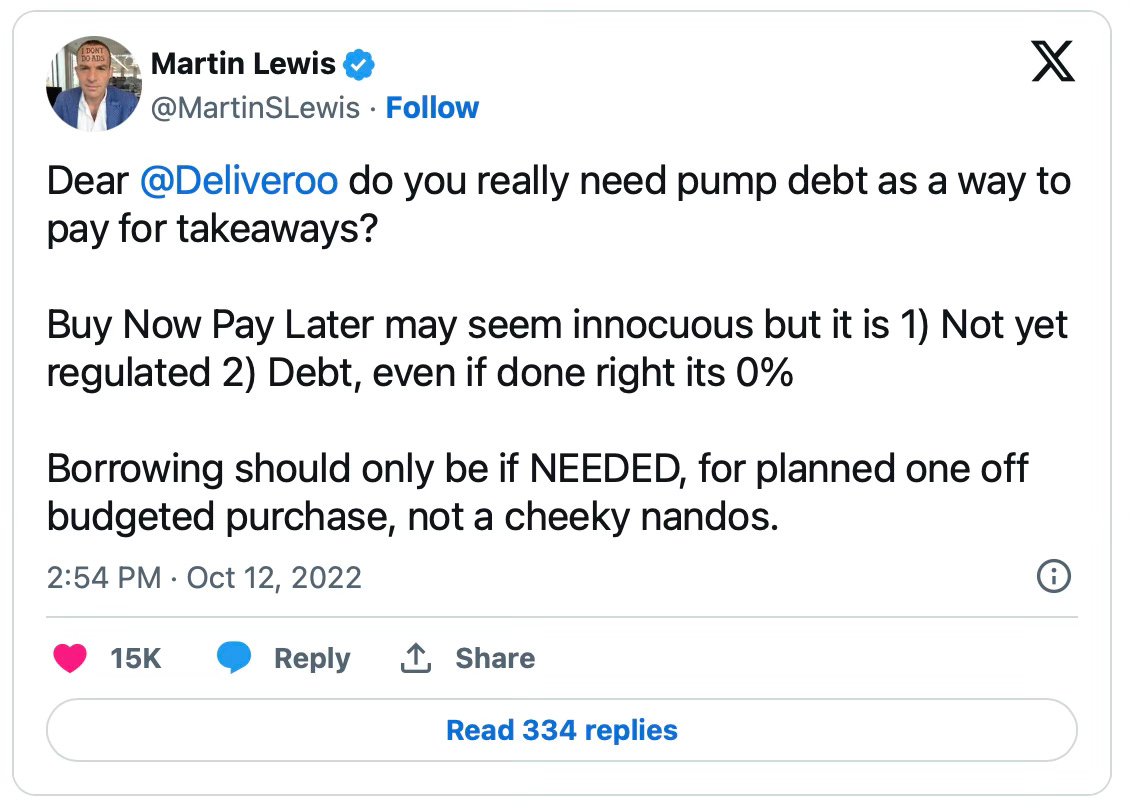

Using BNPL to pay for clothing has long made sense - if you don’t know what size will fit, then why not order two different sizes and send one back? Or order two colours and keep the one you like most. However, there was an uproar when food delivery services started offering Klarna as a payment option. In the UK, consumer champions such as Martin Lewis hit out at the idea of using BNPL to pay for a “cheeky nandos”, yet is it really different to paying on a credit card? The only difference is when the credit is provisioned.

Millennials and Gen Z (those born approximately from 1981-1996, and 1997-2012 respectively) have especially taken to BNPL. These generations make up over half of the global BNPL spend. One of the main benefits of BNPL is that consumers can make purchases without entering a card number. Usually, the checkout experience is nimble. Klarna’s own advertisements have emphasized this by talking about smoooth payments. The other upside for merchants is that BNPL is known to increase basket size. Consumers will likely spend more when they know they can pay in instalments or within 30 days (Klarna’s other main, albeit less popular option). This is the other reason, for which BNPL has been criticised - does the business model lead to consumers spending more than they can afford?

If a consumer misses an instalment payment under BNPL, there are consequences. The precise impact of missing a payment differs depending on the market, as BNPL is regulated differently in each country. But in the UK, a debt collection agency may get involved if reminders for late payments are not acted upon, and often, the debt grows with interest if it’s not paid off in time.

Part of the regulatory discussion is whether users understand the consequences of missing a payment. Indeed, there have been stories in the financial press of users racking up debts with BNPL that spiral over time. What starts as a single purchase can soon become debt of thousands of dollars. Almost frictionless transactions can enable consumers to spend so easily. Some BNPL apps notify users of pre-approved spending limits and encourage them to spend more, which blurs the line between BNPL and traditional credit. Especially now that BNPL providers are offering their credit cards - for example, see Affirm and Klarna.

Instalments Without Credit

There’s a way to benefit from spreading payments over time without taking on debt. This is with an emerging payment method known as Save Now Buy Later (SNBL), which has a different emphasis to Buy Now Pay Later (BNPL).

In BNPL a consumer takes out short-term credit and repays in set instalments, or pays the full balance within 30 days. With SNBL, the consumer commits to a purchase with a specific retailer, makes the first payment, and then adds funds to an account. The expectation is that the total amount added to the account will be the same as the value of the goods they wish to buy. For instance, a consumer may commit to $50 a month, each month for 3 months, to buy an item worth $150. The goods are only sent to the consumer once the full amount is saved. Additionally, customers can decide to pay more quickly than intended and then receive the goods earlier.

One benefit for a consumer using SNBL is that, in some cases, retailers may provide cashback or some other additional upside to those who choose to pay with this model. The retailer benefits from making more sales than they otherwise would have done - especially in markets where formal credit is not easily obtainable. Businesses can share the upside of these purchases with their customers. Like BNPL, SNBL usually leads to an increase in the value of the shopper’s basket (overall purchase value both in-store and online).

Missed payments under SNBL do not have the same negative consequences as in a BNPL model. This is helped by the fact that the consumer does not accumulate debt when making a SNBL purchase. The SNBL business model recognises that sometimes consumers cannot make payments in the schedule initially intended. Sometimes, an additional payment is needed to get to the total amount. One risk consumers face if they do not meet the original payment schedule is that the retailer may reduce or cancel the cashback they would have provided. This mechanism incentivises consumers to make their agreed savings plan but with more options than under a BNPL model. It recognises that circumstances change, and users may need to reprioritise their finances.

Additionally, SNBL can provide attractive promotional opportunities. Events such as Black Friday can be significant for those with the cash on hand to spend. But those with neither cash nor credit may be watching from the sidelines as others enjoy great deals. SNBL changes this. It allows users to lock in the price on a particular day and save to cover the balance within the agreed time period. Likewise, this option can work well for pre-orders. If a new product is coming out soon that may sell out, users can lock in their reservation with SNBL and finish their payments before the release date.

While the wide range of benefits makes SNBL a valuable payment mechanism, its potential extends beyond that. It can be a tool to enhance a user's digital footprint, including bolstering their credit profile. This is best explained by Buhle Goslar:

SNBL is about more than just the ease of obtaining a product through periodic upfront, interest-free payments without credit checks. It's also about generating valuable digital footprints. No matter how small, each transaction adds a data point that showcases spending habits, reliability, and purchasing patterns. These footprints provide the financial system with a rich data reservoir, enabling the use of artificial intelligence and big data tools for custom financial products…

In thinking about scale and ubiquity, this is where Africa's mobile money and banking sector can step up and shine. There's a transformative business proposition in partnering with fintechs and e-commerce platforms to enhance the user experience – integrating digital wallets, providing trust accounts, bolstering security and customer incentives and harnessing the rich data for more inclusive credit assessments, to name a few opportunities. A clear supply side and business model innovation opportunity exists.

This extract provides great insight into SNBL's broader ability to help consumers. Alongside mobile money and other local innovations, SNBL can drive financial inclusion in Africa. Companies operating in the SNBL space can develop their solution into a payments super-app, as Klarna has done with some success in the West. From these ideas, there's space for a new generation of fintechs to emerge in developing economies. Who are they? Let's look at one example.

South Africa’s SNBL Sucess Story

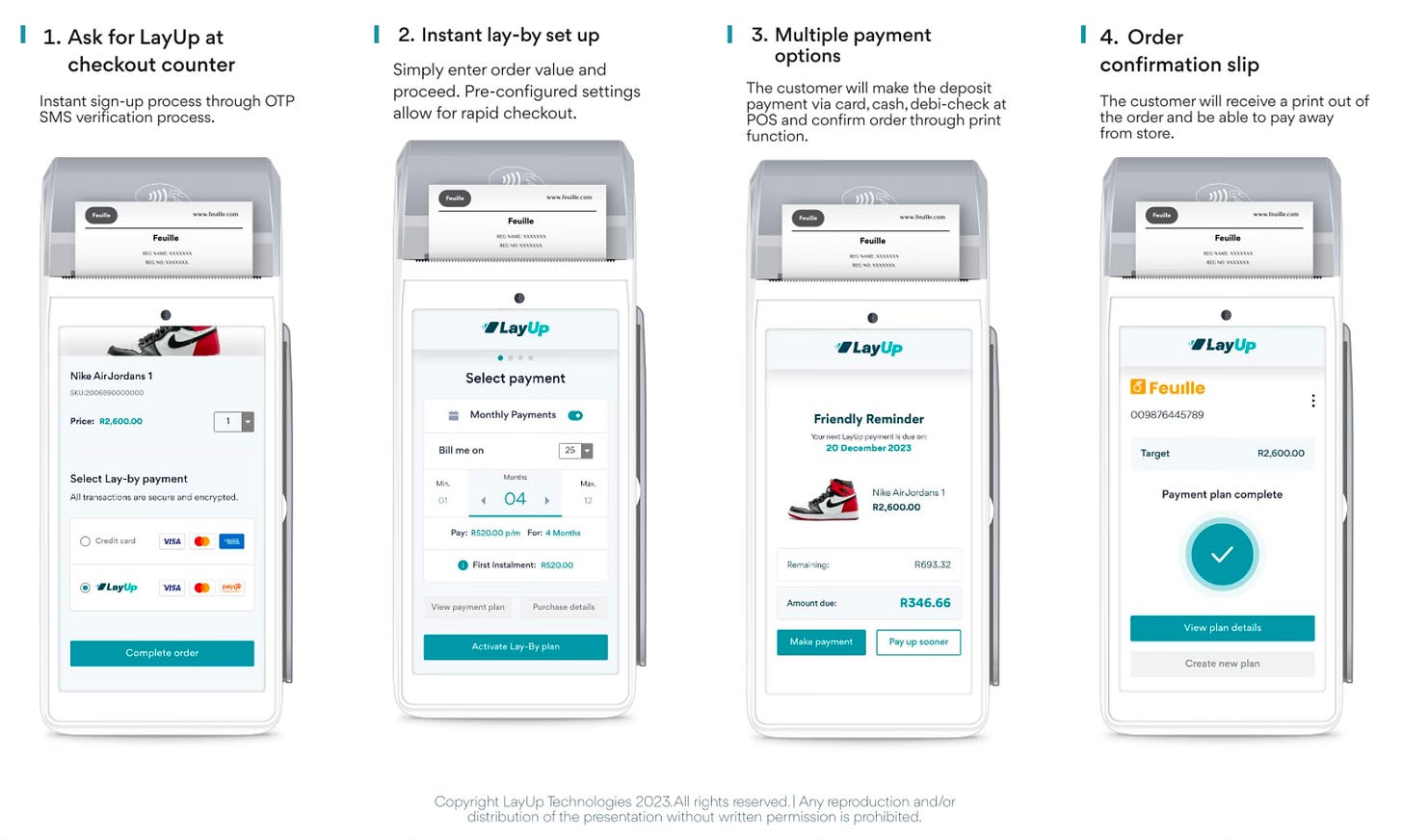

LayUp is a successful example of SNBL and one of the key success stories of this payment mechanism globally so far. I was impressed to see the company's growth trajectory. They've enabled a large number of retailers, both online and in-store, to accept payments in instalments. Merchants all across South Africa are using LayUp in a wide range of sectors.

The company's growth has been helped by its ability to work effectively with both sides of the equation - businesses and consumers. For consumers, a purchase requires just a phone number. Businesses can integrate with APIs or utilise shopping cart integrations, such as for Magento, Shopify, and WooCommerce.

In writing this post I was fortunate to speak with Xolani Shezi from LayUp’s sales team and CEO Andrew Katzwinkel. The Q&A that follows provides insight into LayUp’s offerings in more detail and its mission as a company.

Tell me about the origins of LayUp.

LayUp was founded in 2021 by Andrew Katzwinkel to change how people manage their finances, particularly in lay-by or layaway payment systems. The company was born to provide consumers with an alternative to traditional credit-based purchasing, offering a more flexible and accessible means of acquiring goods and services. Since its inception, LayUp has become a leading provider of lay-by solutions in South Africa, empowering merchants and consumers to make smarter financial decisions.

Please outline your product offerings at a high level.

At a high level, LayUp offers a comprehensive suite of financial solutions to empower merchants and consumers. These offerings include:

1. Lay-by payments: LayUp provides merchants with a digital lay-by payment platform, allowing consumers to reserve products and pay them in instalments without incurring interest or fees.

2. Recurring billing and subscription services: LayUp enables merchants to set up recurring billing and subscription services, allowing them to collect payments automatically regularly for memberships, services, or ongoing product offerings.

3. Pre-order management: LayUp offers pre-order management tools that enable merchants to accept advance payments for upcoming products or services. These tools help drive anticipation and sales while effectively managing inventory.

4. Payment processing: LayUp facilitates various payment methods, including credit/debit cards, instant EFT, and cash, providing consumers with flexibility in how they pay for their purchases.

5. Merchant dashboard: LayUp provides merchants with a personalised dashboard to manage and track their lay-by plans, recurring payments, and pre-orders, gaining insights into their financial performance and customer behaviour.

Overall, LayUp's product offering aims to streamline payment processes, boost sales, and enhance the shopping experience for merchants and consumers.

What was your breakthrough moment when you realised there was strong demand for SNBL in South Africa?

Before LayUp, the prepayment market was largely fragmented, with no cloud-based digital lay-by payment system. LayUp’s tracking, collection and reconciliation technology solves the laborious administration and expensive hassles associated with traditional, analogue layby books to serve businesses and customers better.

Whilst designed to protect consumers and lenders, conventional credit procedures exclude many underbanked consumers in South Africa. LayUp’s service offering places the financial agency into the hands of the consumer by providing a convenient solution that requires little to no qualification criteria; the customer controls their spending towards a product/s depending on how much they can afford.

Why do you think the SNBL product is such a great fit for South Africa?

We aim to achieve impact with the unbanked, credit-excluded and informal sectors of South Africa.

Inflation and rising interest rates have led to an increase in the cost of living. As a result, many consumers need more disposable income and need help making payments on their financial commitments. Failure to make timely payments on loans and credit extensions has, in turn, hurt many consumers’ credit scores, thus resulting in consumers being excluded from the credit market.

Our offering is not credit-linked; there are no qualifying criteria from a credit score or affordability assessment perspective. The consumer simply activates a payment plan by paying a deposit and subsequent instalments, after which they can obtain the item once it is paid for in full. They do not have to forfeit all payments if they face financial difficulty.

How important has social media been to your growth? I notice you’ve managed to build quite a big following on TikTok.

Social media has played a significant role in LayUp's growth by providing a platform to engage with its audience, showcase its offerings, and build brand awareness. LayUp's presence on TikTok and other social media channels has allowed us to reach a wider audience and connect with consumers more interactively and engagingly. Through creative content and engaging with followers, LayUp has effectively communicated its value proposition, drove customer acquisition, and fostered brand loyalty. Social media has been instrumental in LayUp's growth strategy, enabling us to stay relevant, build relationships with our audience, and drive business success.

How do you see products such as SNBL helping with financial inclusion?

LayUp's focus on Save Now Buy Later (SNBL) contributes significantly to financial inclusion by providing accessible and affordable payment options for consumers who may not have access to traditional credit solutions. By offering lay-by payment plans with no credit checks and zero interest, LayUp enables individuals with varying financial backgrounds, including those with lower credit scores or limited access to credit, to make purchases and manage their finances responsibly. This approach empowers a broader range of consumers to access goods and services without falling into debt traps or facing high-interest rates. LayUp's SNBL model also promotes financial literacy and responsible spending habits by encouraging consumers to plan their purchases and budget effectively, ultimately fostering greater financial inclusion and empowerment within communities.

There are many things to like about what LayUp has achieved so far. It has a strong financial inclusion story, and for many brands, offering the solution will bring additional sales by opening the possibility for new customers to buy higher-value items. It’ll be fascinating to follow LayUp’s journey as it unfolds, with growth planned both in South Africa and other markets beyond.

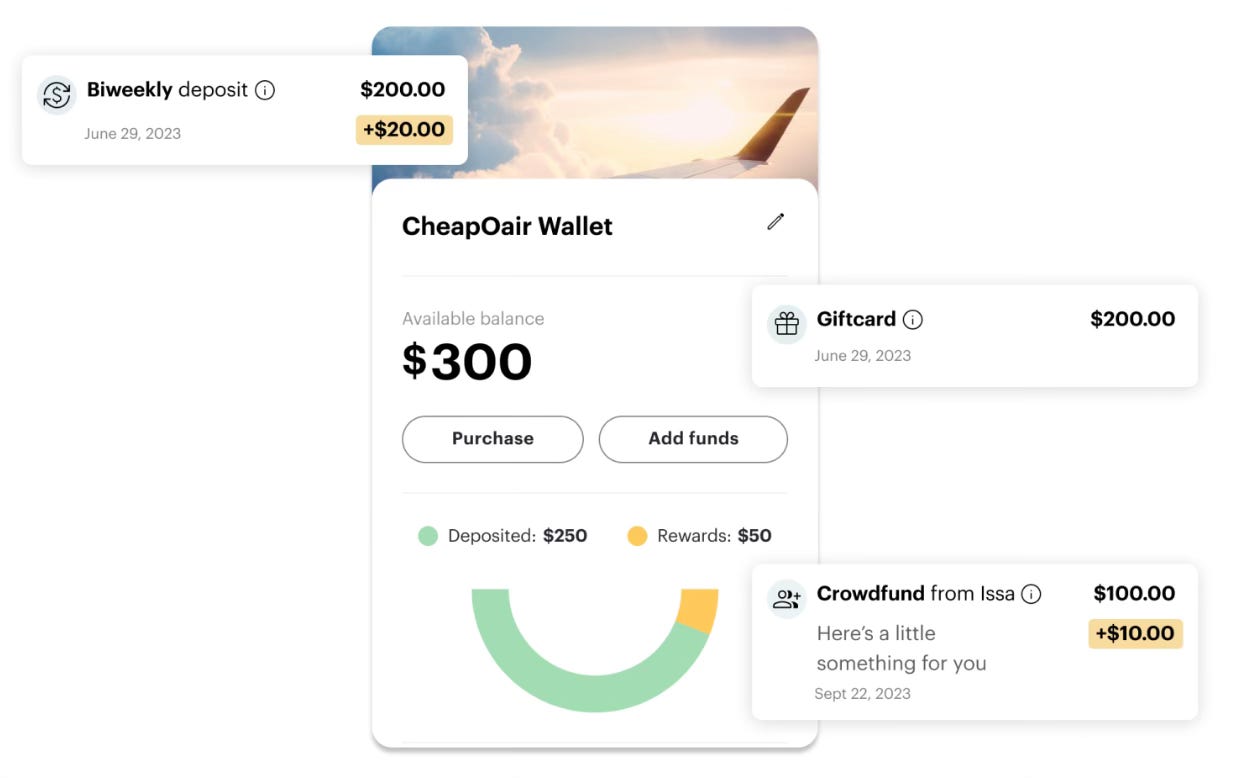

Globally Changing Savings Habits

In developed economies, several fintechs have been working on changing savings habits. However, the merchant-linked model offered by LayUp is rarely seen. In the USA, Accrue Savings is one company that has released a wallet that links to a chosen merchant. Users can fund the Accrue Savings wallet overtime, both on a regular and ad-hoc basis. Additionally, those other than the account holder can fund an Accrue Savings wallet - which it calls a "crowdfund". Merchants can also incentivise users by adding funds to their wallets to help them hit their savings targets.

Away from the merchant-linked savings model, neo-banks in the UK, such as Monzo, Revolut and Starling Bank, have pioneered the concept of savings pots. Rather than accumulating funds in a general savings account, specific savings goals are linked to savings pots. A pot could be named “Trip to Florida” or “Honeymoon Fund”, and a desired savings goal set. As money is added to a pot, users can see the target balance and the value added so far - as a percentage and as a monetary amount. This approach has proved hugely popular. In the UK, the terms savings pot and savings account have become largely interchangeable. Consumers now expect to be able to create sub-accounts for specific goals as part of their mobile banking experience.

Following on from the concept of savings pots, in the USA, Qapital has launched an app that helps users save for specific goals and budget accordingly. Qapital even provides the option of investing in stock market funds, as a way to save for the long-term. In Austria, a fintech called Monkee is providing its own take on helping users meet their savings goals. As per a report from Simon Kucher:

Consider the case of SNBL startup Monkee. This Austrian-based fintech recognized its customers' tendencies for mental accounting, a cognitive bias where people mentally separate or sort their finances into buckets like rent money, vacation money, and daily expenses. Mental accounting is the reason why people spend more when paying with a credit card, and mistakenly treat a tax refund as a windfall. Monkee designed a user interface to ensure mental accounting is not leading customers to spend and save in ways that can be detrimental to their financial wellbeing. This provides customers with a better overview of their financial lives. Monkee users are also encouraged to personalize the amount and frequency they want to save, and to earmark funds for specific purposes.

As well as reminders, suggestions, and automation of saving habits, Monkee also provides cashback opportunities. By shopping with partner companies, users can achieve up to 20% of their purchase value as a contribution to their savings balance. The solution does not follow the model of LayUp by linking savings accounts directly to specific merchants. However, Monkee is taking the first step, by building connections with merchants to deliver cashback. In the future, they could go the next step and link their savings accounts directly with merchants.

What’s old is new again!

As a kid growing up in the US, I remember going with my mother to the department store and when she found an item she wanted and didn’t have the money for, she would have them put item on layaway. They physically put the item in the back so no one else could buy it. She filled out some paperwork - one of those small tickets with an ink sheet between to slips so as to create a duplicate copy. We would usually come back in two weeks, after the next pay check came, to pay the remainder and go home with the item.

I do wonder if SNBL could work where there is easy access to credit. It seems in these markets, only those who don’t qualify for credit could find utility in SNBL. But would merchants set aside warehouse space to hold on to physical items until a consumer paid? What about disputes and fraud? With large merchants in the US like Walmart acquiring fintechs and getting lending licenses to establish more embedded finance, BNPL will remain dominant. There is still a role for SNBL, but likely limited to certain markets, particularly those without established credit structure, and to specific merchant types.

I am indeed optimistic about the potential of SNBL in Africa. At a micro level, it is an upgrade to a proven, low-friction, affordable and consumer-friendly financial product. At a macro level, it is a mechanism to bridge the financial, digital, and green access divides as we navigate a data-centric future. Great piece, and thanks for the mention of my piece Matt 💸📱 🌱.