Can AI-Routing increase revenue? (in conversation with Worldline)

Taking AI from theory to practice in payments

Welcome to Payments Culture!

Exploring the strategy, culture, and trends shaping the world of payments and fintech.

2025 is the year that every senior manager looked at AI and asked: How can this improve my business?

AI can improve processes and optimise outcomes. But enabling AI doesn’t always mean plain sailing. Earlier this year, Klarna replaced much of its customer service team with AI, yet they’ve since tempered ambitions to automate in favour of a more human-centred approach. The challenge is identifying where AI can deliver tangible business results.

S&P Global Market Intelligence report that 46% of AI proof-of-concepts were scrapped before they reached production. This isn’t a bad thing. AI is an inherently experimental technology, and culling underperforming pilots is part of the experimentation philosophy required to unlock genuine business impact.

For payments specifically, the difficulty is going from training models and implementing small pilot projects to scaling in a live environment, with all of the intricacies and challenges this can involve — especially when dealing with the need to process 100s of transactions a second.

As Europe’s largest Payment Services Provider (PSP) and one of the top five globally, Worldline operates across 170 countries. This scale matters. Scale should allow for experimentation. However, as many of us who’ve worked in large organisations will know, nurturing the right culture that allows for innovation, iteration, and launching products at the cutting edge is easier said than done.

Improving acceptance rates with machine learning

Transaction routing is one area where Worldline has seen AI deliver real world results. I sat down with Khalil Kammoun, Head of Shared Services at Worldline, and Julien Carme, Lead Data Scientist for AI Transaction Routing, to understand how they’ve turned AI-Routing from concept to reality, and the benefits this has delivered for businesses around the world.

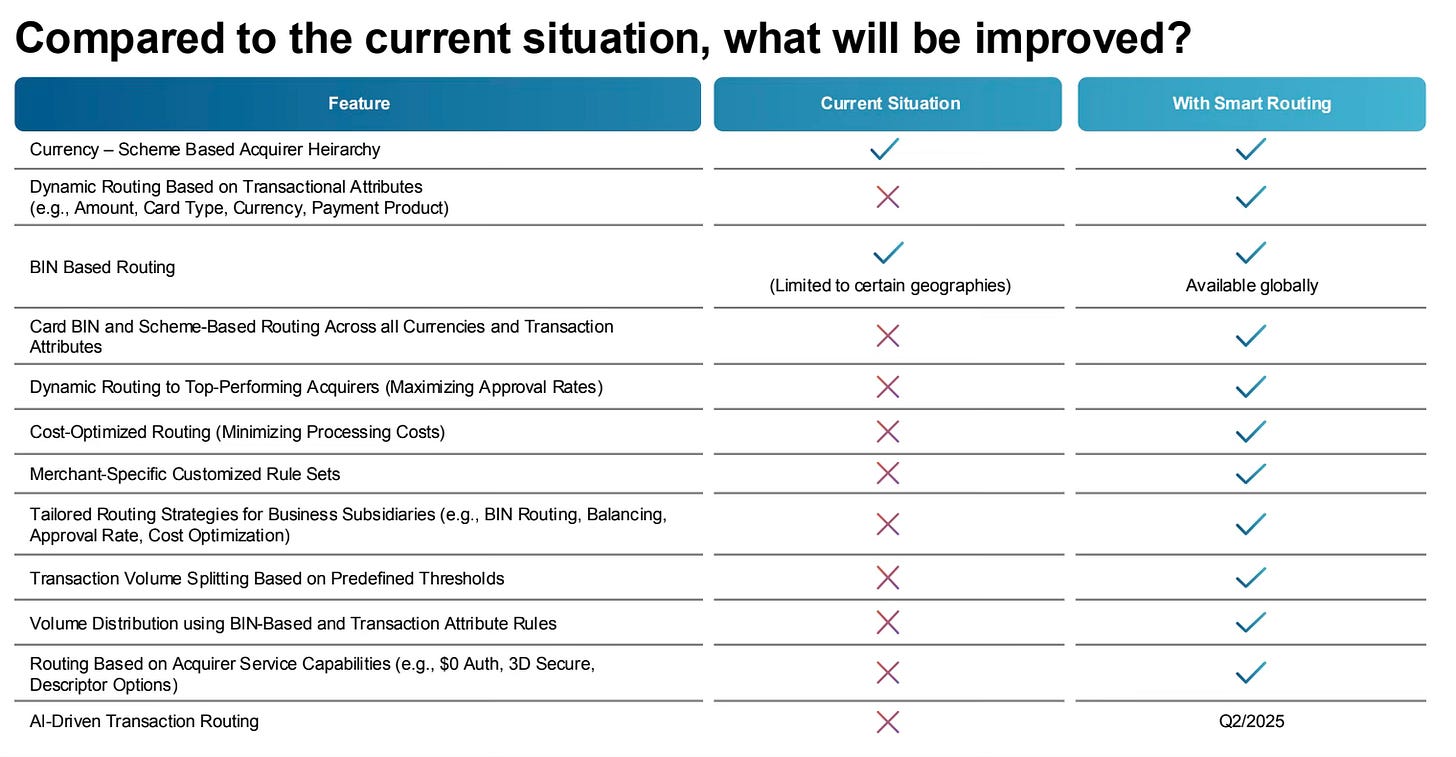

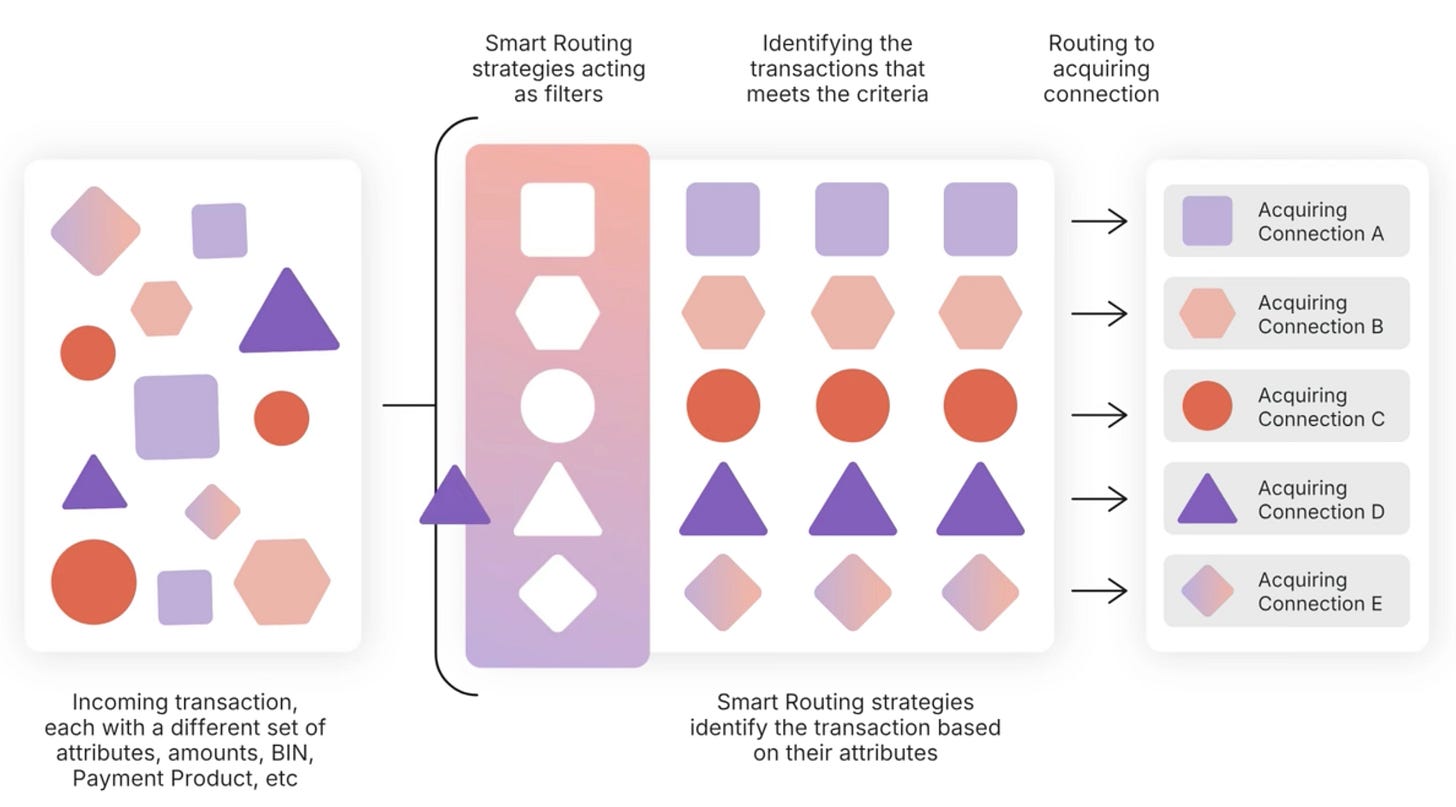

The company connects multi-national businesses to a variety of acquirers and payment processors. In a process sometimes known as payment orchestration, Worldline can deliver transactions to providers based on agreed criteria. One core requirement is the transaction authorisation rate or success rate, put simply, will the acquirer accept or decline the transactions they receive? Cost is another important factor. One provider may process debit card transactions at a lower cost than another, but for the same provider, credit card transactions may be more expensive.

Usually optimising for payment success means using static rules. Based on set rules, providers route transactions to the best processor to maximise acceptance. Payment systems can route transactions based on factors such as BIN range, transaction currency, customer IP address, or even transaction value, to name just a few examples.

Julien told me, “Standard routing models take in large amounts of data but can’t capture changes in acquirer behaviour over time.” This is because traditional orchestration models depend on providers manually examining data and updating predefined rules. With an AI-based orchestration model the system receives feedback with every transaction and continuously adjusts its behaviour.

Worldline’s AI-Routing uses neural networks — machine learning models that analyse dozens of factors at once and capture patterns that humans can’t easily codify.

“The system can create its own rules and find efficiencies,” Julien noted. At times this approach delivered surprising results, “We’ve had cases where the platform routed transactions to an acquirer that was more expensive, but had a much better acceptance rate.” In this instance the merchant benefited from higher total revenue despite paying higher fees per transaction. Such a scenario would be hard to replicate in a model with static rules, showing how machine learning models have the potential to deliver unexpected upside in a live environment.

From training the model to proven results

When Worldline started the AI-Routing project it was unclear if the programme would be a success. Payments orchestration with static rules was long-established but there was no clear benchmark for what success looked like with an AI-based routing model.

The AI-Routing project was premised on the belief that transactions are more likely to be accepted by some acquirers than others. In the test environment the company simulated many different scenarios and saw positive potential with various experimental datasets. But there was no certainty of how this would translate into a production environment with live transactions and significant payment volumes.

“In a live environment the model has to decide which acquirer to route a transaction to within milliseconds,” Khalil said, emphasising that the solution must maintain end-to-end processing speed despite the multiple factors under evaluation in real-time.

When asked about the results of AI-Routing, Khalil explains, “At a baseline level, rule-based routing models deliver an uplift of up to 3% in payment acceptance rates. With AI-Routing capabilities, merchants have seen an average additional 2% uplift in acceptance rates. In some cases even a 0.3% increase in transaction success equated to over a million Euros in additional revenue, which shows how incremental improvements can lead to significant gains for our merchants.”

Analytics and new developments

Worldline has developed a suite of data analytics to allow merchants to better understand the performance of the AI-Routing solution. A team of consultants works directly with businesses to understand their metrics and provide valuable insights on the uplift in acceptance rates.

The consulting team can explain the trends and dynamics that businesses see in their transaction flows. This process helps not only merchants understand their metrics, but also within Worldline, these deep conversations with merchants help shape the product roadmap and feature development.

On a monthly basis more merchants are utilising Worldline’s AI-Routing solution, and further enhancements are planned over time — it seems likely the popularity of this solution will only increase. This was one of the AI projects that worked out well.

Although there is, of course, competition. Mastercard has recently announced its own payment optimisation platform, and other providers are also considering how machine learning can help improve merchant outcomes. Worldline’s strength will be staying close to merchants and building on its success to date.

Thanks to the Worldline team for discussing this topic and sharing their story with me.

If you are a fintech company and want to share your story please reach out and let’s talk further. You can contact me via email, on LinkedIn, or on X.

Note that views expressed on this Substack are my own and do not represent any other organisation. Also nothing I say should be taken as investment advice.

This is a fantastic case study on moving AI from theory to practice. The shift from static rules to dynamic, outcome-optimizing systems is a trend we're seeing across industries.

For those interested in this principle, I explore similar efficiency plays in AI and outsourcing in my own writing.