Circle's bumper IPO and highlights from Money20/20 Europe

How stablecoins are going mainstream

I last wrote about stablecoins in depth back in March. Since then, it feels like there’s been a relentless flurry of news in this area, including but not limited to:

Stripe acquiring crypto wallet infrastructure startup Privy.

Walmart, Amazon and even Expedia exploring the use of stablecoins.

This news hasn’t directly involved retail investors. But now, opportunities are emerging for small investors to participate in the stablecoin space beyond simply holding tokens in their Coinbase accounts. (Other exchanges are available.)

Earlier this month, while much of the fintech crowd in Europe were enjoying Money20/20 in Amsterdam, stablecoin company Circle went public in New York. Trading under the ticker CRCL, Circle Internet Group, as the company is formally known, launched at an IPO price of $31, and closed its first day at $83.32.

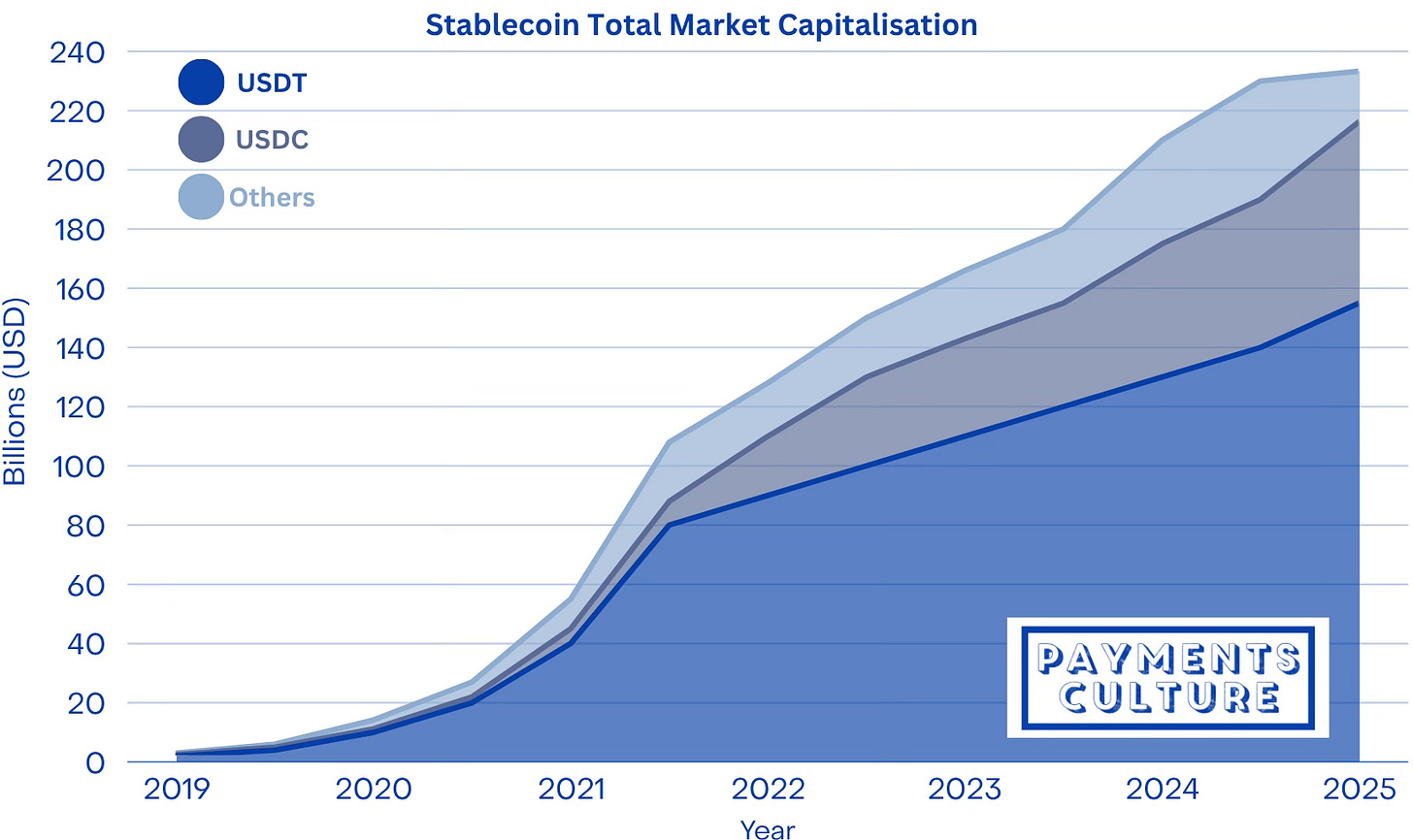

The IPO pop - the term for a first-day share price increase - was 168%. This compares to an average IPO pop of 31.2% for tech IPOs, and 11.1% for other sectors. Usually, a pop of this magnitude signifies that the IPO pricing was too low, or that demand was simply overwhelming. Circle issues USDC, the world’s second-largest stablecoin by market capitalisation, trailing only Tether’s USDT. Buying into Circle is a way for investors to grab a chunk of the stablecoin buzz, which is everywhere in fintech these days.

At the time of writing, Friday 20th June, Circle closed at $242.81, meaning those who got in at the IPO price of $31 are up almost 700% so far.

Who can blame investors for wanting to buy into Circle when their S1, their IPO prospectus, showed a company with impressive revenue growth over the past five years:

2020 - $15.4 million in revenue

2021 - $84.9 million in revenue and reserve income (+451.3%)

2022 - $772.0 million in revenue and reserve income (+809.3%)

2023 - $1.5 billion in revenue and reserve income (+94.3%)

2024 - $1.7 billion in revenue and reserve income (+13.3%)

The clear callout of revenue and reserve income in the S1 is noteworthy.

Revenue is income from platform, service or transaction fees. Reserve income derives from assets held in reserve such as the yield earned on US Treasuries (Government Bonds), or other low-risk instruments. As I noted in my previous post on stablecoins, each stablecoin dollar is backed by a low-risk asset, which generates this type of income.

Over the past five years, Circle benefitted not just from a growth in USDC issuance but also from rising interest rates. As rates stabilised in 2023 and then started to reduce in 2024, Circle’s revenue growth plateaued. This is the downside to Circle’s business model, as Jason Mikula recently highlighted:

Despite the current burgeoning enthusiasm for stablecoins, in general, and Circle, specifically, as a business, Circle is overwhelmingly exposed to short-term interest rates, with some 98% of its revenue coming from interest on its reserves.

With predictions about where the Fed funds rate will go in the future nearly always wrong, Circle and its investors are likely to have a hard time modeling for future performance.

To combat this revenue concentration, Circle is trying to diversify into additional income streams. In addition to their USDC coin, they offer wallets as a service (similar to Privy) and a smart contract enablement product. The reality is that the bulk of their business will continue to be from issuing and obtaining yield on USDC for the foreseeable future. Their reserve income will be sensitive to movements in short-term interest rates.

If real-world use cases grow, then more USDC will be issued, which may offset any potential decline in yield from any drop in short-term interest rates. However, this will depend on the dynamics and interplay between yield and issuance. New use cases and partnerships will open up opportunities for USDC to grow in circulation. In the past few days, Circle has announced a new partnership with financial infrastructure provider OpenPayd.

Opportunities and risks

We can expect to see more partnerships come to fruition after the GENIUS Act fully passes into law. Especially as banks and other regulated financial institutions look for stablecoin partners. Circle is considered a safer bet in the US and other Western economies than the more gung-ho Tether and its USDT. Tether is stronger on consumer-facing crypto exchanges and in emerging markets, but has faced more questions over its governance compared to Circle. Tether doesn’t have the desire to go public and is profitable to the tune of billions of dollars each quarter.

As stablecoins grow from an asset class with a market cap of billions to a market cap of trillions, USDC will be well placed to be the coin of choice for regulated businesses. That’s not to say there are no risks here. The regulatory framework for stablecoins remains in flux. As the Financial Times recently put it:

Stablecoins exist in a grey area, somewhere between a payments network, a bank deposit and a security.

While the GENIUS Act may provide clarity on some elements, stablecoins are fundamentally different in form and function from traditional financial instruments.

Stablecoins represent deep structural change, with the potential to fundamentally transform how money moves globally across multiple domains. With consideration, but not limited to cross-border payments, treasury management, and settlement mechanisms.

We are stepping into a world of programmable money and 24/7 settlement (no more business banking hours). Yet we should be clear-eyed that with innovation always comes new risks. Circle’s S1 makes an interesting point:

Stablecoins may face periods of uncertainty, loss of trust, or systemic shocks resulting in the potential for rapid redemption requests (or runs). Extreme scenarios, such as market shocks that affect the value of USDC’s reserves or simultaneous requests to redeem all or substantially all USDC in circulation, or concerns related to Circle stablecoin reserves, may lead to redemption delays and USDC reserves being insufficient to meet all redemption requests.

This risk description makes clear that stablecoins could be impacted in a scenario similar to a traditional bank run. A situation where everyone wants their money, but the bank doesn’t have the cash on hand to hand back to all their depositors. (Hence why, in the world of banking, deposits are seen as a liability, not an asset.)

Undoubtedly, IPO prospectuses need to consider the worst-case scenarios and clearly call them out. But the flip side to financial innovation only gets discovered in times of crises. For now, for Circle and their investors, it’s been a great couple of weeks.

Circle had a small taste of what can happen when stablecoins meet counterparty risk with the collapse of Silicon Valley Bank in 2023. Circle had approximately 8% of its total reserves in SVB at the time of its collapse. It could be argued that, as SVB faltered, Circle benefitted from a US government guarantee to “make depositors whole”, especially as USDC briefly depegged from the dollar, dropping to $0.88 at one point.

Money20/20 Europe

At Money20/20 in Amsterdam, the central theme I noticed was, to some extent, a continuation of the above. Not just stablecoins though, rather, I would sum it up as everyone wants to be infrastructure.

Over the past decade, Stripe have led the way in showing how infrastructure can be a successful business model in payments. They have historically framed themselves as payment infrastructure for the internet, and at Money20/20 their current tagline financial infrastructure to grow your revenue looked down from their balcony space overlooking one of the main halls.

My observation that everyone wants to be infrastructure is not meant as a slight to companies offering stablecoins, borderless bank accounts, or any other form of infrastructure. However, what was noticeable was the lack of direct-to-consumer businesses and traditional payment processors.

Given that Money20/20 is an industry - as opposed to a consumer -focused conference, this emphasis on infrastructure should be no surprise. Still, this component seemed to be more dominant than ever this year.

Infrastructure can be a great business model. Rather than signing up individual clients, a single infrastructure partner can bring thousands of clients onboard. Yet companies offering infrastructure-as-a-service need a clear differentiation strategy that allows them to evolve from pipes that data flows through, into a platform with defensible competitive advantages.

What follows are some key announcements and highlights from Money20/20 Europe this year.

Open banking continues its momentum

At Money20/20 , Deutsche Bank and Mastercard announced a strategic partnership to accelerate open banking across Europe. Deutsche Bank’s R2P (Request to Pay) solution will be offered to merchants, giving consumers the option to pay directly from their bank accounts via Mastercard’s open banking network.

In commenting on the partnership, Killian Thalhammer, global head of Merchant Solutions at Deutsche Bank, said:

This partnership with Mastercard marks a pivotal moment in the growth of open banking. Together, we are delivering innovative merchant solutions that reflect the needs of a digital-first economy—secure, instant, and built for scale.

Valerie Nowak, executive vice president, head of Open Banking for Mastercard Asia Pacific, Europe, Middle East and Africa, added:

Our long-standing collaboration with Deutsche Bank showcases the power of partnerships in transforming how people and businesses interact with money.

Open banking provider Token.io was particularly active before and during Money20/20. In the run-up to the event, the company announced they had joined the giroAPI scheme and became the first open banking third-party provider (TPP) to do so. GiroAPI is built on the Berlin Group’s Open Finance API framework, launched at the start of this year. The standard goes beyond what was mandated by PSD2 and will allow for Premium APIS in the German market, meaning new use cases and service levels for merchants.

At Money20/20, Token.io announced that HSBC had become a strategic investor in the company. The companies have worked together since 2019, and the investment represents the next phase in this partnership. HSBC joins existing investors such as Switzerland-based financial institution Postfinance and venture funds 13books Capital, Cota Capital, and MissionOG.

Commenting on the strategic investment from HSBC, Todd Clyde, CEO of Token.io, said:

We are excited to deepen our partnership with HSBC as we embark on this collaboration. This investment will not only accelerate Token.io’s growth and innovation, it will also advance our shared vision of making Pay by Bank a mainstream payment method — delivering benefits for HSBC’s customers across the region.

Manish Kohli, Head of Global Payments Solutions at HSBC, added:

Our investment in Token.io reflects the trust and confidence we have in their team and technology, and our firm belief in the role that innovative Open Banking solutions play in transforming the payments experience for both corporates and consumers.

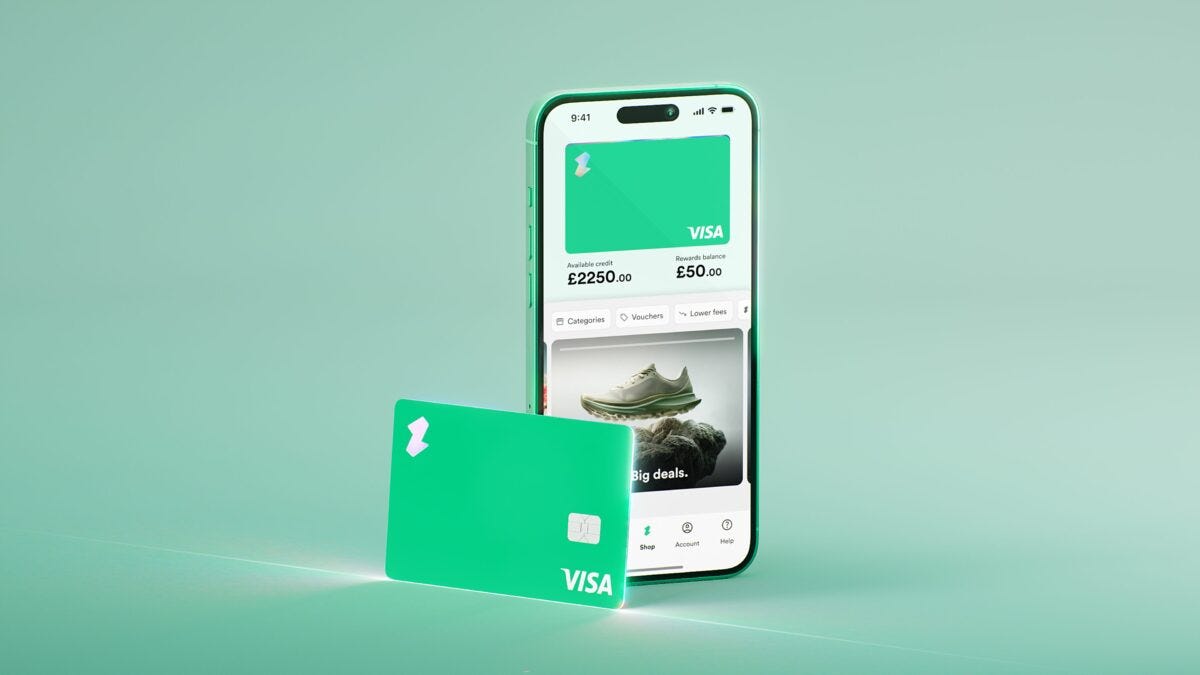

From virtual cards to physical cards

At Money20/20, Zilch announced they would launch a physical card later in 2025. Until now, Zilch’s offering has primarily focused on a virtual payment card. The company has been one of the recent success stories in UK fintech. The success of their BNPL-based, ad-subsidised payments network (ASPN) has led to a unicorn valuation, and the company has been profitable since July 2024.

Philip Belamant, CEO & Co-Founder, Zilch commented:

We have 5 million customers. We grow about 100,000 a month. We’re announcing our physical card today, which looks like a normal card, but what’s unique is the tech. These cards used to be a credit card, a debit card, a prepaid card, a charge card; that doesn’t exist anymore. Through our tech, you choose whether that’s a debit or credit or a deferred debit transaction. You can do it before. You can do that after. You can change your mind.

While almost 1 in 7 adults in the UK are Zilch customers, research found that 80% of the British population do not use mobile wallets regularly. Zilch will be able to capture additional spend from customers who prefer to use an actual card rather than digital wallets like Apple Pay. The physical card also unlocks new use cases, such as at hotels and car rental locations, where pre-authorisation functionality is required.

Additionally, Klarna will issue a physical card in the US. The card is currently in pilot, with 5 million consumers on the waitlist for the Klarna Card. The offering forms part of Klarna’s strategy of becoming an everyday spending solution, rather than solely a checkout financing option. Visa’s flexible credential technology can allow users to pay immediately or pay later, and decide this on a per transactions basis. The card will see a European rollout at a later date.

Next-generation issuer processors

Issuer processors fly under the radar somewhat. Unless you work in fintech, you might not have encountered them, but they are important in powering card payments within fintech apps.

Marqeta has forged a path as one of the leading next-generation issuer processors. They will power Klarna’s physical card offering (mentioned above). This follows their collaboration with Klarna on their virtual card offering since 2018.

In Europe, Marqeta has forged a successful partnership with small-business card provider Capital on Tap, and they power the card programme behind Scalapay, Italy’s first fintech unicorn and leading BNPL provider.

Earlier this year, Marqeta announced the acquisition of E-Money Institution (EMI) Transact Pay. The acquisition will strengthen Marqeta’s card programme management capabilities.

One way to get people returning to your stand at Money20/20 is to offer great food, drink, snacks or other freebies. Enfuce hit the mark on this front, with freshly baked cookies constantly emerging from a mini oven on their stand, which were truly delicious.

The month before Money20/20, Enfuce launched the Fortitude Pledge. This voluntary standard is designed to combat financial crime, much like B Corp certification addresses ethical governance. The pledge goes beyond legal minimums by requiring signatories to screen 100% of transactions and flag all high-risk activity. The Fortitude Pledge is part of Enfuce’s work with the UN Global Compact programme.

At Money20/20, UK-based allpay, which has been working with Enfuce to improve public sector payments, was unveiled as the first signatory to the Fortitude Pledge.

Other news from Enfuce at Money20/20 included announcements in the mobility space. The company will collaborate on an open-loop mobility card with Shuttel.

Additionally, Enfuce announced a strategic partnership with Octopus Energy’s Electroverse, Europe’s largest EV charging network with almost 1 million charging stations.

Note: As this post was already quite long, I’ll save some other insights from Money20/20 until later this week!

If you enjoyed reading this post, you can connect with me on LinkedIn, X, and BlueSky.

PS. I’m currently looking for new opportunities in fintech and payments, such as consulting, writing, and advising. Message me for a conversation.

I totally agree with your assessment of Circle's business model. Too concentrated and too much exposure to short term rate fluctuations.