How every bank can be a payments company

Embedding payment processing inside mobile banking apps is a key opportunity

Disclaimer: views expressed here are my own and do not represent any other organisation

In the last post, we looked at how software is disrupting payments.

We started by looking at the history of card acquiring and payment processing. At its core, card acquiring allows a business to accept customer payments. The acquiring bank deposits money from daily sales into a business bank account.

For many decades, card acquirers were part of a bank. They provided businesses with the ability to accept credit and debit transactions at the point of sale. This card-acquiring capability formed part of a business banking relationship.

Over time, a new wave of card acquirers emerged. Banks lost market share to this second wave of card acquirers focused initially on e-commerce payments.

The latest competitors are software providers who embed payment technology within their app. Only a phone is needed, as the phone's built-in NFC technology, known as SoftPOS (Software Point-of-Sale), can take payments directly. Often, the term Tap to Pay is used for this service.

As well as removing the need for a payment device, the other fundamental change is in the distribution model. A fintech with a business model predicated on SoftPOS doesn't need a significant sales function or an extensive customer support team.

But here’s an addendum to the previous post. On one hand, SoftPOS is a threat to traditional business models - a lower cost structure will enable a technical shift to software-based payments. On the other hand, there’s an opportunity for banks to enhance their offering by embedding payments into their mobile banking apps.

The question is whether they will take the opportunity.

The distribution advantage

Banks can add payment acceptance into their mobile banking app by working either in-house or with a payments partner. Some banks have already started thinking about this. Others will follow, and some are already live.

Revolut has gone live in the UK with Tap to Pay on iPhone earlier this summer:

Revolut Pro and Business customers can start using Tap to Pay on iPhone directly within the Revolut app or the Revolut Business app. New customers wishing to use Tap to Pay on iPhone can do so by downloading the Revolut app or the Revolut Business app on the Apple App Store using an iPhone XS or later running the latest iOS version. From there, they can sign up with a Revolut Pro or Revolut Business account directly within the app to start accepting contactless payments within minutes.

The anecdotal feedback for Revolut's solution has so far been good. Businesses can go live without delay and start taking payments in a few minutes. As well as Revolut, a few other banks have also implemented the tap-to-pay solution for their business banking customers. This trend will continue to speed up.

App stores are a distribution channel for payments acceptance that provide a route to market at zero marginal cost. Banks are one layer ahead in the distribution chain.

Banks have their apps on many devices. Even the limited friction of downloading a new app can be removed. A vast potential customer base could be ready to take payments from their mobile app with limited work required to enable it.

The trust advantage

When it comes to banks, trust matters. Following the 2008 financial crisis the reputation of banks took a hit, but despite many negative headline over the past 15 years, they are still trusted.

More than 60% of those recently surveyed by Edelman still trust banks.

And a study by EY showed that 82% of respondents completely or mostly trust their primary banking provider.

Banks always put a high importance on managing risk, and are focused on making sure nothing goes wrong. Partly, this is why banks have been disrupted in some areas by fintechs - fintechs move much more quickly. Angela Strange at A16Z has stated that legacy banks tend to focus on spending money keeping the lights on:

While many of these institutions may have billion-dollar-plus IT budgets, at some of the larger banks, 75 percent of those dollars is spent solely on maintaining existing products. This is a highly regulated industry, with multiple regulators across state and federal. It has a very complex infrastructure.

A case in point. Under the UK's Senior Managers Regime, executives may be held personally liable if serious issues arise. For instance, if a payment system were to fail and cause severe problems to the functioning of the economy. Then, in this case, the designated Senior Manager could end up in court.

Consumers and Businesses feel that if a bank takes a solution to market, it will be secure, robust, and meet their core needs.

Solutions like contactless cards took off in the UK when banks spent time and effort emphasising both the use cases and security of the technology. Likewise, SoftPOS is a solution that may initially seem strange. Tap your card on someone's phone?

Various parties, including Visa and Mastercard, have been involved in establishing a recent new security regulaton for contactless payment technology called MPoC. For banks, security and compliance are always key, and MPoC gives peace of mind to those launching SoftPOS technology - it covers all aspects of data security when using a standard device as a point-of-sale.

Over time consumers will see tap-to-phone with a contactless card, or a mobile wallet, as a standard way to pay, and banks can help build trust and familiarity.

The onboarding advantage

Around the world, many companies have announced SoftPOS solutions, but the usage and traction could be better. One key reason for this has been the challenge of onboarding customers. Onboarding meaning the various processes and activities so that a business can go live.

Suppose a small business owner downloads an app to take payments. If they wait days or weeks to go live, they'll get frustrated and walk away. Anything except a short wait means the user will move on to another app.

Card-acquiring businesses within banks have traditionally been slow at onboarding merchants (companies). This has improved over time as bank acquirers have faced competition from fintechs. But there is still a lot of room for improvement.

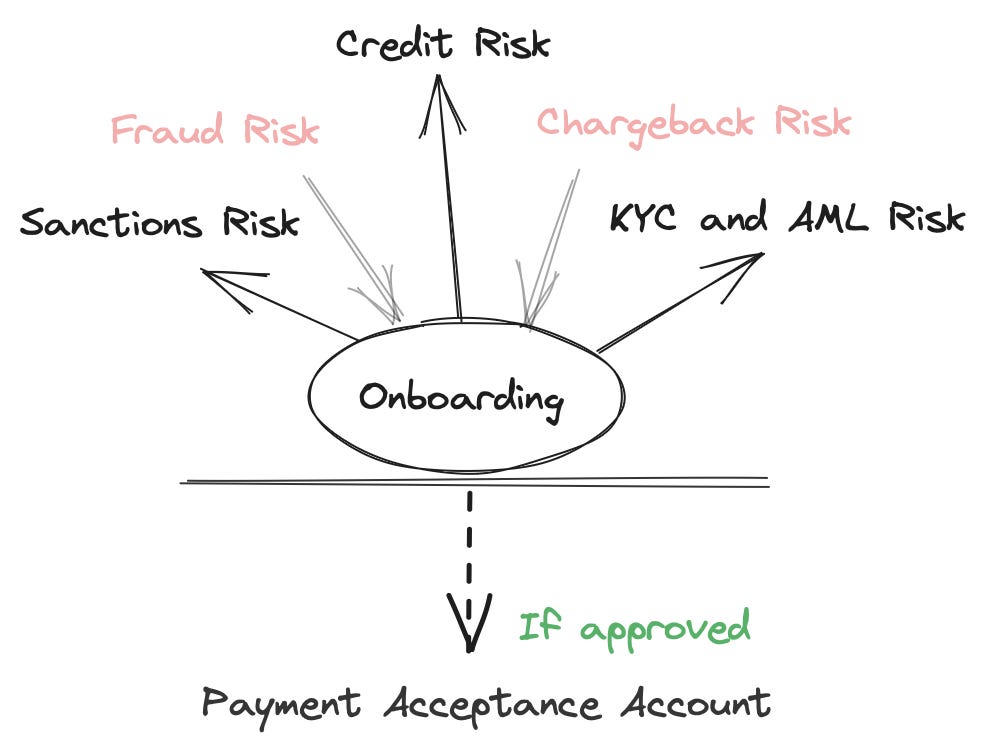

Certain information must be collected to provide a business with a card-acquiring account. And there are a few reasons why a company may have their request for an account declined. These relate to three main risks that need to be covered during the onboarding process:

Sanctions Risk. Sanctions rules mean that businesses interacting with certain countries are forbidden. For example, Russia was sanctioned by the UK, EU, and United States following the 2014 invasion of Crimea. Since then, acquirers have not been permitted to provide a acquiring services to Russia related companies.

KYC (Know Your Customer) and AML (Anti-Money Laundering) Risk. This relates to confirming information about a business. Is the company selling what it claims to be? Are the Directors of the entity who they say they are? Could the company have illegal purposes such as money laundering?

Credit Risk. If a company ceases to function, the financial institution must deal with incoming chargebacks. Cardholders will want a refund for goods not received, and the acquirer must pay.

Getting all the required information can sometimes take time and effort. However, financial institutions need to meet the regulatory requirements. Otherwise, they could find themselves with problems down the line.

But despite these requirements, banks are in a great position to add payment acceptance to their apps. Quite simply, they already know their customers.

If a business has a bank account, then a bank will be comfortable doing business with the company. They will already know the director(s) of the company and will likely be happy to add more services.

The onboarding process for a bank to add payment acceptance to a banking customer should be light touch - if internal processes and procedures are aligned.

Some extra information may be required to open the payment acceptance facility. But 90%+ of the info needed should be available through the existing banking relationship. In the future, AI (Artificial Intelligence) can potentially help fill any gaps.

By simplifying onboarding, banks will have an excellent opportunity to service more businesses with payment acceptance. If you can take payments from your phone, many small businesses won't need to buy a card payment machine. And there are environmental benefits to not purchasing payment specific hardware.

Co-operation and competition

If banks want to put SoftPOS into their mobile banking app, they must decide how. The question is whether to build technology in-house or utilise partners. When working with partners, new capabilities can get to market more quickly and with minimal upfront cost. SoftPOS presents a collaboration opportunity for regulated financial institutions and fintechs.

To launch SoftPOS, an app developer will need a card acquirer for the transaction processing and a technology partner to provide the SDK (Software Development Kit). The SDK will facilitate contactless acceptance within the mobile banking app when required.

In an earlier era, many of the largest card acquirers were themselves banks. These days, it is often different. Many banks have exited the card-acquiring business. Some who have maintained a card-acquiring business are keeping their options open.

Adding SoftPOS to a mobile banking app can be seen in two ways. It could be an excellent opportunity for banks to partner with fintechs to get to market quickly.

Or, for some banks, it could be a great opportunity to reinvigorate card-acquiring within their product offering. With a new distribution model, it can deliver extra revenue, with business banking and payment acceptance in one place.

Neo-banks are, by their nature, more open to these collaboration opportunities. Many neo-banks have offered solutions with other partners and fintechs since their inception. They aim to provide the best customer experience rather than seeking to deliver all aspects of a solution in-house.

As the UK's largest neo-bank (with a full banking license), Monzo hinted at launching SoftPOS earlier this year. They informed investors that a new feature was on its way:

Tap to pay - this new feature will give business owners more flexibility, allowing them to accept card payments using their phone.

A full launch has yet to take place. Yet, users on Monzo's community forum have noticed that some Business Bank account users can now enable SoftPOS on their devices. Monzo is working in collaboration with Stripe, as is clear from their FAQ.

With Monzo, a user who wishes to enable tap-to-pay must sign up for a Stripe account as part of the enrolment process. This business model is a case of Monzo focusing on the UI (User Interface) and leaving the payment processing components to Stripe.

This level of integration and collaboration between banks, neo-banks, and fintechs will become the norm. Companies developing a SoftPOS application may, over time, add banking services (without becoming a bank themselves). At the same time, banks will add payment acceptance to their mobile banking apps.

VivaWallet is an example of this. They have added a debit card capability to their SoftPOS app. Businesses can accept payments one day and use their debit card to spend from their sales balance the next day.

As we will see, it’s likely that the line between banking and payments will continue to blur. Every bank can be a payments company - if they want to.

If you enjoyed reading this post, you can connect with me on LinkedIn, X, and BlueSky.