Understanding Africa's fintechs

Innovation in the informal banking sector has led to growth in products and services for the unbanked

This post is a collaboration with Xolani Shezi. Xolani is an fintech specialist and consultant, based in South Africa.

As population decline is set to take place in many countries, one thing to ponder:

Over the next three decades, the world’s working-age population will increase by 2bn, and almost 80 per cent of those workers will be coming of age in Africa.

With a growing young population, is Africa ripe for fintech innovation?

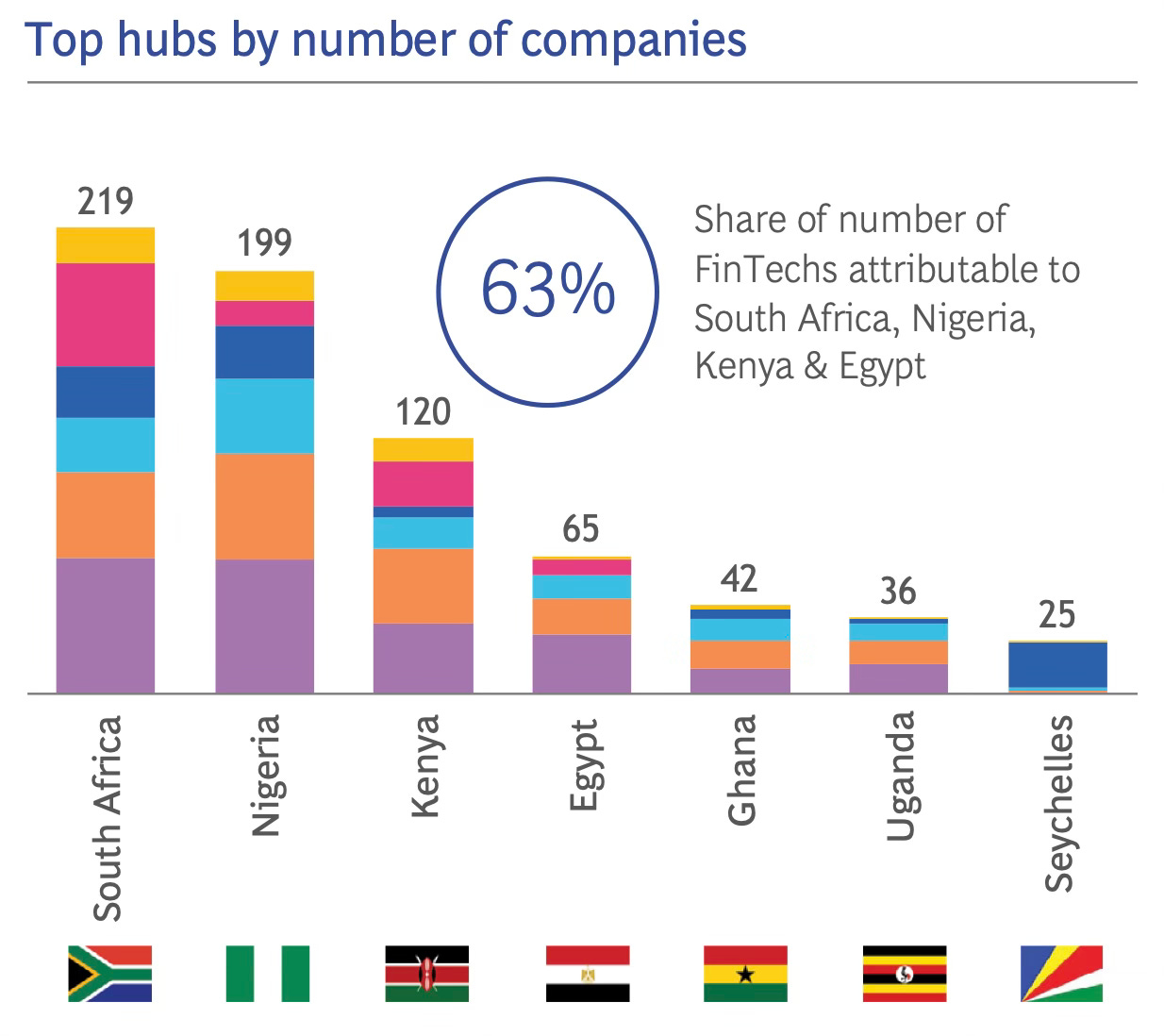

Research by the Boston Consulting Group forecasts that fintech revenue on the continent will go from $5bn in 2021 to $65bn by 2030. In the same period, fintech revenue in North America will grow from $130bn to $520bn, and in Europe, it will grow from $34.5bn to $190bn.

The revenue growth multiple is forecasted to be 13x in Africa, 4x in North America, and 5.5x in Europe. While the absolute growth numbers are smaller in Africa, the growth multiple is much higher.

The numbers look attractive, but there are many challenges. Scalability is one issue.

It’s possible to operate across the EU via a single entity located in one market, and the USA itself is a market of 330m. Africa - with its population of 1.2bn, split across 54 countries - doesn’t have a single regulatory framework. And it’s not easy for companies to operate on a cross-border basis. Often, national authorities require legal entities to be set up within each country of operation. Companies may need staff on the ground to interact with regulators in person.

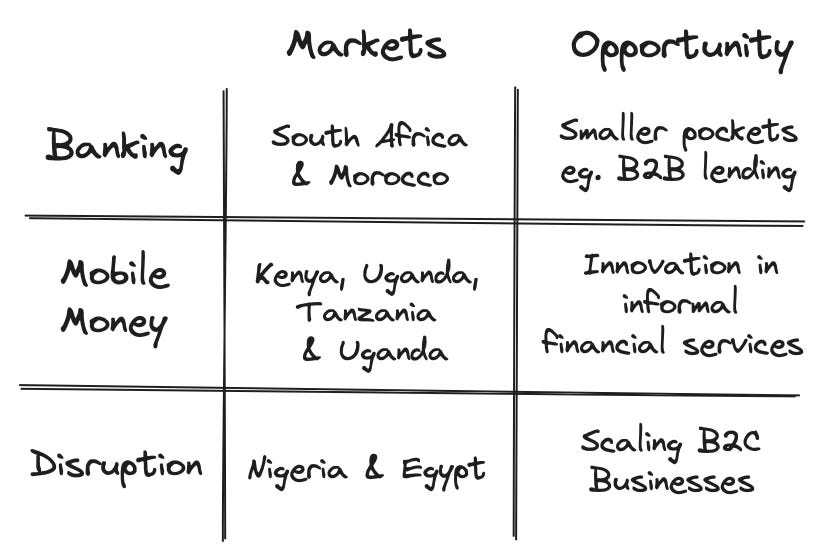

South Africa has a mature formal banking system. Its banks offer a mobile banking experience on par with Western markets and are regarded as the best on the African continent. South Africa’s big four banks - Standard Bank Group, FirstRand, Absa Group, and Nedbank Group - account for half of Africa’s total assets.

(Analysis by The Banker, in its annual Top 1000 World Banks ranking, notes that following South Africa’s banks, banks in Morocco are the best on the African continent. At least according to its ranking metrics. Morocco is a gateway between North Africa, Europe and the wider world.The IMF refers to Morocco as having a “well-capitalized and sophisticated banking system”.)

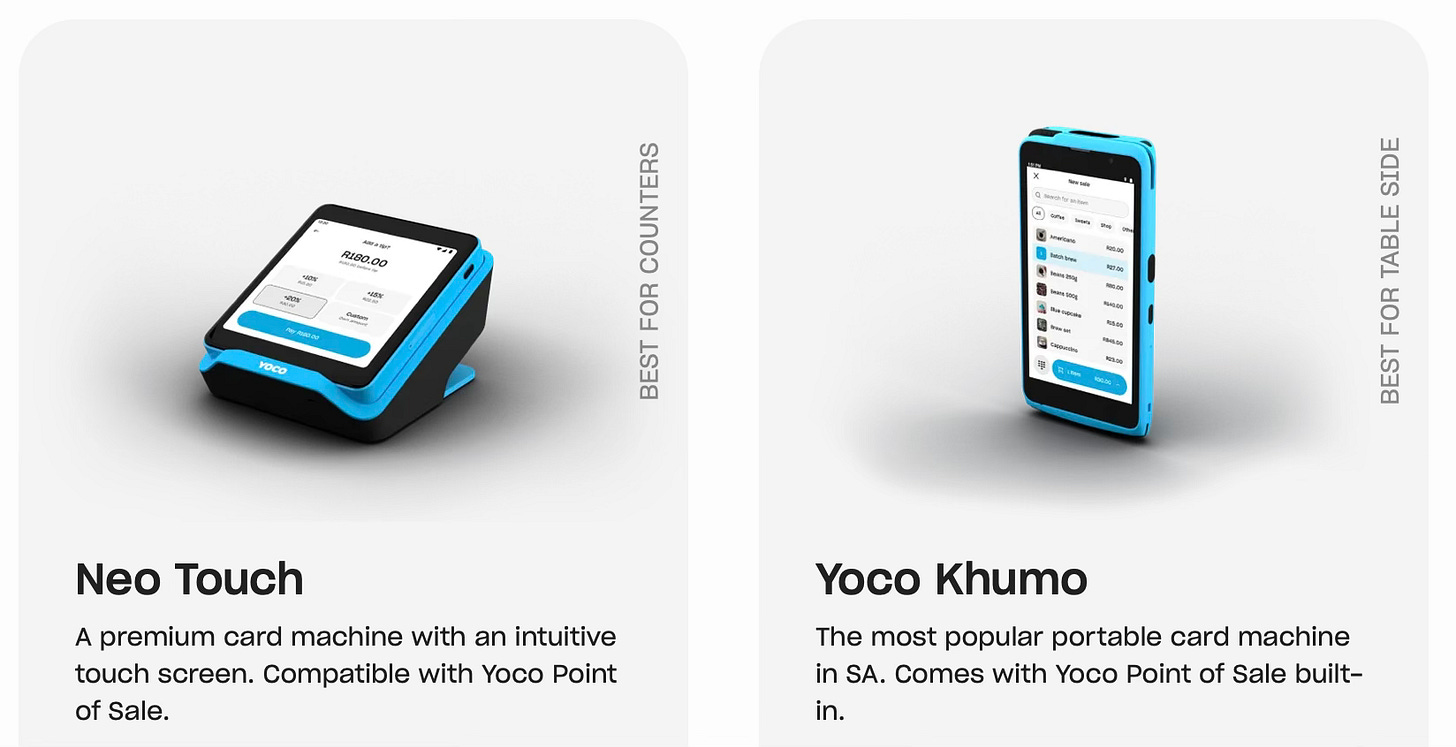

In South Africa, alongside strong banks, new emerging players in the payments space have provided added competition, such as Yoco. They are Africa’s answer to SumUp or Square, offering cheap yet highly functional card readers and fast payment processing. Yoco was recently named in CNBC’s top 250 list of global fintechs, and its product suite continues to evolve, bringing solutions such as cash advances and tax-compliant invoices.

Other African markets follow their own path in line with cultural norms not seen in the West. Often this innovation comes from financial inclusion, or the lack thereof. Let’s take M-Pesa, its emergence in Kenya can be traced back to events that occurred as far back as the 1980s. At that time, a banking crisis led to financial institutions building barriers that kept out many potential customers. There were minimum balance requirements, and restrictions on the number of withdrawals users could make. Njuguna Ndung’u, former governor of the Central Bank of Kenya, noted:

[Then] in the 1990s, as the rural economy went through a severe recession, banks started closing loss-making branches in rural areas and poor urban and peri-urban centres. By the turn of the millennium, financial exclusion and the prevalence of informal financial services were quite evident.

In the mid-2000s, there was a recognition that financial services had to evolve differently to meet the needs of rural communities. 40% of the population were totally outside the banking system still in 2006. M-Pesa launched in 2007 as a collaboration between telco Safaricom and what was then Commercial Bank of Africa (now part of NCBA Bank Kenya). M-Pesa leveraged the existing practice of mobile phone users exchanging airtime to become a Person-to-Person (P2P) payment system. Safaricom deployed a network of agents throughout Kenya. This gave underserved communities a greater ability to make and receive payments than ever before.

M-Pesa evolved, grew, and now covers seven countries. It can even be used for e-commerce payments, making it an effective way for global merchants to enter Africa.

Microfinance plays a crucial role in the socio-economic dynamics of African communities. For instance, in countries like Tanzania, Ghana, and Nigeria, micro-finance thrives through mobile tools and street vendor markets. There is a greater need for payment solutions and personal finance apps, rather than traditional bank accounts. - Xolani Shezi

A specific customer persona has emerged in Africa, that of the micro-finance user.

Micro-finance describes a variety of financial services for small and micro businesses, entrepreneurs, and individuals. Initially targeted at those who did not have access to traditional banking services. Yet now some apps that started as micro-finance propositions are widely across the economy. In some countries, micro-finance apps complement existing banking provision.

Key features of micro-finance products include flexible payment solutions integrated with digital wallets, efficient money transfer services and agile, mobile integrations. Handling large volumes of micropayments day-to-day is vital. Some key examples include:

Nala in Tanzania has developed a money transfer solution utilising USSD (Unstructured Supplementary Service Data) technology - similar, but different from SMS. This provides users free money transfers within Africa and low-cost transfers from outside Africa inwards. Recently, the company raised a $40m series A funding round to expand into new markets.

Ghana’s informal sector is one of Africa's largest micro-payment environments. Bezomoney, is at the forefront of this, providing solutions for unbanked citizens, and small merchants. They notably have helped those lacking an accessible credit history. The Bezo app brings a traditional practice of financial intermediaries called Susu collectors into the digital age with products that allow users to save gradually and improve their financial literacy.

PalmPay in Nigeria shows how micro-finance products operate alongside the traditional banking sector. The company is not regulated as a bank but as a Mobile Money Operator (MMO). In addition to payments solutions, PalmPay also offers business accounts. The business accounts provide a suite of solutions somewhat like E-Money offerings in the UK and Europe.

These companies are examples of fintechs that prioritise flexible payment solutions that integrate with digital wallets and provide efficient money transfer options. In Africa, we see that fintech solutions usually either advance informal merchant businesses, or provide individual consumers with digital wallets.

Payments solutions neither exist, nor evolve, in a vacuum. Those seeking to unlock the potential of Africa’s fintechs will need to keep this in mind. The concept of “hat-to-hand”, mentioned below, reflects the idea that businesses in Africa approach negotiations with humility. Any bartering strikes a balance between what a buyer can afford (negotiate), and a seller who is focused on selling their product at a set price.

During my consultations with clients, I refer to a “hat-to-hand” exchange between businesses and their customers.

Disruptive African fintech companies often extract key traditional banking features and reappropriate them for the specific needs of unbanked users. Through this usability, consumers are categorised by rapidly changing financial dynamics.

Digital solutions must account for flexibility in real-time product price negotiations and changing policy regulations.

- Xolani Shezi

An essential quality investors should look for when assessing a fintech company is the priority placed on consumer needs. Customer focus and discovery are vital. As a result of the micro-finance personas, fintech companies in Africa are unique in specialising in nifty software with a basic user interface and a simplified API. This approach can reach growing populations, who do not always have the same levels of financial literacy as in Western markets.

Additionally, outside of countries like South Africa, a fundamental aspect that foreign investors and institutions should consider, is a thorough understanding of specific African fintech market they wish to enter. There’s a lot of potential for fintech growth in Africa, but what works in one market doesn’t necessarily work in the same way in the others.