How Apple Disrupts Passports (!), Payment Cards, and Payment Terminals

Eleven Ways That Apple Pay Changed Payments — Part 2

Welcome to Payments Culture!

This newsletter explores how money moves, around the world, and why it matters.

This is part two of a two-part series examining eleven ways that Apple Pay changed payments. Why eleven? Because this year marks the eleventh anniversary of Apple Pay, which launched in the US on October 20th, 2014. Part one can be found here.

Imagine waking up at 5am on a Monday morning. It’s early November and you’ve got an important flight to catch. It’s a business trip. You’re excited to get to New York as you’ll be meeting your favourite client. He always meets you at the same coffee shop downtown, with oversized comfy chairs, and the best espresso you’ve found outside of Italy. You dress, grab your backpack, and jump in a taxi. But when you get to the airport, it hits you like a ton of bricks. You’ve left your passport at home.

Yet this stomach-churning situation may soon be a thing of the past.

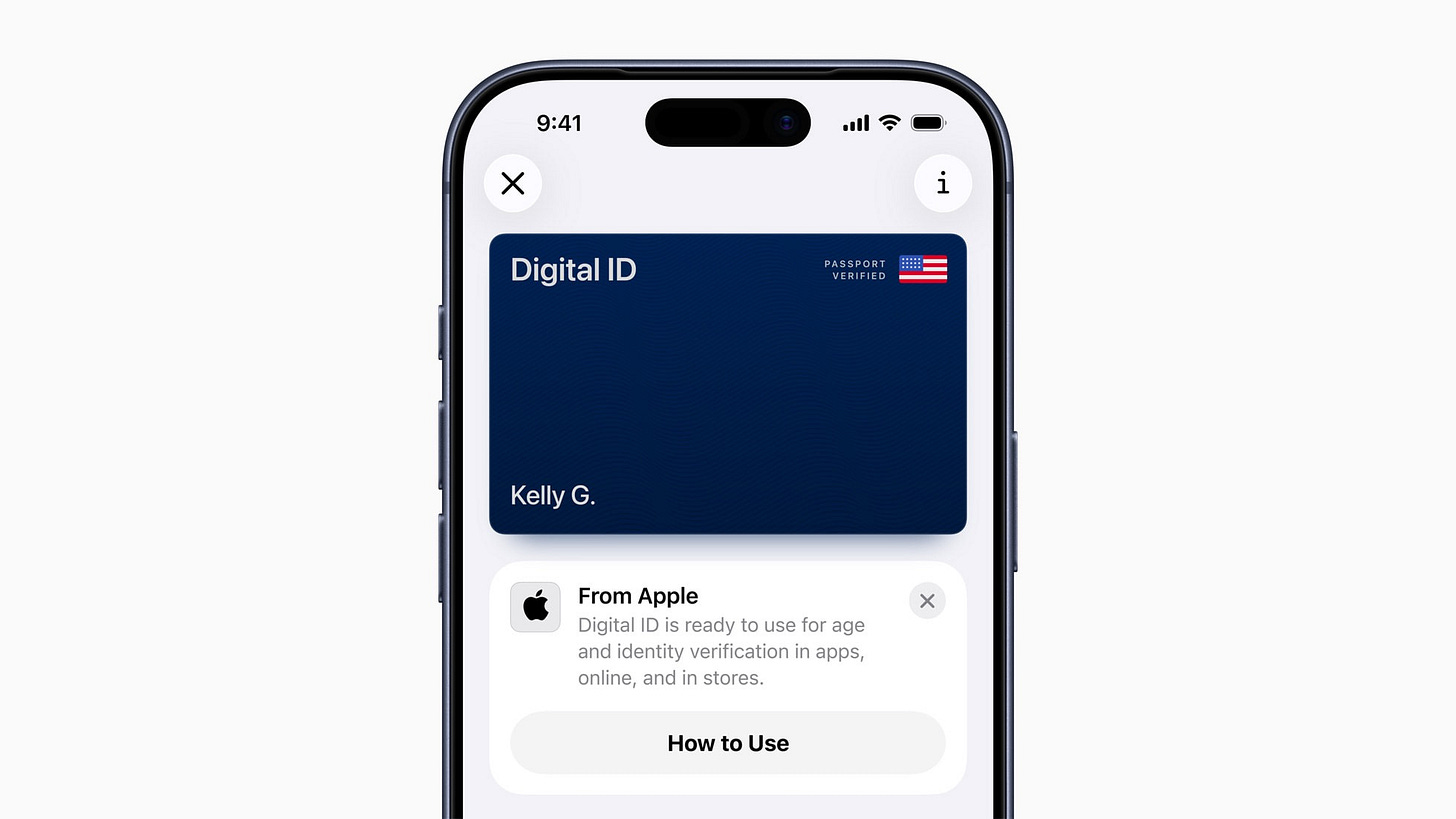

#6.

Digital ID Integrates Payments and Identity Verification

Last week, Apple announced Digital ID for Apple Wallet. The same device that holds your boarding pass and credit cards will soon allow you to add your passport to an iPhone or even an Apple Watch. Here’s how it works: Rather than presenting your passport at the airport, tapping your Apple device at a TSA checkpoint will be enough. These days, no one leaves home without their iPhone (or another smartphone model), so at least for US domestic travel, your stress is about to melt away. Although, to be clear, the solution will not entirely replace a passport as Digital ID is not sufficient for international travel, a passport will still be needed for that. Yet it seems possible that within the next ten years, a Digital ID could suffice for some international flights.

Note: Not all domestic US airports are utilising Digital ID at this time so please check before you travel, and at this early stage it’s best to take your passport as well just in case the solution doesn’t work as intended.

Looking back over the past 11 years of Apple Pay, this progression from payments to Digital ID stands out as a key milestone. Consumers are comfortable double-tapping their phones to pay, and Digital ID sits within Apple Wallet — the ecosystem that stores not only payment credentials but now, digital identity too.

Questions of identity and payments are often thought of as adjacent yet separate challenges. Apple is now starting to bring this together. Think of the last time you opened a bank account on your iPhone or opened an account on a crypto app. It’s likely you had to take a photo of an ID, such as a passport or a driver’s license, and then verify with a selfie. This process will, in some cases, get replaced with Apple’s Digital ID. And is there the prospect to bring payments and identity together in other use cases?

#7.

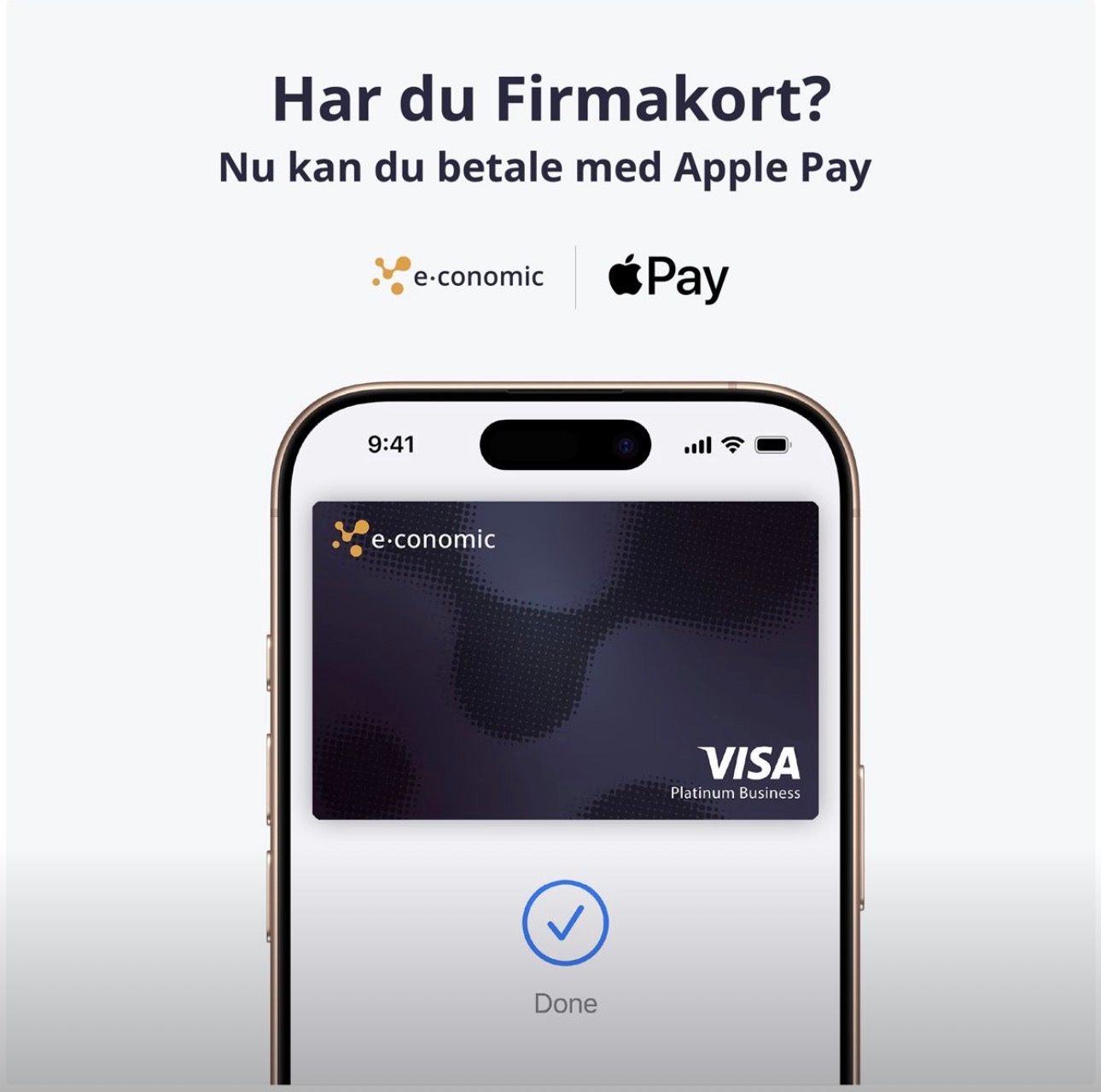

Apple Pay Accelerated Virtual Cards

Ten years ago opening a bank account meant going into a branch to make an appointment to open an account, and going back to the branch on another day to provide documents and sign some forms (this is exactly what happened to me). What followed was a wait of days to get paperwork in the post confirming the account opening. Cards arrived separately. And of course, the PIN number for any cards took another few days to arrive. In total, it could easily take a week for a new account to be truly operational.

The rise of neobanks changed this experience dramatically. Opening a bank account now takes minutes, especially with a bank like Revolut. However, what’s made the account opening experience significantly better is virtual cards. Rather than get frustrated waiting for your new card and PIN number to arrive in the post, virtual cards allow users to load their card to Apple Wallet and spend immediately via Apple Pay. It’s easy to take this for granted in the UK, as many banks now offer virtual cards. Remarkable still is that we don’t have to wait for a PIN number to arrive in the post, as it can often be accessed within a bank app via another Apple innovation we now take for granted: FaceID.

In some cases, virtual cards can be used without Apple Pay — this is mainly seen in business-to-business payments, where virtual card details can be sent to a supplier via APIs. On the consumer side, Apple Pay has normalised the use of virtual cards. Tech that most consumers were unaware of less than ten years ago is now de rigueur in personal finance.

#8.

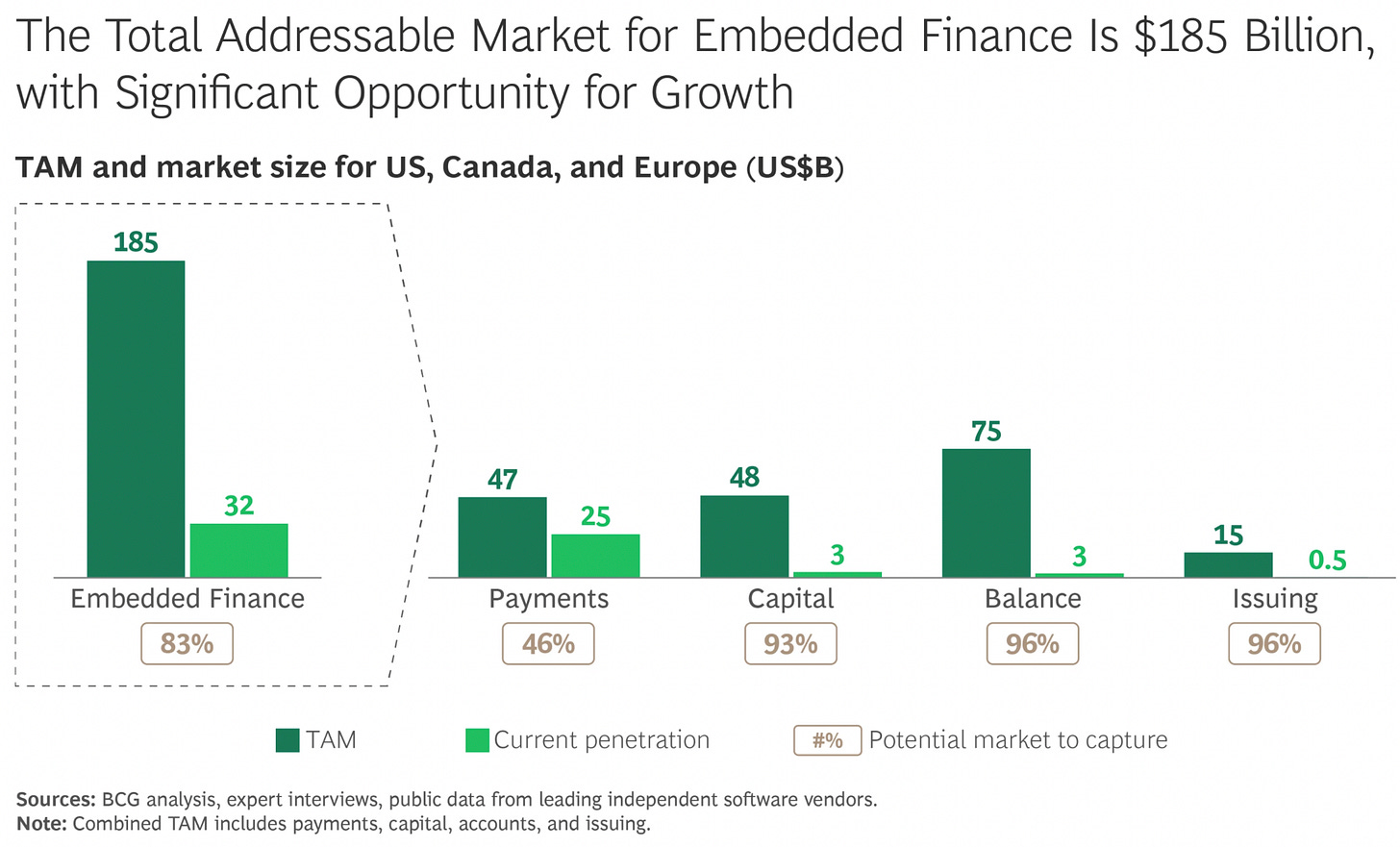

Apple Pay Accelerated Embedded Finance

In a world of APIs, companies can integrate financial services into their apps and wider product offerings even if fintech isn’t the mainstay of their business. The concept is known as embedded finance, and it’s a phenomenon that can be seen throughout the economy. Delivery companies offer loans through third-party lenders. In the US, Uber provides its drivers with a debit card and a digital bank account for instant access to their earnings. Starbucks is a coffee company, yet its well-known loyalty programme is one of the most notable examples of a stored-value payment system.

Even when a company isn’t a bank or fintech we can see financial services that sit within apps and ecosystems, sometimes on the consumer side, sometimes on the business side, or even both. Wherever we look, we can see embedded finance.

Even if many companies launch their embedded finance offering without Apple Pay, they usually add it later as they realise it’s essential — consumers and businesses expect it. Payments is a core facet of embedded finance and Apple Pay plays an essential role in how non-financial brands build financial products.

Lars Markull, Founder of Embedded Finance Review, told me that:

Non-financial brands have a crucial advantage: they can integrate financial products directly into their existing services, something standalone fintechs can’t do. But they still have to compete with fintechs, and some features [such as Apple Pay] are table stakes.

As a distribution model for financial services, embedded finance will only grow in importance. It’s expected to be worth more than $100 billion by 2030, and by then, according to McKinsey, it could be up to 15% of banking revenue.

Actually, the clear demarcation between embedded finance, fintech, and banking will erode, and consumers will notice less and care less who provides financial products, provided they function as expected. The model of delivering financial products is evolving to meet consumers where they want to spend their time.

#9.

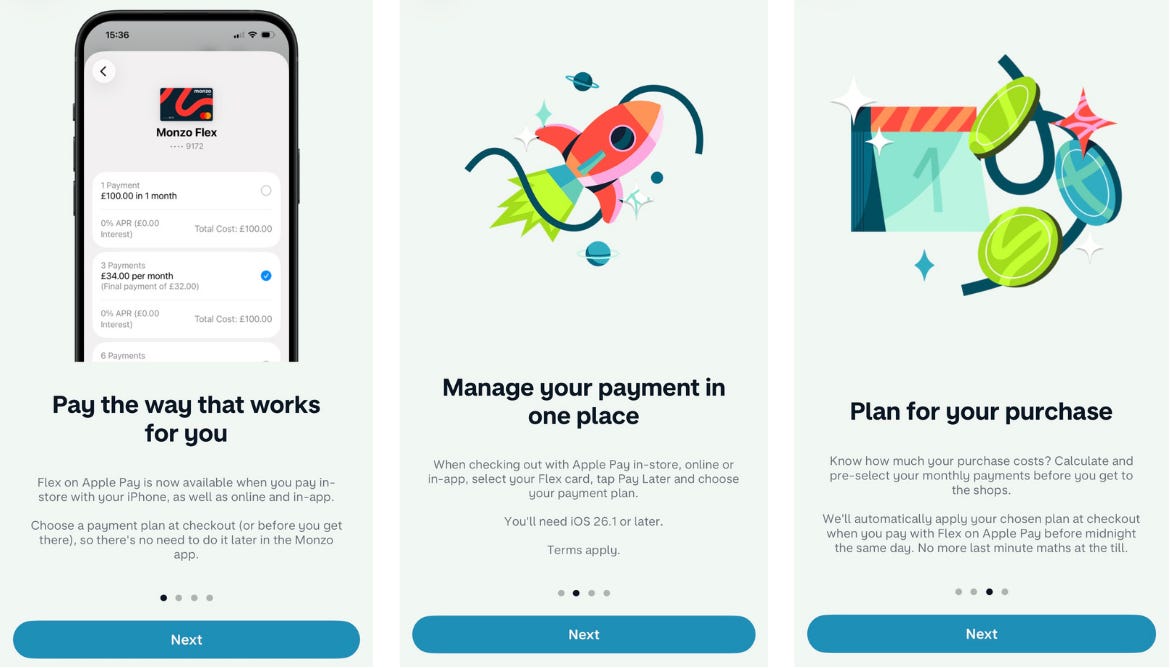

How Apple Pay Accelerated BNPL

Apple has an advantage as a company that controls both hardware and software. Take AirPods. Once you’re used to them, it’s hard to go back to something else. AirPods connect multiple Apple devices and make switching between them effortless. The synergy of hardware and operating system (software) can also be seen in payments. Apple Pay takes advantage of this.

Apple Pay Later was the first BNPL-style offering facilitated by Apple. It allowed users to split purchases into instalments via the simplicity of an Apple Pay transaction. Users could choose “Pay Later” at eligible online checkouts to split a transaction into four payments over six weeks, with one payment upfront and three equal payments every two weeks. However, this strategy lasted barely more than a year. The solution launched in March 2023, but by June 2024, Apple had moved from a model of direct financing to a partner and bank-led model.

The change of strategy let Apple step away from the lending and regulatory requirements of BNPL. At the same time, the shift in approach enhanced Apple’s distribution both domestically and internationally. In the US Apple introduced a BNPL partnership with Affirm, and has since added Citi’s BNPL offering to Apple Pay. In Europe, Apple Pay instalments are live with Monzo in the UK and CaixaBank in Spain.

As a Monzo customer I’ve been able to experience Monzo’s BNPL offering first-hand. Known as Monzo Flex, after paying with Apple Pay, I can open the Monzo app, find any transaction from the past two weeks, and split it into three separate monthly instalments, interest-free, or extend it to six instalments with interest.

#10.

Tap to Pay on iPhone Marked the Next Phase of Apple Pay

Tap to Pay on iPhone is what Apple calls SoftPOS (Software Point of Sale). Turn your phone into a payment terminal. Apple didn’t invent this technology — it was available on Android for years before Apple decided to offer their own iPhone-based solution. Yet, as ever, once Apple got on board, it was only then that the technology truly took off.

This weekend I was at a craft market in Battersea Power Station in London.

Every seller was accepting payments either with Tap to Pay on iPhone or a small payment device from companies such as Zettle and SumUp. This made sense, as the original plan with SoftPOS was to tap into the “micro merchant” segment and remove the friction of buying and setting up a payment device. Market traders, DIY workers, and any business that can efficiently function with one man or one woman at the helm were prime candidates for SoftPOS.

But now, even large retailers utilise SoftPOS. With an iPhone, staff on the shop floor can both manage inventory and accept transactions without the need to send customers to queue at a centralised checkout area. This is the case in Lululemon stores in London. Staff can check inventory and bring the size you need, and check out there and then. Lowering friction means more sales, as it eliminates the risk of customers getting frustrated and leaving their goods behind due to a long queue at checkout.

Tap to Pay on iPhone is available via companies such as Stripe and Adyen, and small businesses can enable the solution directly in seconds when using neobanks such as Monzo and Revolut. With this technology, every bank can become a payments company and enable contactless card payment acceptance on the devices of freelancers and SMEs.

In countries such as Brazil, SoftPOS on Android phones quickly found its user base. It didn’t take long for the country to get over a million SoftPOS users, and this continues to grow, but in Western economies, the tech didn’t take off until Apple came on board.

Apple Pay lets users pay (send money) with their iPhone, and Tap to Pay on iPhone allows businesses to receive money. It was the natural and subsequent evolution of on-device NFC technology that powered Apple Pay, opening up to payment acceptance. SoftPOS, especially following Apple’s involvement, disrupted the payment terminal market and was part of a broader shift in payments — as in many industries — moving primarily from hardware to software.

#11.

Does Apple Pay Mean We Can Leave Our Wallets at Home?

When leaving home what’s the one thing that you absolutely have to take with you, that you can’t leave your house or apartment without? Something you have that is so important, if you notice you’ve forgotten it, even when halfway down the street, you’ll go back to get it.

Less than ten years ago, I might have said my wallet, but these days it’s definitely my iPhone. I always pay with Apple Pay. When riding the Tube, I use Apple Pay alongside the fast transit feature, so I don’t need to double-tap or use Face ID before each transaction. Additionally, I use my iPhone to listen to music, and sometimes I use it to read newspapers or Kindle books while traveling. In short, I can now leave my wallet at home, but I don’t dare leave home without my iPhone.

Last year The New York Times ran a piece titled The Youths Have Spoken: Wallets Are Uncool. Go Digital. The article explored the extent to which Gen Z primarily use digital devices, and often don’t carry a wallet. A survey of Gen Z in the US found that 80% regularly use mobile wallets such as Apple Pay, but this goes beyond payments:

Younger people are increasingly using their phones for purposes that older adults would use a traditional wallet for, like carrying documents such as a driver’s license, boarding passes and event tickets.

In fact, for boarding passes, airlines such as Ryanair have moved to digital as standard, and expect all travellers to present their boarding pass on a smartphone. So it’s not just our wallets; anything that could have once been paper-based is now ripe for adding to Apple Wallet.

Relying on our phones is both good and bad. Having everything in one place is convenient. But most adults — and many teenagers — are dealing with phone addiction on some level (even if we don’t want to admit it). Many of us wish we could stop picking up our phones as much as we do, and techniques and ideas to stop scrolling proliferate online.

Many bestselling books tackle this topic. Earlier this year, I read Smartphone Nation by Dr Kaitlyn Regehr. I didn’t learn too much from this one, probably because I’ve already read Digital Minimalism and other books by Cal Newport that address the topic in a way I could relate to better. Yet exploring how we can use our phones less becomes ever harder as tech means we need our phones for more and more aspects of our daily lives. Many of us are working on this balance. But one thing I would contend is that Apple Pay has allowed us to leave our wallets behind.

Note that views expressed on this Substack are my own and do not represent any other organisation. Also nothing I say should be taken as investment advice.

Why Subscribe to Payments Culture?

Every week (or so), get one long-form email with my curated insights.

Some weeks, I’ll add additional content including personal essays, case studies, and interviews with fintech leaders.

Paid subscribers get at least 1x additional essay(s) per month, access to the full archive, and more features currently under development.

If you’d like to support this newsletter you can get a monthly membership for less than the cost of a beer (in London). An annual membership is more than 95% cheaper than attending a big fintech conference — and you may learn more by reading this!

Note: You can refer friends or colleagues to earn complimentary month(s) of paid membership.

Get in touch

I’m always interested to hear from those who read Payments Culture.

Feedback, collaboration opportunities, or anything else - it’s all welcome.

You can email me, message me here, or on LinkedIn.

Thanks for reading! Matt

Love this!

Great article - I didn't know about most of this. Thank you!