What happened and what's coming up (2024 review)

Reflecting on 2024 and looking ahead to 2025

The first part of this post is some of my observations on payment trends in 2024. The second part features views on where payments may be heading in 2025, with guest comments from Sam Boboev, Michele Mattei and Nicolas Pinto. I really appreciate you reading Payments Culture in 2024! Happy New Year, and I hope to see you here again in 2025!

Part #1 - Looking back on 2024

End-of-year review posts often mix a look back at the year that’s gone, with a look ahead to next year’s trends. As mentioned in my 2023 review:

These [review and prediction] posts can be valuable, but such annual predictions often tend to reflect the current stage of a hype cycle. What’s hot at that moment. And what many firms have placed their bets on for the coming year.

The key point made in that post was that when it comes to payments and fintech:

In one year, not too much changes, but over a 5-10 year period, a lot can change. Often, the most impactful changes develop gradually over many years rather than burst onto the scene and have an immediate impact.

The biggest success stories take years to develop, especially when it’s a new payment mechanism that needs to embed and win favour, with both consumers and businesses. For instance, in India, UPI (Unified Payments Interface) is now ubiquitous across the nation. UPI allows businesses to receive payment instantly and, unlike with card payments, in most cases, at zero cost. Yet less than ten years ago, UPI did not exist; it was created by the National Payments Corporation of India (NPCI) only in 2016.

Looking at the October data over four consecutive years, we can see that UPI has grown with a CAGR (Compound Annual Growth Rate) of 40.87%. Going from 4.21 billion transactions in October 2021 to a remarkable 16.48 billion transactions in October 2024.

India is - rightly - proud of the growth in its digital infrastructure. A press release from the Ministry of Finance lauded the benefits of the UPI payment system:

UPI has revolutionized the nation’s payment ecosystem by integrating multiple bank accounts into a single mobile application. This system enables seamless fund transfers, merchant payments, and peer-to-peer transactions, offering users flexibility through scheduled payment requests.

This is in line with a broader trend in payments. Many countries have moved to cashless payments at pace. While regulatory initiatives to promote cashless payments were underway in many parts of the world, the COVID-19 pandemic spurred innovation. Consumers demanded to pay without handling cash.

Earlier this year, I wrote in Mobile Payments Explosion about the various QR code payment systems operating in Asia. I saw this first hand in September when travelling to Singapore, Malaysia and Indonesia. Upon my return, I wrote of how cashless payments have become the norm in many cases:

When in Malaysia, I was told “cash only” a few times, especially in smaller independent stores, but cashless meant QR code only - I couldn’t always use a credit or debit card… I hadn’t been to Asia for several years, and I was amazed at how quickly cashless infrastructure has developed. Back in 2019, using cash was very common, but five years later, QR code payments linked to banks, or e-wallets such as Grab or GoPay, are often the default option.

Travelling in South East Asia provides an example of how, in one or two years, a change in payments may not be so noticeable, yet over a longer period, it can feel like a whole new world. Similar stories can be seen in markets like Brazil, where local payments system Pix, which only started in 2020, is now expected to handle over 50 billion transactions in 2024.

Despite the move to QR code payments in much of the world, in the UK, paying via a QR code is uncommon. Consumers are used to tapping to pay rather than scanning a QR code to pay. Open Banking payments are growing steadily each month, and this technology can help facilitate account-to-account payments. With the growth in Open Banking, QR code based payments may one day break through in the UK - even if it’s not in 2025.

(For further context on the opportunities and challenges of Open Banking, in 2024, I wrote three articles on Open Banking, which can be found here, here, and here.)

When it comes to changing form factors in payments, in Meta’s Payments Opportunity, I posed the question, “When can I pay with my Ray-Bans?”, the answer was not soon, but maybe one day.

Meta’s Ray-Ban collaboration has been one of the tech success stories of 2024:

The Ray-Bans, which wrap a mic, audio, camera and artificial intelligence assistant into a familiar frame, cost some $300 apiece. Unlike bulky virtual or augmented reality headsets that have failed to win mass appeal, Meta’s devices actually look like normal glasses, are lightweight – under 50 grams – and offer useful day-to-day features like real-time translation and hands-free picture and video capture thanks to in-built memory and processing power.

According to Reuters, other tech companies have got smart glasses FOMO:

Other tech giants are eyeing this space. Baidu, launched glasses, powered by its AI bot Ernie in November. Days later, Reuters reported that Amazon is developing smart glasses for delivery drivers. Suppliers are ramping up capacity: specialist lens maker Vuzix, reckons it will be able to churn out, as many as 50 million units a year by 2028, up from around 1 million in 2024. Apple, Samsung Electronics, Xiaomi, and Alphabet, itself are all working on new products, according to media reports.

With some of the world’s best-known mobile apps (Facebook, Instagram, and WhatsApp), the Quest headsets, and now the Ray-Ban collaboration, I argued that Meta should consider creating a new mobile wallet to function across all platforms. It could be called something like Meta Pay, and be similar to Apple Pay or Google Pay. This approach of leaning into payments could help diversify Meta’s revenue, which currently relies on advertising sales that delivered 98% of Meta’s sales in 2023.

Meta has recently unveiled a prototype of their Orion glasses, which will not be on sale any time soon, but provide an example of how form factors will keep evolving.

Will smart glasses one day replace our phones? It’s hard to say, but building payments into such a device will become possible. I noted that:

Like almost everything else, payments is now software. Integrations and capabilities matter far more than the physical device itself.

A competitor to Meta in the VR (Virtual Reality) and AR (Augmented Reality) space, the Apple Vision Pro provided an example in 2024 of where payment tech may be heading. The Apple Vision Pro features Optic ID. Optic ID uses an iris scan to authorise payments, rather than Face ID, which is used on iPhones. An iris scan is more accurate but costly and too bulky to fit inside a pair of smart glasses - at least for now. But one day, we will likely see similar tech in a slimline pair of smart glasses.

Part #2 - Looking to 2025

In order to get a wider perspective on what may be on the horizon in 2025, I asked three fintech commentators for their thoughts on some key trends to look out for.

Sam Boboev, Product Manager and author of the Fintech Wrap Up newsletter:

Banking-as-a-Service (BaaS) has already transformed the financial sector by enabling non-bank entities to embed financial products within their respective ecosystems. In 2025, we’ll see BaaS reach a new level through tighter integration of AI-driven technologies and a heightened emphasis on compliance and regulatory oversight.

In 2025, BaaS will be less about just providing financial services and more about pioneering a new era of intelligent, secure, and customer-centric finance - Sam Boboev

New regulations will require stronger partnerships and enhanced processes among banks, fintech companies, and third-party providers. This evolution will reinforce trust as regulators insist on BaaS meeting the same robust standards as traditional banking products. AI, in particular, will be integral to risk monitoring, identity verification, and fraud detection - enabling real-time decision-making at scale while keeping costs lower.

Michele Mattei, Advisor, Mentor and Investor in the fintech area:

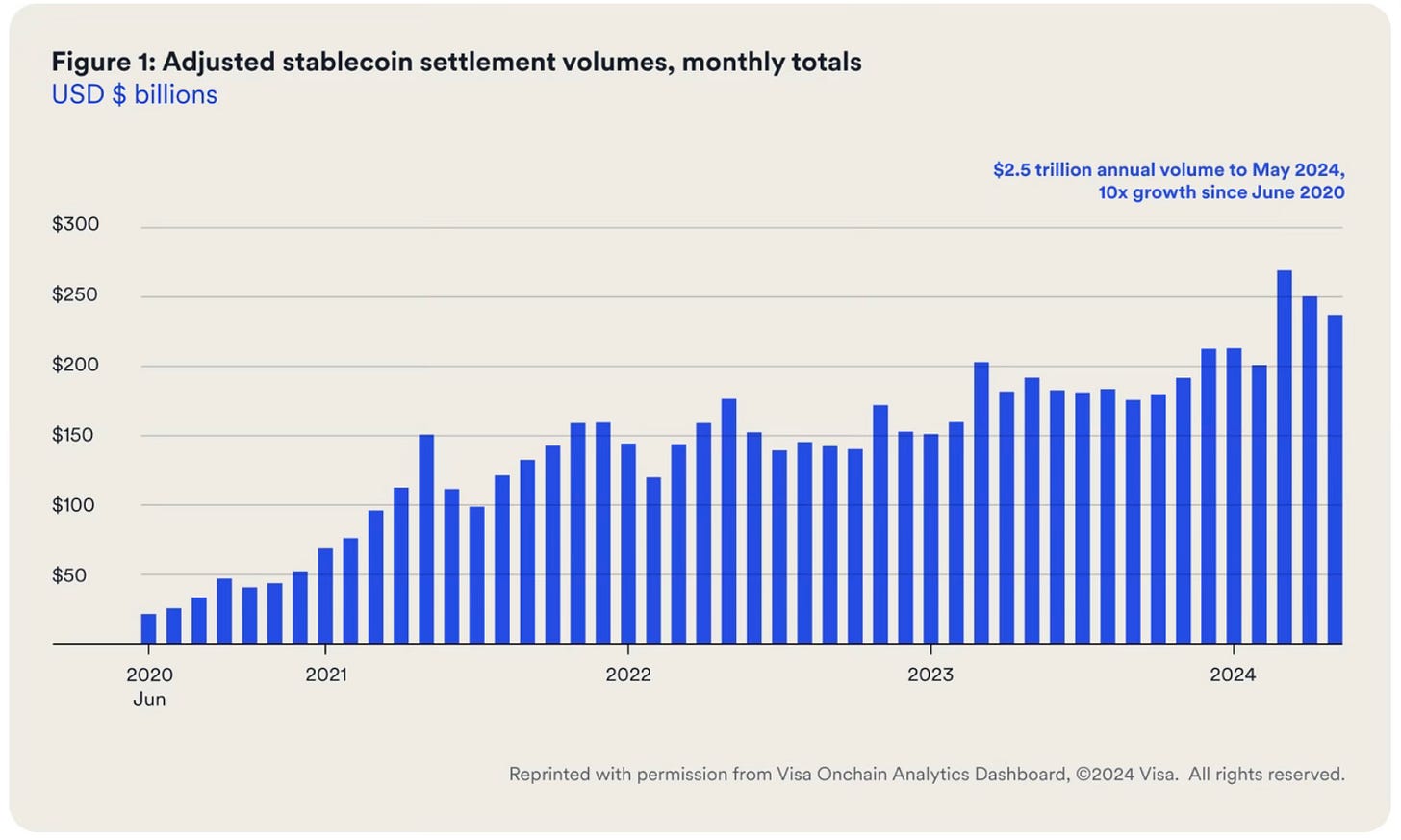

One of my predictions for 2025 is the rise of stablecoins for payments, both for B2B (Business-to-Business) and B2C (Business-to-Consumer) transactions. 2024 was a pivotal year for crypto. Many institutions now accept that this technology is not going away. Banks and asset managers are now embracing this opportunity in a variety of ways, from investment assets to exchanges and, of course, payments. With 10x growth in stablecoin payments from 2020 to 2024, this segment is in a good position to skyrocket in 2025.

Many new startups are entering the stablecoin area, helping lower barriers to entry for day-to-day payments for casual users. One recent example saw Remote, one of the most widely used global HR platforms, partnering with Stripe to enable companies to pay contractors via stablecoins. Something that only a year ago would have been hard to imagine. This trend will continue in 2025, with many companies worldwide embracing the possibility of using stablecoins.

Nicolas Pinto, Head of Marketing & Partnerships at RollingFunds:

The adoption of B2B Buy Now, Pay Later (BNPL) is accelerating and projected to grow from $334 billion in 2024 to $687 billion by 2028. The sheer scale of the B2B commerce opportunity, which is three times larger than that of B2C, underscores its potential to revolutionise how businesses manage cash flow and drive revenue.

What once took months of credit checks, paperwork, and manual processing with factoring can now be done in seconds with B2B BNPL - Nicolas Pinto

B2B BNPL addresses the complexity inherent in business transactions, offering flexible credit solutions tailored to high-value purchases. What sets B2B BNPL apart is its ability to simplify traditionally cumbersome credit processes. Instant credit lines, seamless integration with accounting systems, and advanced risk management make B2B BNPL more efficient than traditional credit facilities.

Posts You May Have Missed (Payments Culture)

Here’s some posts from earlier this year that you may find interesting…?

In February, I collaborated with the Hidden Japan newsletter to write about payments in Japan. This post had a great reaction, as it seems there was an interest in learning about some of the cultural nuances of How Japan Pays.

Also in February I wrote about my trip to Morocco. This trip was entirely for leisure, yet I couldn’t help but think about my experience with money while travelling. Morocco operates mainly on cash. Having to nearly always pay with cash comes with its own challenges, as I learned first hand.

In March, I looked at the role of soft power in payments, particularly when it comes to China. China’s mobile payments apps make the country tick, and it was fascinating to research how important they are for day-to-day life. Foreigners who visit China can now download versions of China’s popular payment apps too.

In April, I spent time understanding and writing about Save Now Buy Later (SNBL). In some ways, it’s a similar concept to Buy Now Pay Later (BNPL), yet at the same time, massively different in practice. Take a read to learn more.

Later in the year, I released a two-part series on neobanks. Part 1 looked at the background of neobanks. Part 2 looked at the strategies of three UK neobanks.