Travel + tech + fintech in Southeast Asia

Notes from Singapore, Malaysia and Indonesia

I recently got back from 18 days of travel in South-East Asia.

Starting with a flight from London to Singapore, I spent a few days in the Lion City, before moving on to Kuala Lumpur, then up to Penang in the north of Malaysia (via train). From Penang, I flew to Jakarta, took the high-speed Whoosh train to Bandung, and eventually made my way back to Jakarta to Singapore and then finally back to London.

During the trip, I attended a wedding, visited family in the region, and had plenty of time to wander around, eat, drink, do tourist stuff, and take in the energy of this vibrant region.

This post is some observations from my trip. It was inspired by reading Trungphan2’s recent Travelogue: Central & Eastern Europe. I did write a couple of posts on this blog some time ago from travels in Morocco and Croatia. But this post is a bit different. Instead of focusing specifically on payments in one country, I’ve pulled together some broader observations about fintech, travel, technology, and consumer brands in the region. I’m going to cover:

Cashless but not as we know it

Chinese brands and international expansion

Recycling schemes - pushing ahead

Travel technology (physical and digital)

Managing Jakarta’s traffic

Visiting Penang

Cashless but not as we know it

In the UK, whenever a business displays a sign saying “cash only”, it usually means card only. Sometimes, it’s just Visa and Mastercard that can be used, usually American Express too, but that’s as far as it goes. When in Malaysia, I was told “cash only” a few times, especially in smaller independent stores, but cashless meant QR code only - I couldn’t always use a credit or debit card. Although I was fortunate that as a tourist they did eventually, but reluctantly, let me use cash.

Malaysia’s domestic QR code scheme is widely used by retailers of all sizes. In addition to facilitating payments from banks and mobile wallets, other payment systems such as Alipay/Alipay+ are also integrated. The ease of paying with Alipay means that Chinese travelers - of which there are many in Malaysia, helped by a 30-day free Visa policy - can pay when travelling as they can at home. (I also saw China’s other popular payment system WeChat Pay, particularly in Singapore. But Alipay is more prominent across the region, particularly as it’s integrated into various national QR systems.)

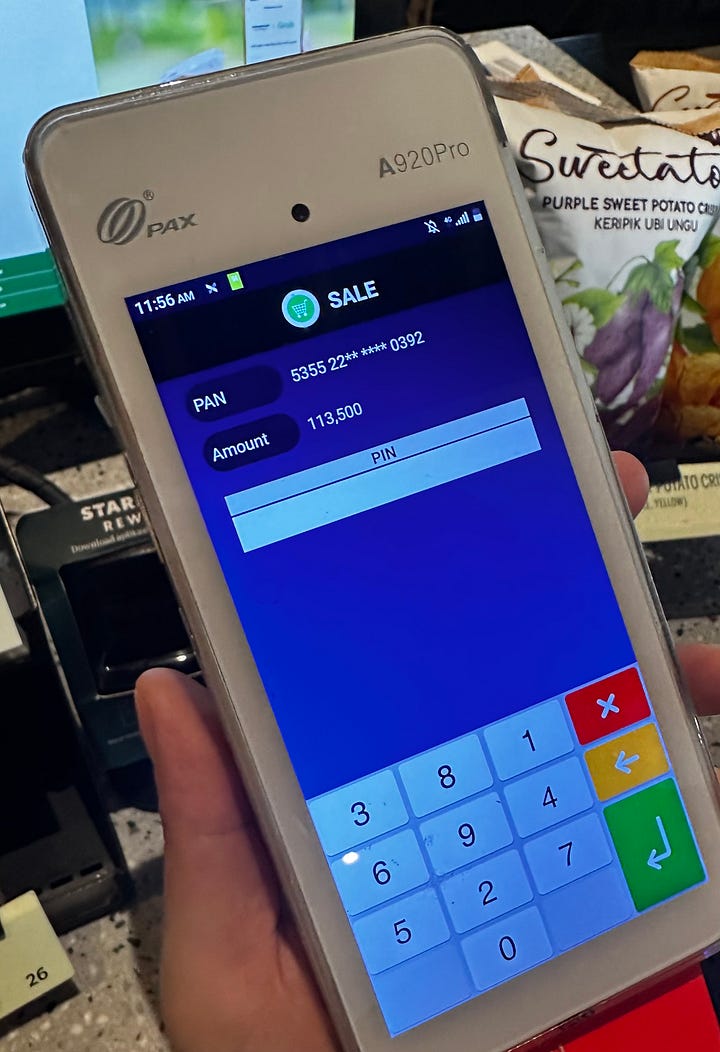

In Indonesia, I encountered some businesses that didn’t want to accept cash at all. They did accept the local QR Code scheme called QRIS, and local debit cards, but no international cards. (Even though the domestic debit cards are also Visa/Mastercard.) The POS machines in the country often don’t accept contactless, so the card must be inserted into the payment device. When doing so, the user sometimes gets a scrambled PIN pad, even for low-value transactions, which is confusing from a user experience perspective.

I hadn’t been to Asia for several years, and I was amazed at how quickly cashless infrastructure has developed. Back in 2019, using cash was very common, but five years later, QR code payments linked to banks or e-wallets, such as Grab or GoPay, are often the default option. This is a sea change in payments, something I recently wrote about in Mobile Payments Explosion, but it was valuable to see in person.

There had long been a view that developing countries would take time to migrate their infrastructure from cash to card. Indonesia shows that many businesses will choose to bypass card payments entirely. I emphasise some, as there will always be specific sectors and use cases where cards make a lot of sense.

Anecdotally, I heard that some bank branches in Indonesia are now closing, partly influenced by the rise of cashless payments. For many branches, their primary function has been providing cash over the counter or ATM facilities. Cash is needed less and less in a world where QR payments are the norm. Instead of the traditional branch locations, there are bank that provide staffed facilities, such as lounges, in some of Jakarta’s mega-sized shopping malls. These floating branches offer the chance to upsell customers on additional products, such as credit cards.

Chinese brands - international expansion

China has some huge brands which don’t make it to the UK. Take Anta, the third largest sports apparel manufacturer in the world (behind Nike and Adidas), with total sales in 2023 of 62.36bn RMB ($8.84bn). I saw Anta stores for the first time in Kuala Lumpur, and I wondered how many in the West have heard of the brand? Anta acquired the Fila brand for mainland China in 2009, and via subsidiary Amer Sports, global brands such as Arc’teryx, Peak Performance, and Wilson also sit within the portfolio. In reality Anta’s international growth has been slow so far, but they have big ambitions:

Anta is tiptoeing into the international market with a multi-brand strategy. Chairman Ding quips that Anta wants to “become the LVMH of the sports world,” referencing the French luxury group that owns dozens of famous brands, led by Louis Vuitton.

Like Anta, Li Ning is another Chinese sportswear brand that has stores in Malaysia. The company is named after a former Chinese Olympic gymnast of the same name, and has been Anta’s main domestic rival in China for a while. The company has sought to spruce up its image by participating in Paris Fashion Week on a couple of occasions, yet it still does the basics well.

The NBA has a massive following in China. Both Li-Ning and Anta have released trainers in partnership with renowned players. Most recently, Anta has collaborated with Kyrie Irving.

Malaysia is a market with a per capita GDP similar to China, with some cultural similarities. Therefore, it makes sense that sports brands see the country as a stepping stone to wider expansion. Chinese brands have local characteristics which may not easily appeal to the average Western consumer, so operating in China’s near abroad allows brands to fine-tune their international strategy:

Anta reported 33.74 billion RMB ($4.7 billion) in revenue for H1 2024, surpassing Nike China by 20% and Adidas China by 160%. Similarly, China sportswear brand Li-Ning’s revenue grew 7% YoY in 2023, to $3.9 billion. Many attribute these figures to China’s growing guochao trend, where local buyers are choosing domestic labels as a symbol of their Chinese cultural pride.

Other big Chinese brands can be seen throughout South East Asia, particularly in the beverage space. Luckin Coffee is a Chinese coffee brand with over 20,000 outlets in China. In comparison, Starbucks has 17,000 outlets in the United States and around 7,300 locations in China, making it the company’s second-largest market. In China, Luckin is much cheaper than Starbucks, costing at least 50% less. Luckin’s first international market is Singapore, but unlike in China, the price in Singapore is comparable to that of Starbucks and other large coffee brands.

Singapore is being used as a testing ground for Luckin’s wider international expansion. They plan to enter Malaysia, and also the US market in due course. It seems like Starbucks’ new CEO is going to be kept very busy, with the Financial Times’s Lex column mentioning that Starbucks has a China problem. Starbucks is under pressure due to Luckin’s success in China. Soon enough, China’s top coffee brand may make it to the US to challenge Starbucks in its home market.

Lastly, on the topic of Chinese brands, one night, when walking from a metro station to my hotel in Singapore, I saw a store with a big queue inside. I crossed the street to investigate. It was the flagship Chagee store. Chagee offers Chinese tea with a modern twist, such as various flavour options and add-ons. I especially enjoyed the White Peach Oolong Milk Tea.

Chagee has over 100 stores in Malaysia, and when I came across the popular flagship store in Singapore, it had only just opened, its first in the city-state, with additional stores planned to open soon. South East Asia is providing a stepping stone to internationalise the brand and to develop CEO Zhang Junjie’s vision of taking Chinese tea to the world. The goal is for Chagee to eventually open stores in a hundred countries.

Recycling schemes - pushing ahead

Some countries in Europe have bottle return schemes. Germany has the most successful programme, known domestically as the pfandsystem. This solution sees an additional fee of €0.08 - €0.50 ($0.55) added to each bottle purchased in a supermarket.

When the consumer returns the empty bottle to one of the 135,000+ return locations, then the original fee is returned at the point of sale. Such schemes help re-use and recycling, and they can lead to cleaner street too. Many European countries plan to launch returns schemes in the near future, and the UK’s scheme is due to start in 2027.

In Asia, some private companies are moving ahead in launching these so-called reverse vending machines. Klean has 60 machines in various locations throughout Malaysia, and so far, the company has recovered 1.2 million containers. When customers return their empty containers, they get points, which can be used for rewards with merchants such as Beam, Grab and DHL.

In Jakarta, I saw a reverse vending machine from a local consortium including Plasticpay. The company describes itself as a “social movement based on a digital platform, that invites people to change plastic waste that damages the environment into something useful that brings goodness.” By returning plastic bottles, consumers are rewarded with credit that can used for some of the country’s most popular e-wallets. And the plastic bottles themselves are recycled to make new products. It’s great to see start-ups in the region embracing sustainability, and in a way which makes it rewarding for consumers.

Travel technology (physical and digital)

Like in London, Singapore’s transit system allows contactless payments with a card, or mobile payments such as Apple Pay. There’s no need to buy a paper ticket, no need for tourists to figure out what ticket to buy at a machine - just tap at the gate, and the system will calculate the correct fare once the journey ends. Malaysia’s capital, Kuala Lumpur, has such a system, but only on part of the local transit network. On some train routes, I still had to get a paper ticket. I assume that the whole network will soon be converted to contactless payments, which will make things easier.

But it’s not possible to travel everywhere in South East Asia with public transport. Some areas in Kuala Lumpur are much quicker to get to with a Grab (the region’s version of Uber). Penang and Jakarta are often impossible to navigate without a car. Coming from London, Grab seems cheap, so I often left a tip in the Grab app, especially after a good conversation with a driver. One useful feature of the Grab app is that where there are several drop-off points at one location, the Grab app informs the user which stop is most commonly selected. This feature helps direct travellers to the most likely endpoint, which is particularly helpful for tourists.

One of the highlights of my trip was taking Indonesia’s high-speed rail service, which is known as WHOOSH. The train connects Indonesia’s capital, Jakarta, with Indonesia’s third-largest city, Bandung. There’s talk of extending WHOOSH all the way to the east of the main island of Java, to Surabaya, Indonesia’s second-largest city.

Did you know? WHOOSH is short for Waktu Hemat, Operasi Optimal, Sistem Hebat, in Indonesian, which translates as Timesaving, Optimal Operation, Outstanding System. I’m glad they shortened the name with the acronym! The acronym is fun, and the announcers on board the train don’t hesitate to say it every few minutes.

Impressively, the train gets up to a speed of 350km/h. If only we had such a train system in the UK, instead we spend decades delaying and changing our plans, and the costs of our High-Speed Rail keep rising. In comparison, Asia seems to know how to build infrastructure, and at pace - the WHOOSH is a great example of this.

Managing Jakarta’s traffic

Jakarta is set to overtake Tokyo as the world’s most populous city by 2030. The city is growing rapidly, and to help with traffic congestion, an odd-even traffic restriction system has been implemented. This regulation means that cars with licence plates ending in odd numbers. and those ending with even numbers, can only drive on certain major roads on designated days.

The flaw in this system is that nothing stops a family with the means from buying two cars and using one or the other on alternate days. Yet an interesting sign of the steps the city government is taking to try and help with traffic congestion. It’s a battle that can never truly be won. But the odd-even measure and growing public transport options reflect how the government seeks to improve, or at least manage, the situation.

Currently, like many developing economies, Indonesia subsidises fuel for its population. These subsidies have been reduced in recent years, but they are still significant. There’s talk of limiting the subsidies, especially for larger vehicles that pollute more, to a set amount of fuel per month. Drivers will be required to scan a QR code associated with their vehicle at the petrol station before refuelling. The fuel price will adjust according to the subsidy permitted for the vehicle type. Adjusting fuel subsidies is another use case for QR codes, and it wouldn’t surprise me if other countries look to try a similar system in the future, especially developing countries looking to wean their population off from large fuel subsidies.

Visiting Penang

Penang is a major tourist destination in the region. The region is famous for the historic centre of Georgetown, its capital city, a UNESCO World Heritage Site since 2008. My tip for visiting Georgetown is to go to the Pinang Peranakan Mansion as soon as possible. I only went there on my last day in the city and wish I had visited sooner. It sets the scene for Penang’s history, culture and food, unlike anywhere else. You’ll get an understanding of the family that used to live in the house and how the Peranakan Chinese way of life has shaped the region.

If you’re looking for a good coffee shop in Penang, I recommend Bean Sprout Cafe (Instagram, Google Maps). I didn’t have chance to try the food, but it looked delicious.

If you enjoyed reading this post, you can connect with me on LinkedIn, X, and BlueSky.

Bonus content - podcasting with AI (Experiment)

Recently, Google unveiled a new feature in its NotebookLM AI-powered research assistant. The new feature allows users to build a mini-podcast, a conversation between two hosts who can “summarize your material, make connections between topics, and banter back and forth”. As an experiment, I provided NotebookLM with links to my recent posts on neobanks (part 1, part 2). Below is the output that it generated. I was impressed by this feature! Let me know what you think.

Chagee was actually in Singapore for awhile! A lot of us thought they over-expanded so they closed it a year ago if i remember correctly, and only came back this year! Also yes, we're very dependent on cashless payment these days, even hawker centres resort to cashless QR payments as well. Many places still accept cash, though!