What's going on with the UK's favourite bank?

The state of Monzo in 2026

My sub-heading says that Monzo is the UK’s favourite bank. This may be contentious. But I’m comfortable saying this. In the second half of 2025, Monzo topped the two most-watched UK banking customer satisfaction surveys.

The Ipsos twice-yearly ranking asks customers how likely they'd be to recommend their bank to friends or family. In the latest results, Monzo scored 82%, with Chase and Starling Bank joint second at 78%. Since 2020, Monzo has led or come joint top almost every time. They also topped the latest YouGov customer satisfaction survey.

Revolut’s first market was the UK, and it’s still Revolut’s biggest, with more than 10 million customers, so you may be wondering: why isn’t Revolut included in these banking satisfaction surveys?

While Revolut has been approved for a UK banking licence, it’s still in the “mobilisation phase”, which means it doesn’t yet have a full banking licence, and therefore is not eligible for these surveys. Part of Revolut’s challenge is that while their international growth has been phenomenal, it has made UK regulators nervous.

Any bank dealing with tens of millions of customers will need to demonstrate they can scale their risk management infrastructure accordingly. It’s a unique situation as most UK banks focus on their home market rather than expanding globally, especially before securing their UK licence.

Since I last wrote about Monzo, a lot has happened, and its future direction makes it one of the most interesting stories to watch this year. The bank has been a huge success in the UK. Now, after ten years of focusing on the UK, the bank is stretching into other markets, and its strategy is evolving faster than ever. All this while major leadership changes are happening at the top.

In this series, I’m going to review the state of Monzo, as it stands at the start of 2026.

The story will unfold in three parts:

The marketing magic ✨

The strategy 📖

The leadership clash ✊🏻

Note: The subsequent posts covering Monzo’s strategy and leadership will follow in the next weeks. Though they will not come immediately after this one, as I’m going to break it up with some other posts in between. Be sure to subscribe not to miss the full series.

Welcome to Payments Culture!

This newsletter explores how money moves, around the world — and why it matters.

Make sure to subscribe, and let’s connect on LinkedIn and on X.

Monzo’s Marketing Magic ✨

At the end of last summer I wrote about my experience at Monzo’s book pop-up.

The event lasted for two days, and it’d be wrong to call it a store. There was nothing to buy as the books were free. The only catch was waiting in line for an hour to get one (luckily it was early September, and not the middle of Winter!).

As well as a free copy of the book of money, I also got a chocolate bar, a notebook, and a £20 book token. Not bad at all.

One of the key messages in my write up of the book pop-up was that almost all other banks would struggle to approve such a marketing strategy. This experiential marketing approach is not something that can be easily measured in terms of ROI.

However, it does reflect Monzo’s approach of creating fans. You can call them customers or users, but if you actually create fans then this will cascade.

While only a few thousand lined up to get their free book and chocolate bar, countless more saw and shared the campaign on social media.

The bank has long positioned itself differently to legacy banks. Lacking the deep pockets of the established banks, Monzo had to build a sense of community and connection to gain a foothold. This approach is now set in Monzo’s DNA and continues in many ways.

Monzo’s Sponsorship of Coventry City FC

These days, football teams in some parts of the world are franchises that get created seemingly out of thin air (think Inter Miami). But the origins of most football teams in the UK are in the local community. Many were founded by working-class men who spent six days a week in coal mines or factories, then spent their one day off each week playing football. From their hobby emerged the teams we know and love today.

These origins are why football teams in England are usually based in working-class neighbourhoods. Industrial towns such as Burnley and Blackburn in the North of England have long-standing and very successful teams given their population size.

Monzo have been the shirt sponsor of Coventry City FC since the start of last season. Coventry is not a glamorous club. They are not in the Premier League. They are not based in London. Coventry is a small city in the Midlands around 20 miles from Birmingham. However, they are a good match for Monzo.

Frank Lampard, former Chelsea and England captain, manages Coventry City, who currently sit top of the Championship (England’s second-tier league). There’s a good chance they’ll be a Premier League team next season. If they get promoted, it’ll be the first time the team has made it to England’s top league since the 2000-2001 season.

Likewise, Monzo is also on a journey from underdog to champion. Despite having millions of customers, the bank is often still referred to as a challenger bank. There’s still a long way to go in attracting customer deposits at a similar level to the big legacy banks, and there’s considerable room to expand their product suite.

From a financial perspective sponsoring a Championship team makes sense:

Sponsoring a Premier League team can cost upwards of £50m per annum.

Sponsoring a Championship team can cost £5m per annum (perhaps less).

The benefit of sponsoring a Premier League team is the global reach that you get from TV viewership and social media. But for Monzo this isn’t so important right now - their focus remains the UK market. In addition, working with a smaller team allows Monzo greater scope and creativity when building that sense of community, which is important to their own ethos and to football fans, including those of Coventry City.

If Coventry City win promotion, Monzo may find itself sponsoring a Premier League team. But this past weekend brought its own excitement. There was a mini-frenzy in the city. Coventry City football shirts were for sale for 1p. The shirt on offer was Coventry City’s away kit, which is in Monzo’s trademark hot coral colour. The only requirement was to have a Monzo account and to pay the 1p with your Monzo card.

Coventry City fans were able to purchase a coral away shirt at two pop-up shops. By mid-morning there was an expected wait time of more than three hours at the city centre stand.

The company offered the shirts at the CBS Arena and Broadgate Square ahead of the Sky Blues match against Leicester City at the CBS arena.

Fans were queuing for more than hour before the Broadgate pop-up shop, run by online bank Monzo, opened. Some fans on social media joked they would still be in the queue when the match kicked off at midday

On the club’s website, Vuokko Aro, Monzo’s Chief Design Officer emphasised the community aspect, and how Monzo’s motto fits with the moment:

We know how much the kit means to Coventry fans, so we wanted to do something special to kick off the year. For one day only, we’re covering the cost so fans can get their hands on it for just 1p. It’s a simple way to show our support for the club and the community, and a reminder of what we stand for at Monzo: making money work for everyone.

As expected, many fans were keen on getting a football shirt for a penny, especially as the adult sizes can cost up to £80. Behind the 1p shirts was a logic that Monzo fans would understand. It wasn’t a coincidence that the shirts were sold for a penny and not for a pound. It all links back to one of Monzo’s most successful annual marketing campaigns.

Making Saving and Switching Easy and Fun

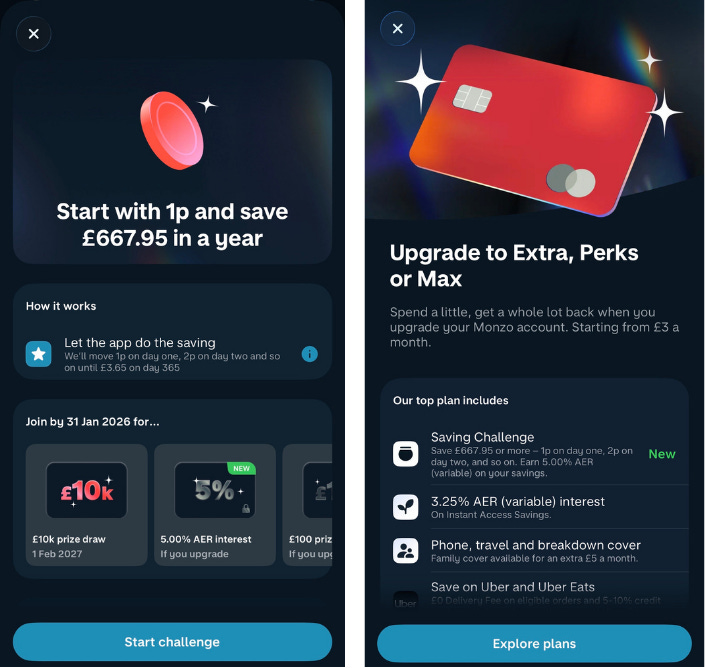

At the start of each year Monzo publicises the 1p Saving Challenge. The idea is simple. Users save 1p on the first day of the year, 2p on the second day of the year, 3p on the third and so on. If a customer signs up on January 1st and continues throughout the year, after the addition of £3.65 on the last day of the year, they’ll have saved a total of £667.95 (before any interest).

The end result may not seem substantial, but the goal of the 1p Saving Challenge is to encourage those who may not have a strong habit of saving money to get used to putting the pennies away. The challenge shows that by even starting small, savings can add up, and encourage the saving habit to grow.

In announcing the 1p football shirt offer Coventry City linked the promotion back to Monzo’s ambition of making money work for everyone. And a key part of this mantra is building sustainable savings habits:

Why 1p? Because pennies add up. Monzo is kickstarting long lasting saving habits and fronting the cost of the shirt to show just how much impact a single penny can have - and how easy it is to turn small daily savings into something big.

The concept of a year-long daily savings challenge existed before Monzo productised it.

It was often discussed on the popular personal finance website Money Saving Expert, and in various Reddit groups. But the Monzo magic was in automating the user experience. Once enrolled, the daily savings goal is automatically moved from a user's current account to a savings pot each day — no manual transfers required.

Deepening customer engagement

As well as those looking to enhance their savings habits interest in the 1p Saving Challenge this year has been spurred by Monzo’s use of gamification, or what I’m calling lotto-isation. Let me explain. In joining the 1p Saving Challenge before the end of January, Monzo customers are eligible to win £10k in a prize draw provided they complete 365 days of daily saving. Additionally those with paid accounts have the chance to win £100, with 100 prizes on offer each month.

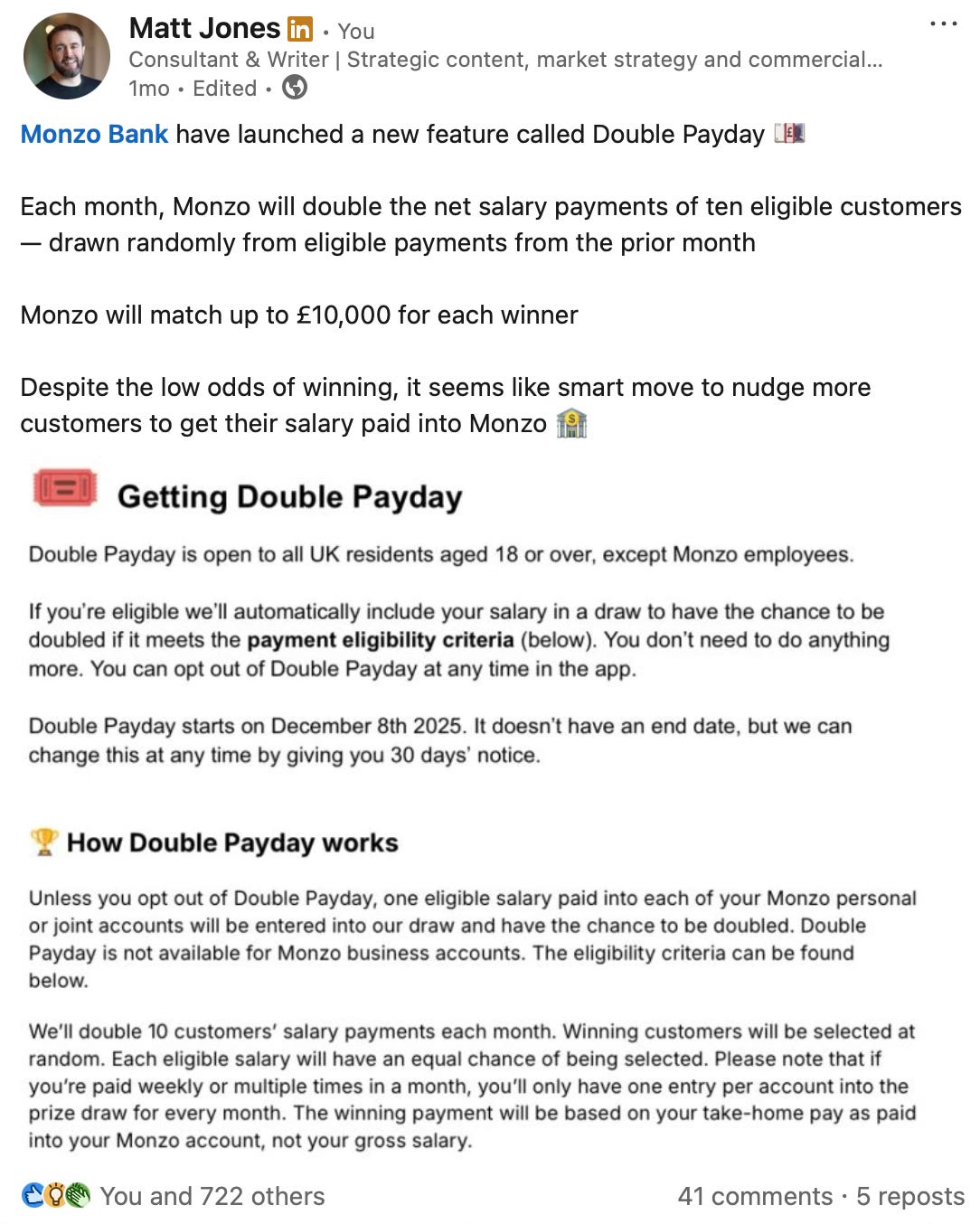

This isn’t the first time that Monzo has taken this approach of rewarding customers with a giveaway. Double Payday was launched at the end of last year and generated lots of publicity for the bank. There are still many customers who use Monzo — and other neobanks — as their second bank, such as for tracking expenses, when spending money abroad, or to make payments easily. Double Payday is a way to nudge customers to pay their salary into Monzo, and to use it as their main bank account.

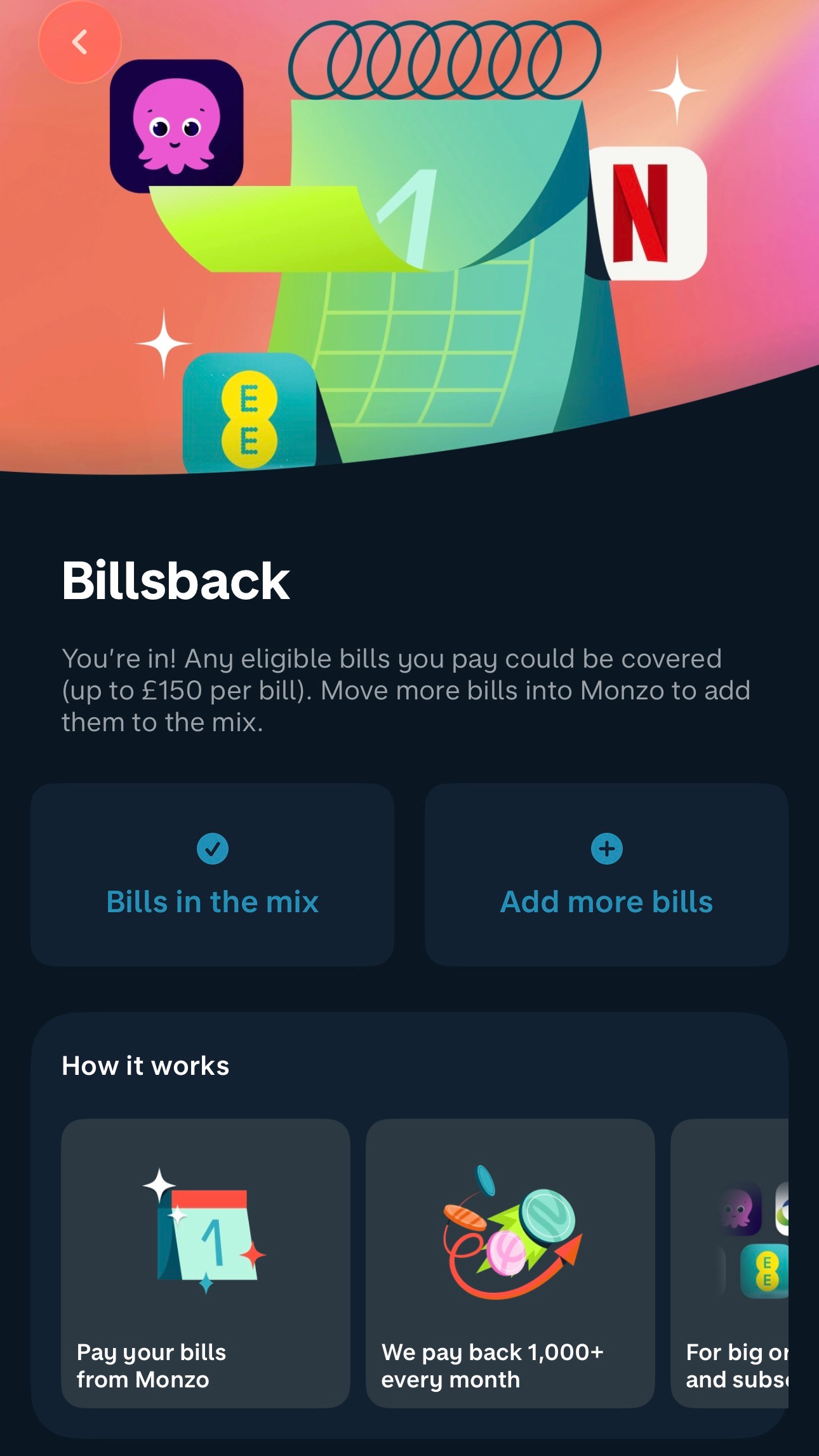

Billsback works similarly but targets recurring payments. Each month, Monzo refunds around 1,000 customer bills in full (up to £150 each). Everything from Netflix to utility bills is in scope provided your Monzo debit card is used for payment. It’s a direct financial incentive for users to move regular payments across to Monzo, and those who do so will likely make Monzo their primary account.

Traditional banks have long offered switching bonuses, for instance rewarding consumers with a one-off payment for moving across their main account, usually on the proviso that they pay in a minimum salary and set up some direct debits. Some users game the system by cycling through banks to collect multiple bonuses.

Monzo’s approach is different. Customers are offered many ways and incentives to ramp up engagement. It’s not just about signing up for an account (though you do get £10 for referring a friend). Rather, ongoing lottery-style rewards deepen engagement and interaction with the bank. This is where marketing and strategy come together, and Monzo’s strategy will be the topic of the next post in this series.

Thanks for reading Payments Culture. I appreciate it!

Please leave a comment or share with a friend or colleague if you enjoyed reading this edition. It’s much appreciated and helps grow the audience of this newsletter.

Note that views expressed on this Substack are my own and do not represent any other organisation. Also nothing I say should be taken as investment advice.

Very insightful. The "service to the community" philosophy imbued into its products & marketing strategy is brilliant.

Love this piece! Very well researched and interesting to read!