In January 2024, there were 14.41m Open Banking payment transactions in the UK. Whilst this was an increase of 69% year on year (from 8.54m in January 2023), it's still tiny compared to the number of card payments. In the same month, there were over 2 billion card payments. In other words, according to January's data, the ratio of open banking to card payments was 0.7%. For every 143 card payments there was 1 Open Banking payment. (Sources: UK Finance, Open Banking)

The numbers above show that Open Banking hasn't been a success - at least not so far. I'm talking here about in the UK. Despite many companies operating in this space and a lot of VC funding, the concept hasn't taken off. But why is that?

As a premise it’s simple enough. Instead of using a credit or debit card to pay, you can pay directly from one bank to another.

But the problem is that Open Banking has focused on the needs of businesses, of merchants. The needs of consumers - currently those who usually pay with cards - haven't been addressed and often seem to have been barely considered. What's required to convince more consumers to move to Open Banking as a payment method? We'll get to that, but first, the key benefits for merchants.

Cheaper Fees. Card payments come with various fees, including interchange fees, which are a % of each transaction. Open Banking payments are usually charged as a flat fee - say 10p per transaction. For merchants, transactions over a certain size can be much cheaper if Open Banking is used as the payment mechanism. But for consumers, with lower fees comes lower rewards as credit card rewards are funded from interchange fee revenue. I wrote - here and here - of how the UK market doesn't have high interchange fees, at least compared to other markets such as the United States. However, with Open Banking as a payment mechanism, there's no cashback or points at all. Lower fees may be great for merchants, but there may be a downside to consumers.

Receive Money Fast. With card payments, it's usual for businesses to receive money in their bank account with a one-day delay. Sales made on Monday are deposited into a business's bank account on Tuesday - one incoming payment will contain all sale transactions minus any refunds. With Open Banking the funds are received almost right after a transaction. There's usually no delay at all. For some small businesses, this will be a big benefit. For consumers, this doesn't impact them.

No Chargebacks. Chargebacks can be one of the main challenges that come with accepting payments. Open Banking eliminates chargebacks entirely. The payment has to be authorised by the user, usually via biometrics, so in theory, it's secure with limited risk. However, there have been recent fraud cases in which drivers scanned a fraudulent QR code to pay for parking. Rather than what they expected, they were scammed into paying criminals instead of the parking company. It's much easier to set up a fake QR Code to accept bank-to-bank payments than to set up a fake account for receiving card payments. Due to fraud concerns, there's regulation under discussion which may allow banks to delay payments for up to 72 hours if fraud is suspected. So, whilst a lack of chargebacks is good for merchants, there can be a downside for consumers.

Sometimes, Open Banking is used interchangeably with terms such as Account-to-Account (A2A) or Real Time Payments (RTP). However, many argue that open banking should not be used synonymously with A2A or RTP, as it's a broader concept of sharing information via APIs rather than just a payment mechanism.

Companies operating in the Open Banking space are usually classed as either an AIS (Account Information Service) or as a PIS (Payment Initiation Service). Some companies may even be both. The first concerns providing financial information via APIs, for instance, to see the balances across various accounts. The second is Open Banking as a payment mechanism. Taken together, there's an infrastructure of various providers and third parties utilising APIs that banks maintain to facilitate both data and payments.

For a more detailed technical understanding of the evolution of the various facets of Open Banking in the UK, take a look at ’s post on the topic:

To understand Open Banking, it's worth taking a look at a report published in May 2023. The report is titled Recommendations for the next phase of Open Banking in the UK, published by the Financial Conduct Authority and the Payment Systems Regulator. It highlights how far Open Banking has come since it was first mooted back in 2016. The report states:

The UK pioneered open banking and established itself as a leader in the field. We are now taking the next step on the UK’s open banking journey.

The UK is going for a slow, steady and consensual approach to building an ecosystem for Open Banking, and over time, building to the participation of a critical mass of end users. There are hundreds of companies offering various Open Banking services, so on one level, the operating model may be seen as a success. However, as we saw at the start of this post, user adoption and actual payment transactions are still very low. So still the challenge is appealing to consumers, and driving up the transactions volumes. Chris Skinner summed it up nicely in his recent blog post:

The thing is I always come back to: does anyone want Open Banking or Open Finance or Open Payments?

The industry does, yes, but the customer doesn’t.

What does Open Banking need to address to build momentum? What is holding it back? It can be helpful to look at other similar initiatives around the world that have been successful. Let’s see what they’ve got right and what can be learned from them.

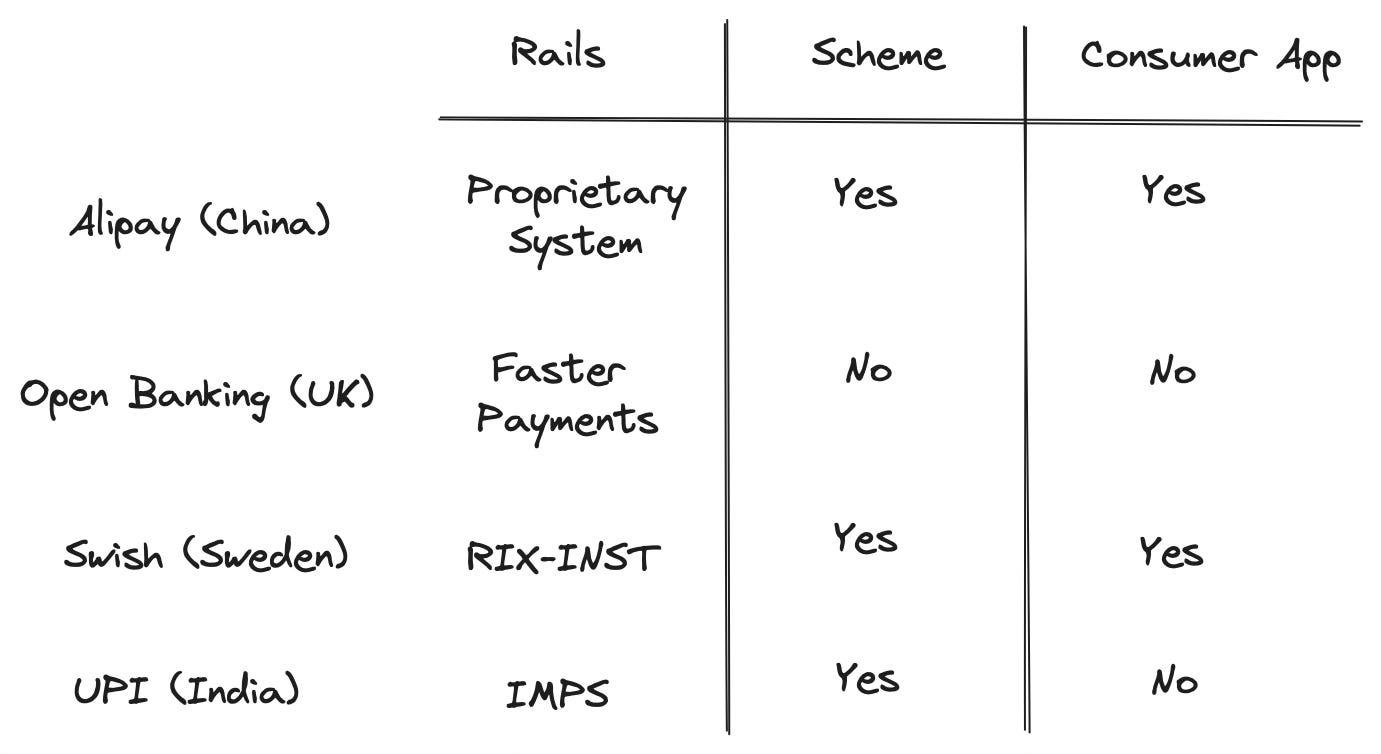

In terms of key differences between the various payments mechanisms, the key one is that Open Banking is a framework which utilises the Faster Payments rails. It's not a payment scheme, nor is it a consumer-facing app. But it provides the basis for providers to build upon. However, this is part of the challenge. The others listed above have more momentum, whether it's from banks working together (Swish), a strong regulatory push (UPI), or a first-mover advantage with their app targeted at both consumers and businesses (Alipay). And all of the above payments mechanisms - except Open Banking - have documented information on how to try and reverse a transaction or to initiate something akin to a chargeback:

Swish offers information on how a user may reverse a transaction.

Alipay offers a dispute resolution guide - at least for international merchants.

In a market such as the UK - where consumers have a high awareness of the chargeback mechanism - a centralised dispute management system as part of Open Banking would help adoption and consumer confidence. Additionally the UK has domestic legislation worth noting. Section 75 of the Consumer Credit Act, is well known, and holds a credit card company responsible for a breach of contract or misrepresentation. (Essentially Section 75 is another layer of protection on top of a chargeback but it only applies to credit card transactions.)

Apart from the lack of dispute management, what else is holding back Open Banking?

A Consumer Facing App. In India, 2/3rds of UPI transactions go through two consumer-facing apps (PhonePe and Google Pay). These apps are used to pay on a person-to-person basis as well as to pay businesses. The nature of Open Banking in the UK means there's no large-scale direct-to-consumer app; instead, the framework is all about adding Pay by Bank as an option within existing apps.

With Open Banking, scaling is reliant on collaboration and businesses providing a Pay by Bank option to their customers, rather than directly providing a consumer facing app.

Sweden's Swish is a useful case study of an alternative approach. A consortium of banks launched a direct-to-consumer app and continue to operate Swish as a separate entity to the banks. Swish is now embedded as a well recognised payment option in Sweden. Given the extent of competition in the UK, it may now be too late for a similar project to Swish, but the lack of a popular consumer facing app specifically for Open Banking payments has held back momentum.

An Acceptance Mark. Geoffrey Barraclough mentioned in the latest edition of The Business of Payments that an acceptance mark for Open Banking has recently been mooted. This would be a way to highlight where Open Banking payments are accepted, and would tell consumers they are shopping somewhere genuine when they pay directly from their bank account. As a comparison, when we see the Visa or Mastercard logo, we know that our cards will be accepted wherever in the world we go. Similarly, why not develop an acceptance mark for Open Banking payments?

Provide An Incentive. How can users be incentivised to use Open Banking as a payment method? We've already seen that open banking means losing any credit card rewards and also the right to raise a chargeback. In the US, some merchants, such as Uber, have started piloting discounts on rides if users pay directly from their bank account. This approach makes sense in the US as interchange fees are, on average, almost 2% higher than in the UK. The savings of moving someone from card payments to direct bank payments will be substantial. It may even be worth making a loss in the short term by providing such an incentive if the habit can be ingrained.

Open Banking has a strong foundation. The ecosystem is robust. And it isn't going anywhere. Consider this post as a reflection on how open banking can be accelerated. We need to change the pitch to include the consumer more; what's in it for those who mainly use cards today? Why would they switch to a bank payment?

The UK may be one of the markets where cards will remain the preferred payment method, even in the long term. Cards are trusted and well-understood, but that said, there are undeniabley some strong use cases for open banking. In a few years, I expect the ratio of 0.7%, or 1 Open Banking payment for every 143 card payments, will have changed significantly for the better.

If you enjoyed this post, please consider liking this post or leaving a comment. It's much appreciated. Please consider subscribing to receive new posts via email or in the Substack app. If you’re an existing subscriber, you can upgrade your subscription to support this newsletter.

Great write up Matt. On the payments side it's a slow and steady race. Everyone jumps to incentives in the west (which I think will be a driver) but if you look at most of the global implementations where payments has taken off, incentives hasn't been a core part of that growth. Timing, low-friction and using OB payments for use cases where payments are not purely transactional will be growth factors in the west. Needs for the consumers should be catered for more, but consumer education on Open Banking Payments is also needed and something that was part of UPIs accelerated growth