Why Ryanair wants you to Pay by Bank

How to save £3m+ in payments acceptance costs

Welcome to Payments Culture!

This newsletter explores how money moves, around the world.

In this week’s edition I cover:

Ryanair’s move to save £3m+ in payments acceptance costs

The economics of Open Banking payments vs cards

Additional advantages of Pay by Bank

Consumer expectations and adoption challenges

The default effect in payment choice

My future outlook and recommendations

I’m currently looking for new opportunities. Let’s talk if I may be able to help you. I am open to short-term assignments such as consulting, advising and writing as well as long-term work. You can email me or contact me on LinkedIn to discuss further.

I hope you had a great summer! As we are now coming near to the end of September, the hot days of summer feel like a long time ago. In the UK we’re strapping in for more than six months of dreary rain and grey skies. The one advantage of living in a country with such sh*tty weather is that we have no excuse but to get our heads down and work hard for the next few months.

My August highlight was a late summer vacation. I’ll write more about my travels next week. But this post is about Pay by Bank and how it’s seeping into more and more online checkouts. What’s the significance of this? And could companies like Ryanair save £3m+ a year through Pay by Bank? Let’s get into the details.

Pay by Bank is powered by Open Banking technology. In the text below, I use both terms interchangeably to refer to the same bank account-based payment method.

Payments as cost control

Ryanair is Europe’s largest airline.1 They carried over 200m passengers last year (the first European airline to do so). The service is no-frills but always punctual and usually good value. If you want to fly to some locations in Europe, Ryanair may be your only option - their network is much bigger than legacy carriers such as British Airways and Lufthansa. In the early days, Ryanair’s business model was to fly to second-tier airports that traditional airlines often avoided, but over time, in many locations, they now compete directly with legacy carriers.2

Ryanair’s growth has been premised on exceptional and unwavering cost control.

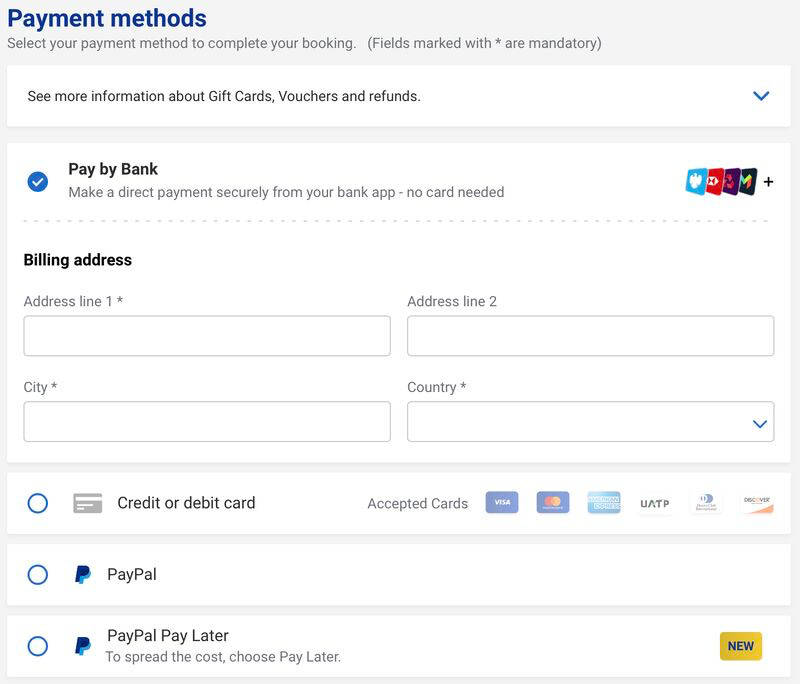

This discipline extends across their entire business, including into payments. When I recently opened their checkout page I wasn’t surprised to see that they now offer Pay by Bank as their default payment method.

Pay by Bank is a term widely used for payments directly from a bank account (instead of from a credit or debit card). The main benefit to Ryanair is cost. For some businesses, it’s much cheaper to accept payments directly from a bank account than card payments. When transaction values are high — such as booking a ticket for several travellers in one payment — then the cost difference really shines through.

Let’s look at some of the economics:

The average payment transaction for Ryanair is around £803

Ryanair will pay merchant service fees to their card acquirer, PSP, or payment processor on every card transaction

The total fees paid will range from circa 0.45% for debit cards and 0.55% for credit cards4

On a £80 transaction this will equate to £0.36 (debit) and £0.44 (credit)

The cost base of card payments is fixed due to interchange and scheme fees that are paid to Visa and Mastercard and the issuing bank. But with Pay by Bank, the cost of payments are based on what the third party payment initiator – known as a PISP – sees as a fair price. True Layer, one of Europe’s largest Open Banking providers is the PISP for Ryanair, and while the exact pricing that Ryanair pays for Pay by Bank is confidential, usually Open Banking payments are priced as a per-item fee (pence per transaction) rather than as a percentage (ad valorem). In the case of a large airline like Ryanair a fee of around £0.20 per transaction would be possible.5 This equates to just 0.25% on a £80 average transaction.

Therefore, on average, with Pay by Bank, Ryanair would save £0.16 on every debit card transaction and £0.22 on every credit card transaction. A credit card transaction is likely to cost twice as much as a Pay by Bank transaction! And this is just the start.

Note: The above example assumes that these transactions are consumer domestic transactions. Card fees differ depending on the type of card used. I wrote more about the nuances of interchange fees in my recent post titled Can Revolut compete with American Express?

Business and commercial cards — unlike consumer cards — are unregulated and incur a fee of over 2%. If a business or a commercial card is used to pay at Ryanair, the total cost will be close to £2 per transaction, a world away from the possible 20p per transaction for an Open Banking payment.

Additionally, if Ryanair's merchant domicile for card payments is based in Ireland rather than the UK, due to a post-Brexit quirk, even consumer cards will attract fees of over 1%. Taken together these nuances mean that the potential cost savings highlighted above the minimum savings, and the average may be much higher.

It’s not just lower transaction fees

With Open Banking payments, businesses benefit from6:

Lower fees

Instant settlement

No chargebacks7

Lower fees are discussed above and will be covered further later in this post.

Looking at the other two points.

Instant settlement means that the merchant receives money from each payment instantly into their bank account. Businesses usually have to wait until the next day to receive funds, or in the case of some airlines, due to risk considerations, they have to wait days or even weeks.

Yet other than the lower fees, the most significant factor, and to be clear, the biggest positive of Open Banking payments for many merchants is lack of a chargeback mechanism.

The chargeback rate for the travel sector overall is often quoted as somewhere in the region of 0.5%-1% globally. This contains a large degree of variability depending on region and each specific merchant, but even a chargeback rate of 0.2% is highly disruptive and costly. This means that for every 1,000 transactions, two transactions are successfully disputed by a cardholder. For those two transactions, not only will an airline be debited for the original payment, but they'll also be hit with a £20 fee by their payment provider.8

Chargebacks drive up the total cost of payments, and it’s not surprising that many large merchants employ teams, and pay for tools, to specifically stop chargebacks from recurring. When chargebacks do occur, merchants usually try and win each case. The whole process is costly and time-consuming so for merchants, using Open Banking payments to say sayonara to chargebacks is a great!

Whether it’s lower fees, faster settlement, or no chargebacks, all of the benefits of Open Banking payments accrue to merchants and not to end users.

Last year I quoted a blog from Chris Skinner:

The thing is I always come back to: does anyone want Open Banking or Open Finance or Open Payments?

The industry does, yes, but the customer doesn’t.

Consumers are largely ambivalent.

They don’t benefit from lower fees.

They don’t benefit from faster settlements.

And consumers definitely lose out from the lack of a chargeback mechanism. Chargebacks are especially valuable in the travel sector. If an airline goes out of business before a customer takes their flight, then they can utilise the chargeback mechanism to get their money back.

It’s not Ryanair that we should worry about. From a financial perspective, Ryanair is one of the safest airlines in Europe. But if Pay by Bank proliferates there’s a risk that an airline insolvency of a smaller airline will lead to consumers not getting their money back.

In such a scenario the financial media will soon make clear that if a card had been used users would have been covered. In that event there’s reputational risk for Pay by Bank as a payment method. Even though companies who offer Pay by Bank — such as True Layer — will not make a financial loss in an airline insolvency scenario (as there’s no chargebacks), merchant-level risk should be part of the consideration when offering Pay by Bank as a payment option.

Consumer expectations

While the merchant-focused benefits are clear, consumer adoption of Pay by Bank remains a challenge — especially when card payments work so well in the UK.

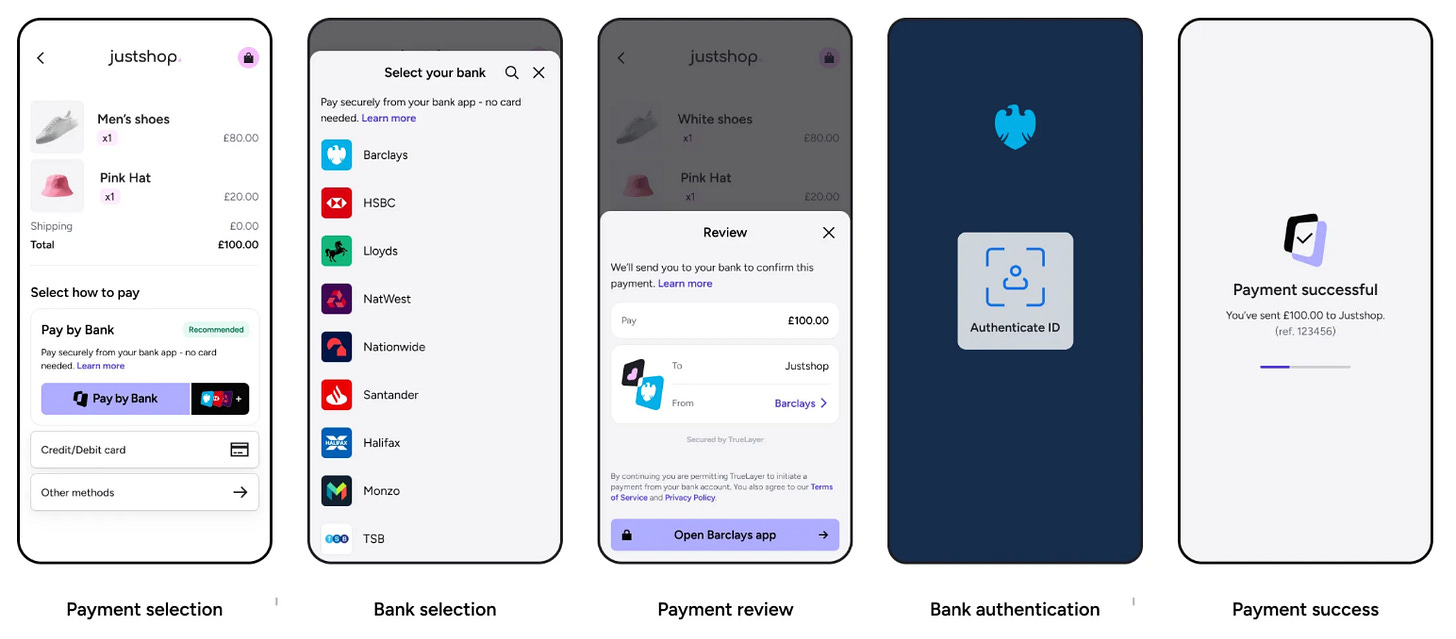

One positive aspect of Open Banking payments from a consumer perspective is that the UX (User Experience) is seamless. The UX is particularly good if a transaction is initiated and completed on a mobile device (although the UX isn’t quite as smooth as an Apple Pay transaction). The user is directed from the merchant checkout to their banking app to approve the transaction along with Face ID for verification, and no card number needs to be entered. In most cases, neobanks such as Monzo, Starling and Revolut have the best user experience for Pay by Bank, and Barclays works well too, with the others are catching up.

A strong UX alone won’t drive adoption. However, some consumers will prefer the experience of Open Banking payments over cards. Some users will choose the option to authenticate with their bank rather than entering a card number.

This preference for choice reflects a broader shift in customer behaviour. We are not in an era where one payment method will win over all others. There’s room for Open Banking and cards to co-exist side by side.

Even if cards account for 95% of all payments, consumer choice is a good thing and consumer habits will always differ, even within the same country. That's why in some markets, especially in Asia, many mobile wallets exist side-by-side9 and it’s normal to see many payment options at the Point of Sale. It’s not a battle of cards vs Open Banking. Rather, as cashless payments grow in aggregate, we should, at least in some use cases, expect Pay by Bank to take a small but growing share of the pie.

The challenge for merchants: how to change consumer habits. Cash-based incentives sound like the easiest option. Offering a discount on the purchase price for those who opt for Pay by Bank over cards may change consumer behaviour, or at least lead consumers to take that first step. However, the cost differential between cards and Open Banking isn’t big enough in the UK for merchants to offer a big enough discount to make a real difference. It’s tough to make the numbers work.

When considering an airline ticket, what level of cash-based incentive would make a consumer switch from cards to Pay by Bank? I’d say £5, yet the actual cost differential is pence, not pounds, and any incentive would require a large marketing spend. In short, it’s only a short-term promotional strategy, and not something which can be maintained in the long-term without very deep pockets.10

The default effect

As mentioned earlier, when booking my flights, I noted that Pay by Bank was the default payment option on Ryanair’s checkout.

The checkout was nudging me to Pay by Bank.

This is status quo bias, or what is known as the default effect. It’s a psychological phenomenon, as explained in this paper by Hu et al:

The default effect refers to the phenomenon where individuals naturally pay more attention to the default option than alternatives. Numerical empirical studies demonstrate the existence of the default effect in various real-life scenarios.

We encounter the default effect in various aspects of life.

In the UK, since 2012, legislation has mandated that employees are automatically enrolled into a defined contribution pension scheme by their employer. In the ten years following this change, employee participation in employer-based defined contribution pension schemes increased from under 50% to almost 90%.

Another example of the default effect in action is organ donation. Most countries in Europe assume consent for organ donation. This has increased organ donation rates and ultimately saved lives,11 but each country has its own nuances, and some are more successful than others. From medical journal The Lancet:

Spain operates a soft opt-out system: everyone is an organ donor by default, but families of the deceased have the final say. Other countries have introduced opt-out systems, but this has not necessarily resulted in a more positive donation attitude (for example, while eight out of ten families in Spain consent to donate, the rate in the UK is six out of ten).

Therefore while the default effect is a strong predictor of success, other factors also play a part. In this case, Spain leads the way due to additional support and education offered in the healthcare system.

In the case of Pay by Bank, offering it as the default option won’t convert the majority of consumers any time soon. Cards will remain dominant. Yet by having Pay by Bank as the pre-selected default option and at the top of the checkout page, Ryanair can try to capture a meaningful share of payment transactions. Even take up of 5% or 10% will make a big difference to the total cost of payments.

True Layer’s own recommendations for increasing the adoption of Pay by Bank are in line with what Ryanair has implemented. Pay by Bank is placed at the top of the checkout as the default option; security and ease of use (no card needed) are both clearly emphasised. Minimising friction is key. Many consumers will be using Pay by Bank for the first time — Ryanair will be hoping it won’t be the last time.

Final thoughts

My calculation is that Ryanair could more than £3m per annum in card fees if they can move just 5% of their payments from cards to Open Banking.12

This estimates that both cardholder and merchant location are in the UK. If the merchant location is in Ireland, then this saving could more than double (due to the difference in cross-border fees post-Brexit).

This scale of potential cost saving explains why we're seeing interest in Pay by Bank.

So what’s coming next? I’ll leave you with some expectations and recommendations in terms of Pay by Bank going forward:

I anticipate:

More large brands, including those in the travel sector, will offer Pay by Bank in the coming months and years. The cost differential makes it worthwhile. Even if take-up is small, it can make a big difference in terms of total payment acceptance fees.

There is a real risk that consumers who use Pay by Bank may get caught out by an airline insolvency. In such a scenario, with no ability to initiate a chargeback, consumers are unlikely to get their money back. Up until now cards and their chargeback mechanism have provided security for consumers. With Open Banking payments this security ceases to exist.13

I recommend:

Consumers should be given choice at the checkout. Pay by Bank won’t dethrone cards, but we need to embrace the fact that offering non-card payment options (alongside cards) is now the norm. Consumers should be able to choose which payment method they prefer.

As Open Banking payments expand across a wide variety of sectors — including travel and airlines — Open Banking providers will need to consider merchant-level risk. Understanding merchant risk is something that card processors are experts in, and they have had to be as they take on the respective chargeback risk. However, while Open Banking providers don’t assume the risk of incoming chargebacks, they will suffer reputational damage and face regulatory scrutiny if an airline fails, and consumers are unable to recover their money. In short, offering Pay by Bank to Ryanair or British Airways will be at minimal risk, but smaller or newer airlines will come with a much greater risk.

As more merchants opt for Pay by Bank at the checkout, getting the balance right will be key. Some consumers will welcome the choice but others may think twice. Would you be happy to use Pay by Bank for your next airline ticket?

Thanks for reading Payments Culture!

Please leave a comment or share with a friend or colleague if you enjoyed reading this edition. It’s much appreciated and helps grow the audience of this newsletter.

Note that views expressed on this Substack are my own and do not represent any other organisation. Also nothing I say should be taken as investment advice.

Many years back Ryanair was one of my clients. What I write about here is based on my experience of payments in the airline industry and publicly accessible information. No confidential information is disclosed.

Legacy carriers is a term which signifies airlines such as British Airways, Air France-KLM and Lufthansa. Airlines with a long heritage, which were once publicly owned national champions. In the modern era the emergence of low-cost carriers such as Ryanair and Easyjet scrambled the business model of legacy airlines by offering low fares and no-frills service. In today's world, as legacy carriers have cut costs to compete, the differences between the legacy and low-cost models are smaller than they once were, but historically they offered two very different operating models.

This average transaction size is based on publicly available financial data and general metrics from the airline industry. In reality the actual transaction size will fluctuate greatly. Also with a merchant such as Ryanair, a large share of their sales is made up from ancillary revenue — often this can be as much as, or more than the airline ticket itself.

Card fees are made up of several elements including Interchange Fees, Scheme Fees, and the Acquirer Margin. In the UK/EU interchange for consumer domestic transactions is capped at 0.20% for debit cards and 0.30% for credit cards. Additionally, scheme fees will average at around 10-15 basis points and the remainder of the quoted 0.45% for debit and 0.55% for credit will be the acquirer, processor and PSP margin. All of this is speculative based on a merchant processing £10bn+ of card volume per annum.

Finexer’s Open Banking buyers guide notes an average transaction fee of £0.20-£0.30 for business with a higher than average transaction size. The £80 transaction size estimated for Ryanair is above the overall card payment average of £50-£60 per transaction in the UK.

I originally outlined these three key merchant benefits last year in a Substack post titled What’s holding back Open Banking?

To anyone not familiar with the term, a chargeback allows the holder of a credit or debit card to contact their bank and challenge a debit on their card account. If the cardholder can prove that the charge was not authorised, or was charged incorrectly, then the bank will credit the cardholder at the expense of the merchant.

Many payment providers charge a fee when a chargeback is raised and another fee if the merchant chooses to respond to the chargeback with evidence. If the chargeback is won then the merchant does not get the fees back, but they retain the original transaction value.

You can see an example of many mobile wallets at a checkout in Malaysia in this post recounting my travel in the region.

It appears that Ryanair and True Layer did cooperate on an incentive based marketing campaign. I didn’t see it in action, but I found the terms and conditions of the campaign. You’ll notice that the incentive was for 5% of the transaction value capped at £10 per transaction and with a maximum total value of £200k.

I appreciate that are various reasons including religious and cultural reasons why some people do not want to be organ donors. However, this is an example of how an automatic opt-in process has been a success from a policy perspective.

Assumptions are as follows: 200 million transaction per annum with £80 ATV; card split 63% consumer debit, 27% consumer credit, 10% business cards; Pay by Bank fee fixed at £0.20 per transaction. First scenario assumes all domestic transactions and second scenario assumes 50% domestic and 50% cross-border, in which debit is 1.15% and credit 1.5%.

It may not always be as black and white as this. In some cases where an airline cannot fulfil its obligations, administrators may be able to recover some funds, but lacking chargeback protection, Pay by Bank represents a much bigger risk for consumers than cards.

Ryanair always look for the angle and who can blame them here?